Research Methodology on Military Drone Market

Research Objective:

The primary objective of this research is to provide an in-depth analysis of the global military drone market in terms of market size, growth rate, key trends, and drivers, and to provide an overview of the international military drone industry.

Research Design:

The research design of this research is exploratory in nature and relies heavily on both qualitative and quantitative research. Qualitative research includes conducting desk research, specialist interviews, and focus group discussions to gain insights into market behaviour and dynamics. The collected data is then subjected to rigorous analysis and interpretation to gain a clear picture of the market. For the quantitative part of the research, the primary focus is on the use of primary and secondary data to analyze the market size and trends. Primary research involves collecting data from actual consumers and experts in the industry, while secondary research included collecting data from annual reports, regional perspectives, white papers, public databases, industry magazines and journals, and other sources.

Data Sources:

The data used in this research was gathered from both primary and secondary sources. Primary research methods included surveying to collect data from military drone market specialists and industry players. The survey is also conducted among years companies across different regions. Secondary sources include collecting and analyzing data from various sources such as industry reports, books, white papers and databases such as Market Research Future. The data is also collected from market reports, magazines and journals about the military drone industry.

Research Analysis and Interpretation Methodology:

The collected data is then subjected to detailed analysis and interpretation to gain an in-depth understanding of the global military drone market dynamics. This includes assessing market size, market share, and trends, and analyzing the competitive landscape. In addition, qualitative research is conducted through interviews and focus group discussions to gain insights into the current scenario in the market. The collected data is then analyzed using statistical and econometric methods to gain a 360-degree view of the market.

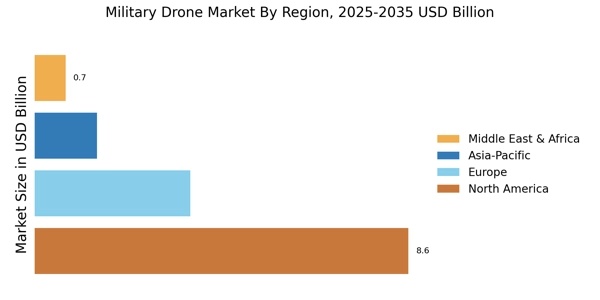

For instance, multiple regression analysis is one of the methods used to assess and analyze industrial data, which is a technique used to identify how and in what ways one or more independent variables influence the outcome variable(s). This method helps in understanding the interrelationships and relationships among market players, customers, emotions, and sectors. Additionally, the collected and analyzed data has been presented in the form of graphs, charts and tables to make the data more accessible and easy to comprehend.

Finally, the collected data is also subject to examination, critical assessment, and proper validation process before finalizing the report.