In May 2022, a contract amounting to USD 500 million for the Family Of Weapon Sights-Individual Programmed and given by the US Army has been awarded to Teledyne FLIR.

Northrop Grumman, in April 2022, announced satellite facility extensions in Gilbert, Arizona, to expand and meet NASA and the national security space program requirements. The facility is among the most advanced satellite manufacturing in the world and has been expanded by 120000 square feet of space.

In January 2023, Autel Robotics powered up the EVO Max 4T drone, which has an enhanced payload performance feature and is able to carry a multitude of sensors and cameras, making it useful in the fields of public safety and agriculture.

In January 2023, DJI unveiled the Zenmuse P1, a specially designed camera payload meant for aerial surveys and photogrammetry. The launched payload also includes a full-frame 20-megapixel sensor and a three-axis gimbal aimed at improving aerial images.

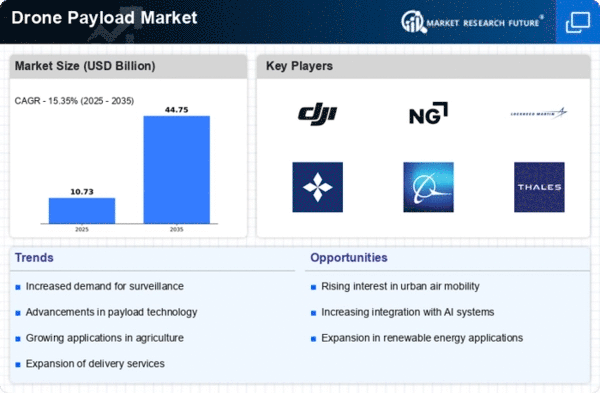

To further squeeze in their dominance in the UAS and advanced air mobility (AAM), such as air taxi systems, the US Government also passed the National Drone and Advanced Air Mobility Initiative Act in May 2023. The act allocates funding as high as $1.6 billion. Furthermore, the increase in drone technology development also the development of artificial intelligence and machine learning algorithms allow for even more new possibilities for the use of drones

In February, Garuda Aerospace launched Droni, a nano drone aimed at consumer photography and cinematography markets in India. Droni is currently offered for sale on the e-commerce site Amazon, it is a quadcopter advertising a small package measuring approximately 250 gm when folded.

In October 2023, UAV (Unmanned Aerial Vehicle) startup Amber Wings came up with its hybrid drone, Atva. The Atva drone flies 10 times faster than its competitors and has a long lasting battery and multiple payload options as well.

In January 2022, YellowScan assessed a product called Voyager, which is a LiDAR scanning system that works with both fixed and multi-rotor UAVs (unmanned aerial vehicles). It is able to capture complex targets that are vertical or vertical targets with an accuracy of about 1 cm and a high speed of data collection of 1800 kHz.

Drone Payload Market Key Market Players& Competitive Insights

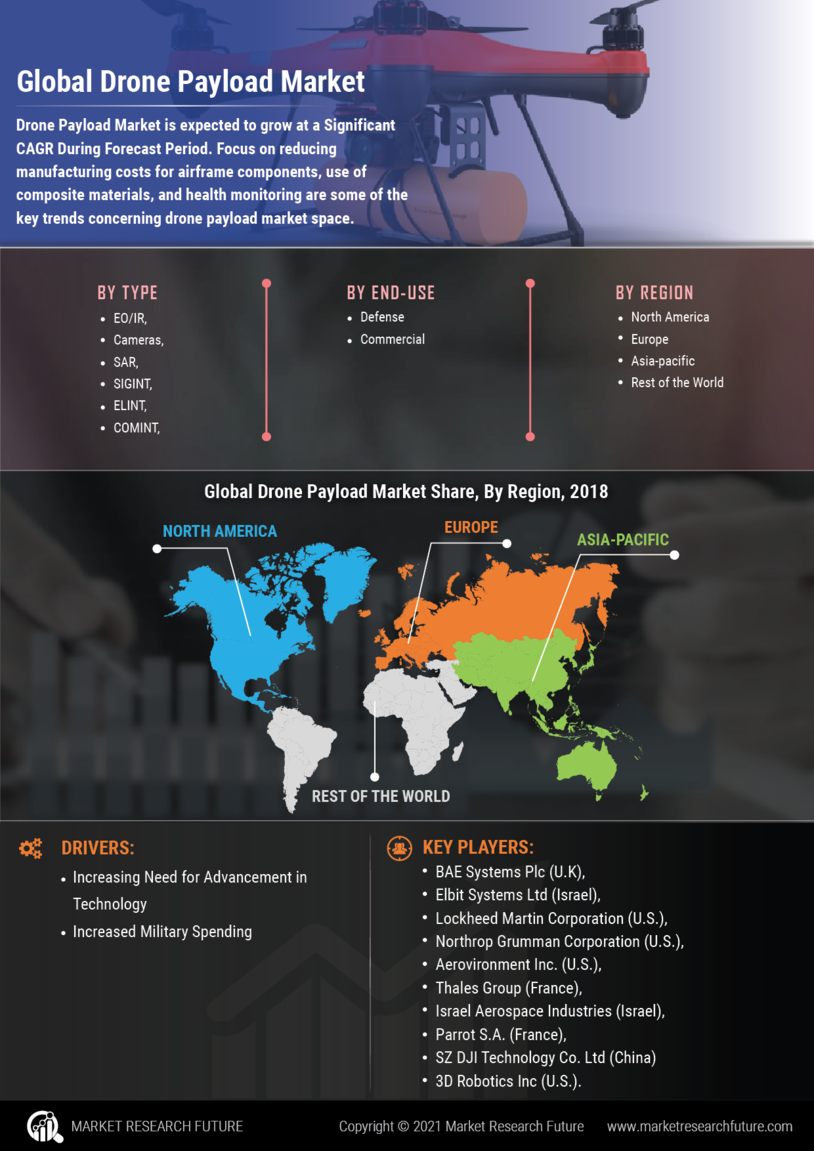

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Drone Payload Market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Drone Payload industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Drone Payload industry to benefit clients and increase the market sector. In recent years, the Drone Payload industry has offered some of the most significant advantages to medicine.

Major players in the Drone Payload Market attempting to increase market demand by investing in research and development operations are Lockheed Martin Corporation (US), BAE Systems Plc (UK), Northrop Grumman Corporation (US), Elbit Systems Ltd (Israel), Thales Group (France), Israel Aerospace Industries (Israel), AeroVironment (US), Parrot SA (France), Raytheon Technologies Corporation (US), and SZ DJI Technology Co., Ltd (China).

The Lockheed Martin Corporation is a corporation interested in aircraft, weapons, defense, information security, and technology. In March 1995, Lockheed Corporation and Martin Marietta merged to become it. As of January 2022, Lockheed Martin employed over 115,000 people worldwide, including about 60,000 engineers and scientists. Lockheed Martin is one of the biggest businesses in the aerospace, military support, security, and technology sectors. By revenue for the 2014 fiscal year, it is the biggest defense contractor in the world.

Lockheed Martin led the list of US federal government contractors in 2013, generated 78% of its revenue from military purchases, and got roughly 10% of the money distributed by the Pentagon.

BAE Systems, in conjunction with Boeing company, produces vertical/short-takeoff-and-landing (V/STOL) Harrier jet fighter, which also develops and manufactures fighter aircraft in joint ventures with several European and American aerospace firms. The British Royal Air Force has received Hawk jet trainers from it, and they have been widely exported. In addition to developing and building surface warships and submarines for the British Royal Navy, BAE Systems' non-aerospace business segments also produce a range of weapons systems and ammunition. As the largest exporter in the United Kingdom in 2000, the corporation employed about 100,000 people directly and through joint ventures.

Key Companies in the Drone Payload Market include

Drone Payload Industry Developments

For Instance, May 2022 A $500 million contract for the Family of Weapons Sights-Individual Programmed from the US Army has been given to Teledyne FLIR.

For Instance, April 2022 Northrop Grumman expands its satellite facility in Gilbert, Arizona to meet the needs of NASA and the national security space program. One of the world's most cutting-edge satellite manufacturing facilities has grown by 120,000 square feet.