Growing Aging Population

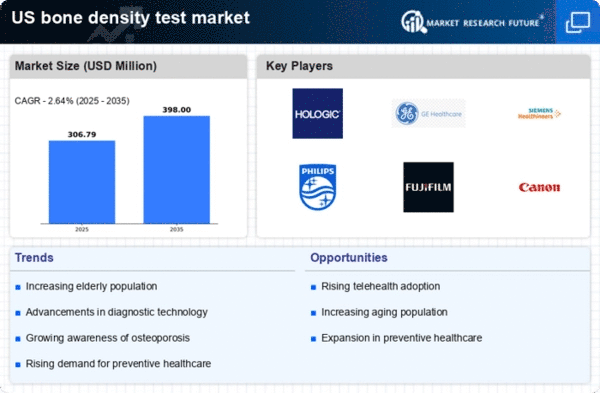

The increasing aging population in the US is a primary driver for the bone density-test market. As individuals age, the risk of osteoporosis and related bone disorders escalates, necessitating regular screening. According to the US Census Bureau, by 2030, all baby boomers will be over 65 years old, leading to a significant rise in the demand for bone density testing. This demographic shift indicates a potential market growth of approximately 25% in the next five years. Healthcare providers are likely to prioritize preventive measures, including bone density tests, to manage osteoporosis effectively. Consequently, the bone density-test market is expected to expand as healthcare systems adapt to the needs of an older population, emphasizing the importance of early detection and intervention.

Focus on Preventive Healthcare

The growing focus on preventive healthcare is a vital driver for the bone density-test market. As healthcare systems shift towards preventive strategies, the importance of early detection of osteoporosis becomes increasingly recognized. This trend is reflected in the implementation of screening guidelines by organizations such as the US Preventive Services Task Force, which recommends bone density testing for certain populations. The bone density-test market is likely to benefit from this proactive approach, as more individuals become aware of the need for regular screenings. Additionally, public health campaigns aimed at educating the population about bone health may further stimulate demand for testing services. This emphasis on prevention could lead to a market expansion of around 22% in the next few years, as healthcare providers prioritize early intervention to reduce the burden of osteoporosis.

Increased Healthcare Expenditure

Rising healthcare expenditure in the US is another crucial driver for the bone density-test market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing emphasis on preventive care and early diagnosis. This trend is likely to enhance the adoption of bone density testing as part of routine health assessments, particularly for at-risk populations. The bone density-test market stands to benefit from increased funding for osteoporosis screening programs, which may lead to a higher volume of tests conducted annually. Furthermore, insurance coverage for preventive services is expanding, making bone density tests more accessible to patients. This financial support could potentially increase the market size by 15% over the next few years, as more individuals seek out these essential diagnostic services.

Rising Incidence of Osteoporosis

The rising incidence of osteoporosis in the US population is a significant driver for the bone density-test market. Recent studies indicate that approximately 10 million Americans are currently diagnosed with osteoporosis, with an additional 44 million at risk of developing the condition. This alarming trend underscores the necessity for widespread screening and early intervention, which the bone density-test market aims to address. As awareness of osteoporosis grows, healthcare providers are likely to recommend regular bone density tests, particularly for women over 65 and men over 70. This increasing prevalence may lead to a projected market growth of around 20% in the coming years, as more individuals seek testing to monitor their bone health and prevent fractures.

Advancements in Diagnostic Technology

Advancements in diagnostic technology are transforming the bone density-test market. Innovations such as dual-energy X-ray absorptiometry (DXA) and quantitative computed tomography (QCT) are enhancing the accuracy and efficiency of bone density assessments. These technologies allow for more precise measurements of bone mineral density, which is crucial for diagnosing osteoporosis. The bone density-test market is likely to see increased adoption of these advanced testing methods, as healthcare providers seek to improve patient outcomes. Furthermore, the integration of artificial intelligence in imaging analysis may streamline the testing process, potentially increasing the number of tests performed annually. This technological evolution could contribute to a market growth rate of approximately 18% over the next five years, as healthcare facilities invest in state-of-the-art diagnostic equipment.