Increased Defense Budgets

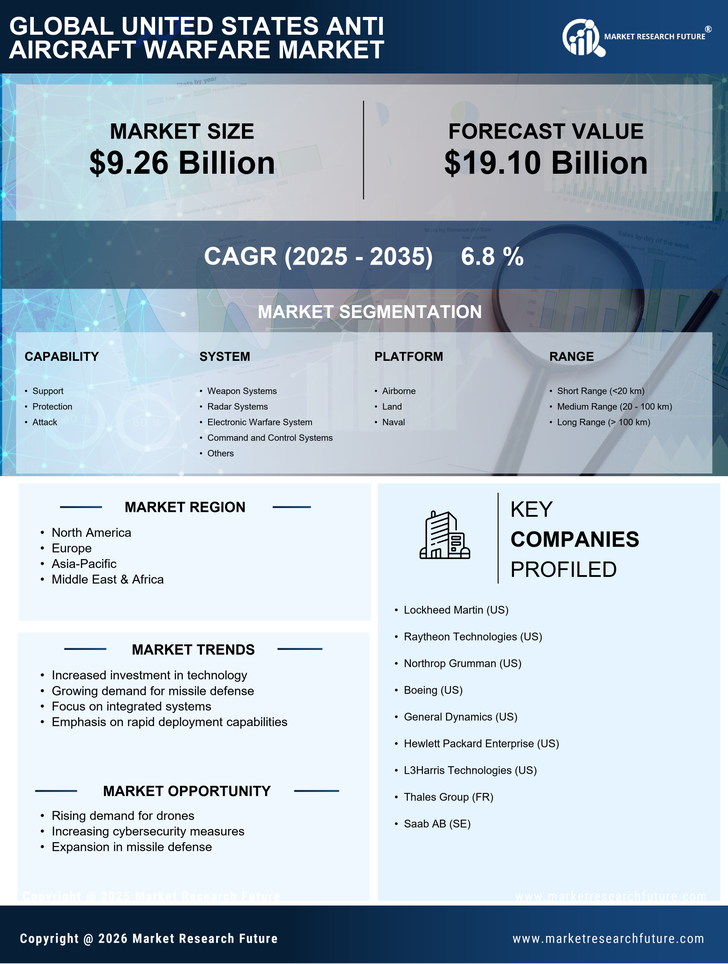

The US Anti Aircraft Defense Systems Market is benefiting from increased defense budgets at both federal and state levels. The US government has recognized the necessity of modernizing its military capabilities, particularly in air defense. The fiscal year 2026 budget proposal includes substantial funding for anti-aircraft systems, reflecting a strategic priority to enhance national security. This financial commitment is expected to facilitate the procurement of advanced systems such as the Patriot missile system and the Terminal High Altitude Area Defense (THAAD). Furthermore, state governments are also investing in local defense initiatives, which contributes to the overall market growth. The combination of federal and state funding is likely to create a robust environment for the development and deployment of advanced anti-aircraft systems.

Rising Geopolitical Tensions

The US Anti Aircraft Defense Systems Market is experiencing growth due to escalating geopolitical tensions globally. Nations are increasingly investing in advanced defense systems to counter perceived threats. The US, in particular, has heightened its focus on enhancing its air defense capabilities in response to regional conflicts and the emergence of new adversaries. This trend is reflected in the increased budget allocations for defense, with the US Department of Defense proposing a budget of over 700 billion dollars for fiscal year 2026, which includes significant investments in anti-aircraft systems. The urgency to protect national airspace from potential aerial threats is driving demand for sophisticated defense technologies, thereby propelling the market forward.

Growing Threat of Unmanned Aerial Vehicles

The proliferation of unmanned aerial vehicles (UAVs) poses a significant challenge to national security, thereby driving the US Anti Aircraft Defense Systems Market. As UAV technology becomes more accessible, the potential for hostile entities to deploy drones for surveillance or attacks increases. The US military is actively seeking solutions to counter this emerging threat, leading to the development of specialized anti-drone systems. The market for counter-UAV systems is projected to grow substantially, with estimates suggesting a market size of over 2 billion dollars by 2027. This growing concern over UAV threats is likely to spur further investments in anti-aircraft defense technologies, ensuring that the US remains prepared to address evolving aerial threats.

International Collaboration and Partnerships

The US Anti Aircraft Defense Systems Market is also influenced by international collaboration and partnerships. The US has engaged in various defense agreements with allied nations to enhance collective security and interoperability. Programs such as the Foreign Military Sales (FMS) allow allied countries to procure advanced US defense systems, including anti-aircraft technologies. This not only strengthens alliances but also expands the market for US defense manufacturers. The recent agreements with NATO allies to share air defense capabilities illustrate the growing trend of collaborative defense efforts. Such partnerships are expected to drive demand for US-made anti-aircraft systems, thereby contributing to the overall growth of the market.

Technological Innovations in Defense Systems

The US Anti Aircraft Defense Systems Market is significantly influenced by rapid technological innovations. Advancements in radar systems, missile technology, and command and control systems are reshaping the landscape of air defense. The integration of artificial intelligence and machine learning into defense systems enhances target detection and engagement capabilities. For instance, the development of the Next Generation Interceptor aims to improve the interception of advanced aerial threats. As the US military seeks to maintain its technological edge, investments in research and development are expected to rise, with projections indicating a compound annual growth rate of 5% in defense technology spending over the next five years. This focus on innovation is likely to sustain the growth trajectory of the market.