Top Industry Leaders in the Underbalanced Drilling Market

*Disclaimer: List of key companies in no particular order

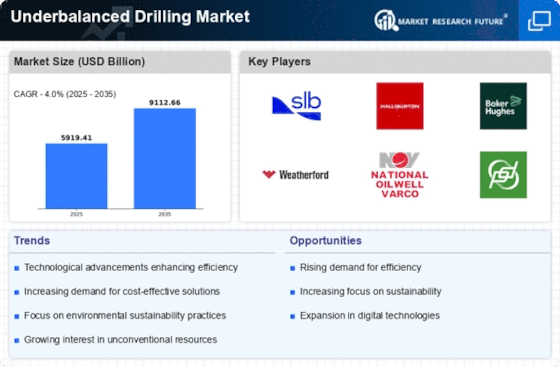

Top listed companies in the Underbalanced Drilling industry are:

Air Drilling Associates Inc. (US)

Ensign Energy Services (Canada)

Schlumberger Limited (US)

Halliburton Inc. (US)

Weatherford International (US)

National Oilwell Varco (US)

Beyond Energy (Canada)

STRATA Energy Services (Australia)

Kinley Exploration LLC (US)

Precision Air Drilling Services Inc. (US)

Drilling Downward: Analyzing the Competitive Landscape of the Underbalanced Drilling Market

Beneath the earth's surface, a silent battle for oil and gas unfolds, fought not with brute force but with delicate pressure control – the underbalanced drilling market. This multi-billion dollar space pulsates with competition, as established giants, ambitious innovators, and regional specialists vie for a share in the technology that unlocks resources with a lighter touch. Let's delve into the key strategies, market dynamics, and future trends shaping this crucial landscape.

Key Player Strategies:

Global Titans: Companies like Schlumberger, Halliburton, and Baker Hughes leverage their extensive experience, diverse pressure control equipment, and global reach to maintain their dominance. They cater to major oil and gas producers, offering advanced underbalanced drilling technologies like managed pressure drilling (MPD) and underbalanced well completions. Schlumberger's DrillWell MPD system exemplifies their focus on comprehensive pressure control solutions.

Technology Disruptors: Startups like Welltec and Core Laboratories are disrupting the market with innovative tools like real-time downhole sensors and data-driven process optimization. They cater to niche applications like tight reservoir development and horizontal drilling, offering solutions with enhanced precision and control capabilities. Welltec's Well Safe Barrier system showcases their focus on intelligent pressure management and real-time data analysis.

Cost-Effective Challengers: Chinese manufacturers like SinoEnergy Oilfield Service Co. Ltd. and Yantai Jingcheng Petroleum Machinery Co. Ltd. are making waves with competitively priced underbalanced drilling equipment, targeting budget-conscious projects in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Yantai Jingcheng's MPD units demonstrate their focus on cost-effective pressure control solutions.

Niche Specialists: Companies like Expro International and Weatherford excel in specific segments like underbalanced coiled tubing drilling for complex wellbore geometries or wellbore cleanout and stimulation services. They leverage their deep understanding of specialized applications and offer tailored solutions with robust functionalities for challenging environments. Expro's coiled tubing units showcase their focus on underbalanced drilling in unconventional reservoirs.

Factors for Market Share Analysis:

Technology and Performance: Offering features like precise pressure control, efficient fluid circulation, and real-time downhole monitoring caters to diverse reservoir types and operating conditions, improving well productivity and minimizing risks. Companies with high-performance and adaptable underbalanced drilling technologies gain an edge.

Reliability and Safety: Ensuring consistent wellbore pressure control, minimizing operational downtime due to equipment failures, and prioritizing safety through rigorous training and certifications are crucial for successful underbalanced drilling operations. Companies with a track record of reliable and safe well control stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive projects. Companies offering affordable solutions without compromising on basic pressure control functionality gain market share.

Regulatory Compliance and Regional Expertise: Adherence to strict environmental and safety regulations, tailoring solutions to specific regional wellbore characteristics, and providing localized training and support attract major oil and gas producers and regulatory bodies. Companies prioritizing compliance and regional expertise gain an edge.

New and Emerging Trends:

Focus on Data-Driven Optimization and Automation: Integrating real-time downhole data with advanced control algorithms, automating pressure control processes, and developing decision-support systems for underbalanced drilling operations enhance efficiency, optimize wellbore placement, and improve safety. Companies leading in data-driven solutions stand out.

Sustainability and Environmental Focus: Developing closed-loop drilling systems that minimize fluid discharge and emissions, utilizing clean-burning fluids, and exploring environmentally friendly underbalanced drilling techniques cater to growing sustainability concerns and regulatory mandates. Companies demonstrating environmental commitment attract ethical investors and regulatory benefits.

Focus on Unconventional Reservoirs and Horizontal Drilling: Developing underbalanced drilling solutions optimized for tight gas formations, shale plays, and complex horizontal wellbores facilitates access to unconventional resources and improves reservoir recoveries. Companies leading in unconventional reservoir drilling stand out.

Regional Customization and Service Support: Adapting equipment and services to cater to specific regional geological formations, reservoir pressures, and regulatory frameworks, offering localized training and spare parts availability, and establishing strong regional service networks attract local oil and gas operators and drilling contractors. Companies with strong regional customization capabilities gain market share.

Overall Competitive Scenario:

The underbalanced drilling market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their resources and global reach, while technology disruptors introduce innovative solutions and niche applications. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific segments. Factors like technology, reliability, affordability, and compliance play a crucial role in market share analysis. New trends like data-driven optimization, sustainability, unconventional reservoirs, and regional customization offer exciting growth opportunities. To succeed in this evolving landscape, players must prioritize innovation, cater to diverse reservoir types and drilling objectives, embrace sustainable practices, and explore data-driven

Latest Company Updates:

Air Drilling Associates Inc. (US):

- December 2023: Announced successful completion of a complex UBD project in the Permian Basin, achieving record production rates. (Source: Company press release)

Ensign Energy Services (Canada):

- November 2023: Partnered with a major operator to develop and deploy a next-generation UBD fluid system for improved formation cleanup. (Source: Company presentation)

Halliburton Inc. (US):

- September 2023: Introduced a new underbalanced coiled tubing system for improved wellbore access and control in tight formations. (Source: Company website)

Weatherford International (US):

- December 2023: Secured a multi-million dollar contract to provide UBD services for a major shale development project in North America. (Source: Company announcement)