Regulatory Support and Industry Standards

Regulatory support plays a crucial role in shaping the Managed Pressure Drilling Market. Governments and regulatory bodies are increasingly recognizing the benefits of managed pressure drilling techniques in enhancing safety and reducing environmental impact. As a result, there is a growing emphasis on establishing industry standards that promote the adoption of these practices. Recent initiatives have led to the development of guidelines that encourage the use of advanced drilling technologies. This regulatory backing is expected to facilitate market growth, as companies seek to comply with new standards while improving operational efficiency in the Managed Pressure Drilling Market.

Increasing Demand for Oil and Gas Resources

The rising demand for oil and gas resources is a significant driver of the Managed Pressure Drilling Market. As economies expand and energy consumption increases, the need for efficient extraction methods becomes paramount. Managed pressure drilling offers a solution by enabling access to challenging reservoirs that were previously deemed uneconomical. Market data suggests that the demand for oil is projected to grow by 1.5% annually over the next decade, necessitating innovative drilling techniques. This trend is likely to stimulate investments in managed pressure drilling technologies, thereby bolstering the market.

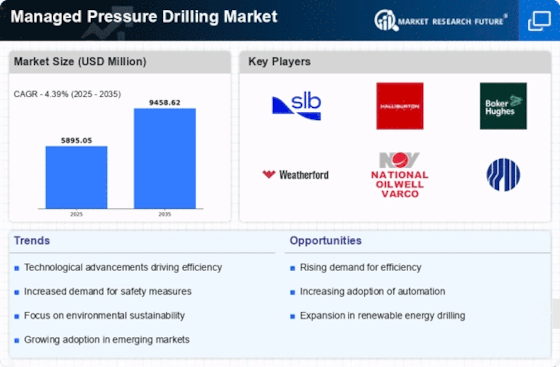

Technological Advancements in Drilling Techniques

The Managed Pressure Drilling Market is experiencing a surge in technological advancements that enhance drilling efficiency and safety. Innovations such as real-time monitoring systems and automated drilling processes are becoming increasingly prevalent. These technologies allow for better control of downhole conditions, reducing the risk of blowouts and improving overall operational performance. According to recent data, the adoption of advanced drilling technologies has led to a 20% increase in drilling efficiency in certain regions. This trend is likely to continue as companies invest in research and development to further refine these technologies, thereby driving growth in the Managed Pressure Drilling Market.

Focus on Sustainability and Environmental Concerns

Sustainability has emerged as a critical driver in the Managed Pressure Drilling Market. Companies are increasingly prioritizing environmentally friendly practices to minimize their ecological footprint. The implementation of managed pressure drilling techniques reduces waste and enhances resource utilization, aligning with global sustainability goals. Recent studies indicate that the adoption of these practices can lead to a 30% reduction in carbon emissions compared to traditional drilling methods. As regulatory frameworks become more stringent, the demand for sustainable drilling solutions is expected to rise, further propelling the Managed Pressure Drilling Market forward.

Integration of Data Analytics for Enhanced Decision Making

The integration of data analytics into the Managed Pressure Drilling Market is transforming how drilling operations are conducted. By leveraging big data and predictive analytics, companies can make informed decisions that optimize drilling performance and reduce costs. This trend is evidenced by a reported 15% decrease in operational costs for firms utilizing data-driven strategies. The ability to analyze real-time data allows for proactive adjustments during drilling operations, enhancing safety and efficiency. As the industry continues to embrace digital transformation, the reliance on data analytics is likely to grow, further influencing the Managed Pressure Drilling Market.