Government Initiatives and Support

Government initiatives in Indonesia play a crucial role in shaping the drone camera market. The Indonesian government actively promotes the use of drones for various applications, including surveillance, disaster management, and environmental monitoring. By establishing regulatory frameworks and providing financial incentives, the government encourages businesses and individuals to adopt drone technology. Recent policies indicate a commitment to integrating drones into public services, which could potentially increase the market size by 30% over the next few years. Furthermore, partnerships between government agencies and private companies are likely to enhance research and development efforts, leading to innovative drone camera solutions. This supportive environment fosters growth in the drone camera market, as stakeholders recognize the potential benefits of drone technology.

Emergence of Drone Racing and Sports

The drone camera market in Indonesia is witnessing a unique driver through the emergence of drone racing and sports. This growing trend attracts enthusiasts and participants, leading to an increase in demand for high-performance drone cameras. Events and competitions are becoming more popular, with local organizations hosting races that showcase the capabilities of drone technology. The market for racing drones is projected to grow by approximately 25% annually, as more individuals engage in this thrilling sport. This surge in interest not only boosts sales of specialized drone cameras but also encourages manufacturers to innovate and improve camera features. Consequently, the drone camera market benefits from this dynamic segment, which fosters a vibrant community and stimulates further investment in drone technology.

Rising Demand for Aerial Photography

The drone camera market in Indonesia experiences a notable surge in demand for aerial photography services. This trend is driven by various sectors, including real estate, tourism, and agriculture, which increasingly utilize drone technology for capturing high-quality images and videos. The real estate sector, in particular, has shown a growth rate of approximately 15% annually, as developers seek innovative ways to showcase properties. Additionally, the tourism industry leverages drone cameras to create captivating promotional content, enhancing visitor engagement. As a result, the drone camera market is projected to expand significantly, with an estimated market value reaching $150 million by 2026. This rising demand for aerial photography not only boosts sales but also encourages advancements in drone technology, further propelling the drone camera market in Indonesia.

Expansion of Agricultural Applications

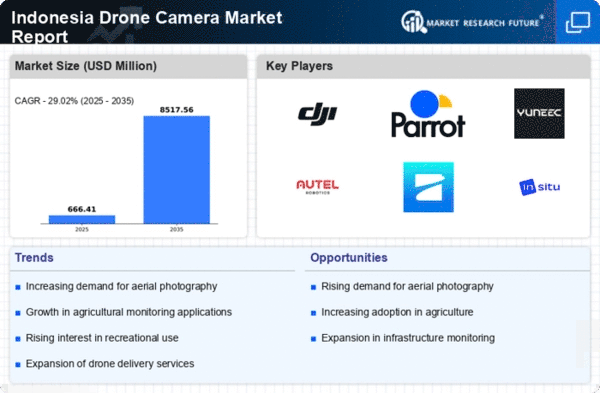

The agricultural sector in Indonesia increasingly adopts drone technology, significantly impacting the drone camera market. Farmers utilize drones equipped with advanced cameras for precision agriculture, enabling them to monitor crop health, assess irrigation needs, and optimize yields. The market for agricultural drones is expected to grow at a compound annual growth rate (CAGR) of around 20% over the next five years. This growth is attributed to the need for efficient farming practices and the rising costs of labor. Furthermore, the Indonesian government supports this trend by promoting smart farming initiatives, which further enhances the adoption of drone cameras in agriculture. As a result, the drone camera market is likely to witness substantial growth, driven by the increasing integration of technology in farming practices.

Growth of E-commerce and Delivery Services

The rapid growth of e-commerce and delivery services in Indonesia significantly influences the drone camera market. As online shopping becomes increasingly popular, companies explore innovative delivery methods, including the use of drones for last-mile delivery. This trend is expected to drive the demand for drone cameras, as businesses seek to enhance their logistics operations. The e-commerce sector is projected to grow at a CAGR of around 18% over the next five years, creating opportunities for drone technology integration. Companies are likely to invest in drone cameras to improve delivery efficiency and customer satisfaction. Consequently, the drone camera market is poised for expansion, as the intersection of e-commerce and drone technology presents new avenues for growth.