Increasing Regulatory Scrutiny

The trade surveillance-systems market in France is experiencing heightened regulatory scrutiny, driven by the need for financial institutions to comply with stringent regulations. Authorities such as the Autorite des Marches Financiers (AMF) are enforcing rigorous compliance measures to mitigate risks associated with market manipulation and insider trading. This regulatory environment compels firms to invest in advanced surveillance systems to ensure adherence to legal requirements. As a result, the market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the increasing demand for compliance solutions. The trade surveillance-systems market is thus positioned to benefit from this trend, as organizations seek to enhance their monitoring capabilities and reduce the risk of regulatory penalties.

Rising Incidences of Market Abuse

The trade surveillance-systems market is significantly influenced by the rising incidences of market abuse in France. With the financial landscape becoming increasingly complex, instances of fraud, insider trading, and market manipulation have surged. This trend has prompted financial institutions to adopt sophisticated surveillance systems to detect and prevent such activities. According to recent data, the cost of market abuse to the financial sector can reach billions of euros annually, underscoring the necessity for effective monitoring solutions. Consequently, the trade surveillance-systems market is likely to see robust growth as firms prioritize the implementation of technologies that can identify suspicious trading patterns and ensure market integrity.

Growing Demand for Real-Time Monitoring

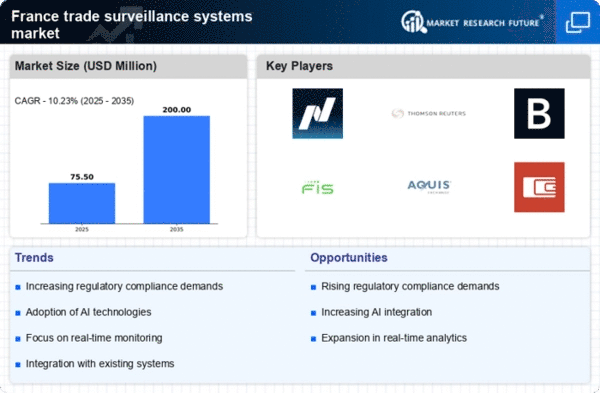

The demand for real-time monitoring solutions is a key driver in the trade surveillance-systems market. As trading activities become more dynamic, financial institutions in France are increasingly recognizing the importance of immediate detection of irregularities. Real-time surveillance systems allow firms to respond swiftly to potential threats, thereby minimizing risks associated with market abuse. This shift towards proactive monitoring is expected to propel the market forward, with projections indicating a growth rate of around 10% in the coming years. The trade surveillance-systems market is thus adapting to these evolving needs, as organizations prioritize systems that provide timely insights and enhance decision-making processes.

Technological Integration and Innovation

The trade surveillance-systems market in France is witnessing a wave of technological integration and innovation. Financial institutions are increasingly leveraging artificial intelligence (AI) and machine learning (ML) to enhance their surveillance capabilities. These technologies enable the analysis of vast amounts of trading data in real-time, allowing for quicker identification of anomalies and potential compliance breaches. The integration of advanced analytics is expected to drive market growth, with estimates suggesting a potential increase in market size by 15% over the next few years. The trade surveillance-systems market is thus evolving, as firms seek to adopt cutting-edge solutions that not only meet regulatory requirements but also improve operational efficiency.

Increased Focus on Data Privacy and Security

In the context of the trade surveillance-systems market, there is an increased focus on data privacy and security among financial institutions in France. With the implementation of regulations such as the General Data Protection Regulation (GDPR), firms are compelled to ensure that their surveillance systems not only comply with market regulations but also protect sensitive customer data. This dual requirement is driving investments in advanced security features within surveillance systems. The trade surveillance-systems market is likely to benefit from this trend, as organizations seek solutions that balance compliance with robust data protection measures, potentially leading to a market growth of 12% over the next few years.

Leave a Comment