Increasing Regulatory Scrutiny

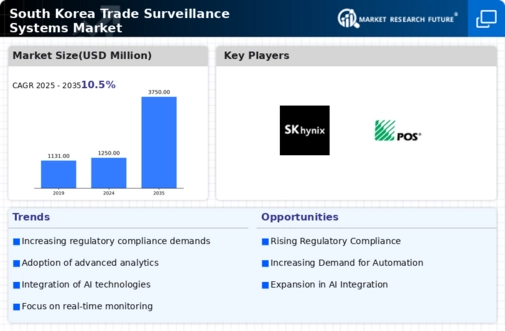

The trade surveillance-systems market in South Korea is experiencing heightened regulatory scrutiny, compelling financial institutions to adopt robust surveillance solutions. Regulatory bodies are enforcing stringent compliance measures to mitigate risks associated with market manipulation and insider trading. As a result, organizations are investing in advanced surveillance systems to ensure adherence to these regulations. The market is projected to grow at a CAGR of 12% from 2025 to 2030, driven by the need for compliance with evolving regulations. This trend indicates a strong demand for sophisticated trade surveillance technologies that can monitor trading activities in real-time, thereby enhancing transparency and accountability within the financial sector.

Demand for Enhanced Data Analytics

The trade surveillance-systems market is increasingly driven by the demand for enhanced data analytics capabilities. Financial institutions are seeking solutions that can provide deeper insights into trading behaviors and market trends. Advanced analytics tools enable organizations to process large datasets, facilitating the identification of suspicious activities and compliance breaches. This growing emphasis on data-driven decision-making is likely to propel the market forward, with an expected growth rate of 10% annually over the next five years. The ability to harness data effectively is becoming a critical factor for organizations aiming to maintain competitive advantage in the financial sector.

Rising Incidences of Financial Crimes

The trade surveillance-systems market is significantly influenced by the increasing incidences of financial crimes in South Korea. As the complexity of financial transactions grows, so does the potential for fraudulent activities, including money laundering and market manipulation. Financial institutions are recognizing the necessity of implementing comprehensive surveillance systems to detect and prevent such illicit activities. The market is expected to reach a valuation of $300 million by 2026, reflecting a growing investment in technologies that can analyze vast amounts of trading data. This trend underscores the importance of proactive measures in safeguarding the integrity of financial markets.

Technological Integration and Innovation

Technological integration plays a pivotal role in shaping the trade surveillance-systems market. The adoption of artificial intelligence (AI) and machine learning (ML) technologies is revolutionizing how financial institutions monitor trading activities. These innovations enable organizations to analyze patterns and detect anomalies with greater accuracy and speed. As a result, the market is witnessing a shift towards more sophisticated surveillance solutions that can adapt to evolving threats. The integration of these technologies is projected to enhance the efficiency of trade surveillance systems, potentially reducing operational costs by up to 20%. This trend indicates a strong inclination towards leveraging technology for improved market oversight.

Shift Towards Automated Surveillance Solutions

The trade surveillance-systems market is witnessing a notable shift towards automated surveillance solutions. Financial institutions are increasingly adopting automated systems to streamline their monitoring processes and reduce manual intervention. This transition is driven by the need for efficiency and accuracy in detecting irregular trading patterns. Automated systems can analyze vast amounts of data in real-time, significantly enhancing the speed of response to potential compliance issues. The market for automated trade surveillance solutions is projected to grow by 15% annually, reflecting a strong preference for technologies that can provide timely alerts and insights. This trend indicates a broader movement towards operational efficiency in the financial services industry.