Growing Focus on Fraud Prevention

the market is witnessing a growing focus on fraud prevention as financial institutions strive to protect their assets and maintain customer trust. With the rise of complex trading strategies and the increasing prevalence of market manipulation, firms are investing heavily in surveillance systems that can identify fraudulent activities. This trend is reflected in the market's expected growth, with estimates suggesting an increase of around 12% annually. The emphasis on fraud prevention not only helps in safeguarding financial interests but also aligns with regulatory expectations, thereby reinforcing the importance of effective surveillance systems in the trade surveillance-systems market.

Heightened Compliance Requirements

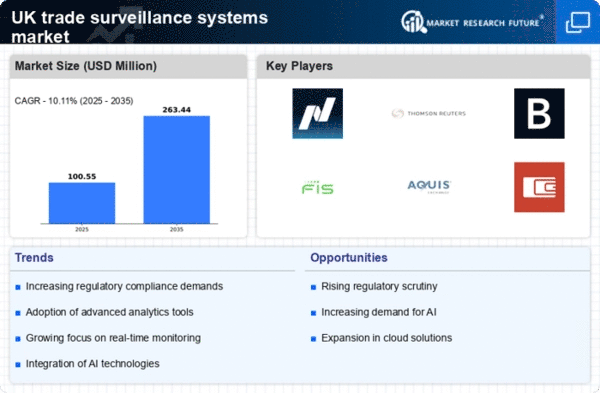

the market is experiencing a surge in demand due to heightened compliance requirements imposed by regulatory bodies in the UK. Financial institutions are increasingly required to implement robust surveillance systems to monitor trading activities and ensure adherence to regulations. This has led to a projected growth rate of approximately 15% annually in the market, as firms invest in advanced technologies to meet these compliance standards. The need for real-time monitoring and reporting capabilities is becoming paramount, as non-compliance can result in substantial fines and reputational damage. Consequently, the trade surveillance-systems market is evolving to provide solutions that not only meet regulatory demands but also enhance operational efficiency.

Integration of Multi-Asset Surveillance

The integration of multi-asset surveillance capabilities is becoming a crucial driver in the trade surveillance-systems market. As trading activities expand across various asset classes, firms require comprehensive surveillance solutions that can monitor equities, derivatives, and fixed income simultaneously. This trend is indicative of a broader shift towards holistic risk management strategies, with the market projected to grow by 10% over the next few years. By adopting multi-asset surveillance systems, firms can enhance their ability to detect irregularities across different trading environments, thereby improving overall compliance and risk mitigation efforts. This integration is likely to play a pivotal role in shaping the future of the trade surveillance-systems market.

Increased Investment in Cybersecurity Measures

In the context of rising cyber threats, the trade surveillance-systems market is experiencing increased investment in cybersecurity measures. Financial institutions are recognizing the importance of safeguarding their trading systems against potential breaches that could compromise sensitive data and disrupt operations. This focus on cybersecurity is expected to drive market growth, with estimates indicating a potential increase of 14% in the coming years. As firms implement more robust surveillance systems that incorporate cybersecurity features, they not only enhance their protection against external threats but also ensure compliance with regulatory requirements. This dual focus on surveillance and cybersecurity is likely to be a defining characteristic of the trade surveillance-systems market.

Technological Advancements in Surveillance Tools

Technological advancements are significantly influencing the trade surveillance-systems market. Innovations such as big data analytics, machine learning, and artificial intelligence are being integrated into surveillance tools, enabling firms to detect anomalies and suspicious activities more effectively. The market is projected to reach a valuation of £1 billion by 2026, driven by the increasing sophistication of trading strategies and the corresponding need for advanced monitoring solutions. These technologies allow for the analysis of vast amounts of trading data in real-time, thereby improving the accuracy of surveillance systems. As firms seek to stay ahead of potential risks, the adoption of these advanced tools is likely to become a critical factor in the trade surveillance-systems market.