Focus on Risk Management

The heightened focus on risk management within financial institutions is a critical driver for the surveillance systems market. As firms strive to mitigate risks associated with trading activities, the implementation of comprehensive surveillance systems becomes paramount. These systems provide insights into trading patterns and potential risks, enabling firms to take proactive measures. In Europe, the demand for risk management solutions is projected to grow by 15% annually, reflecting the increasing recognition of the importance of effective surveillance in risk mitigation strategies. This trend underscores the necessity for firms to invest in trade surveillance systems that not only ensure compliance but also enhance overall risk management frameworks.

Technological Integration

The integration of advanced technologies into the trade surveillance systems market is a significant driver. Innovations such as artificial intelligence (AI), machine learning (ML), and big data analytics are transforming how firms monitor trading activities. These technologies enable real-time analysis of vast amounts of trading data, enhancing the ability to detect anomalies and potential market abuse. In Europe, the adoption of AI-driven surveillance systems is expected to increase by over 30% in the next five years, as firms seek to improve their operational efficiency and compliance capabilities. This technological evolution not only streamlines processes but also provides a competitive edge, making it a crucial factor in the growth of the trade surveillance-systems market.

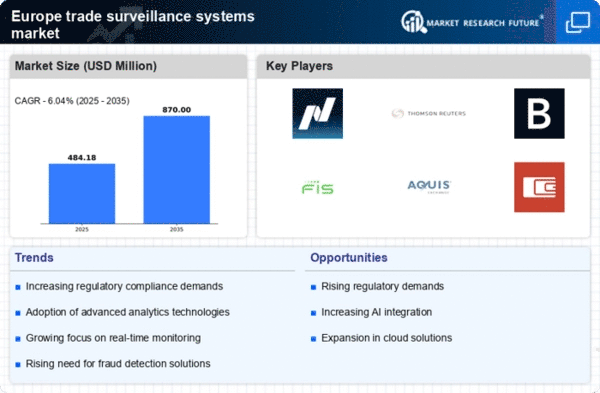

Regulatory Landscape Evolution

The evolving regulatory landscape in Europe is a primary driver for the trade surveillance-systems market. Regulatory bodies are increasingly imposing stringent compliance requirements on financial institutions to ensure market integrity and protect investors. For instance, the European Securities and Markets Authority (ESMA) has introduced various regulations that necessitate robust surveillance mechanisms. As a result, firms are compelled to invest in advanced trade surveillance systems to monitor trading activities effectively. The market for these systems is projected to grow at a CAGR of approximately 12% from 2025 to 2030, reflecting the urgency for compliance. This trend indicates that organizations must adapt to the changing regulatory environment, thereby driving demand for sophisticated surveillance solutions.

Market Volatility and Complexity

The increasing complexity and volatility of financial markets in Europe are driving demand for surveillance systems. As trading strategies become more sophisticated and markets more interconnected, the potential for market manipulation and fraud rises. This complexity necessitates advanced surveillance solutions capable of monitoring diverse trading activities across multiple platforms. According to recent data, the trade surveillance-systems market is expected to reach €1.5 billion by 2026, largely due to the need for enhanced monitoring capabilities in volatile market conditions. Firms are recognizing that effective surveillance is essential not only for compliance but also for maintaining investor trust and market stability.

Increased Investment in Cybersecurity

The rising threat of cyberattacks in the financial sector is significantly influencing the surveillance systems market. As cyber threats become more sophisticated, financial institutions in Europe are prioritizing cybersecurity measures, including the implementation of robust surveillance systems. These systems play a crucial role in identifying and mitigating potential cyber risks associated with trading activities. Recent studies indicate that investment in cybersecurity within the financial sector is expected to exceed €10 billion by 2027, highlighting the urgency for firms to enhance their surveillance capabilities. This focus on cybersecurity not only protects sensitive data but also reinforces the integrity of trading operations, driving demand for advanced trade surveillance solutions.