Increasing Regulatory Scrutiny

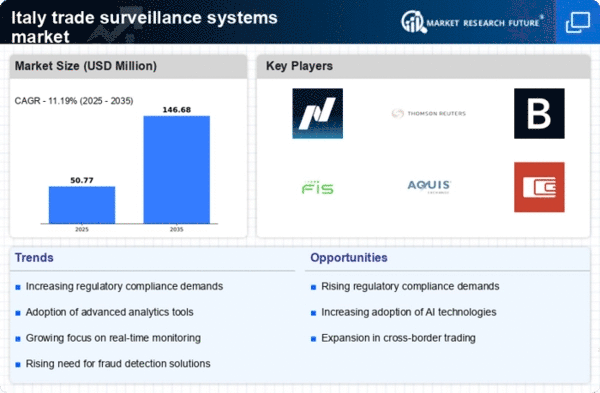

The trade surveillance-systems market in Italy is experiencing heightened regulatory scrutiny, driven by the need for compliance with stringent financial regulations. Authorities are increasingly mandating that financial institutions implement robust surveillance systems to detect and prevent market abuse, insider trading, and other illicit activities. This regulatory environment compels organizations to invest in advanced trade surveillance technologies, which can monitor trading activities in real-time. As a result, the market is projected to grow at a CAGR of approximately 10% over the next five years, reflecting the urgency for compliance solutions. The trade surveillance-systems market is thus positioned to benefit from this trend, as firms seek to enhance their compliance frameworks and mitigate regulatory risks.

Demand for Enhanced Risk Management

In the context of the trade surveillance-systems market, there is a growing demand for enhanced risk management solutions among financial institutions in Italy. As market volatility increases, firms are recognizing the importance of implementing systems that can monitor trading activities and assess risks in real-time. This trend is particularly relevant in light of recent market fluctuations, which have underscored the need for robust risk management frameworks. The trade surveillance-systems market is thus witnessing a shift towards solutions that not only ensure compliance but also provide comprehensive risk assessment capabilities. This dual focus is expected to contribute to a market growth rate of approximately 9% over the next few years.

Rising Incidents of Financial Fraud

The trade surveillance-systems market in Italy is being propelled by a notable increase in financial fraud incidents. As market participants become more sophisticated, the methods employed for fraudulent activities evolve, necessitating enhanced surveillance measures. Financial institutions are compelled to adopt comprehensive surveillance systems to safeguard their operations and maintain investor confidence. The trade surveillance-systems market is responding to this challenge by offering solutions that can effectively detect and prevent fraudulent transactions. This growing concern over financial integrity is likely to drive market growth, with estimates suggesting an increase in market size by approximately €200 million over the next three years.

Technological Advancements in Analytics

The trade surveillance-systems market is significantly influenced by advancements in analytics technologies. The integration of artificial intelligence (AI) and machine learning (ML) into surveillance systems allows for more sophisticated data analysis and anomaly detection. These technologies enable firms to process vast amounts of trading data efficiently, identifying patterns that may indicate fraudulent behavior. In Italy, the adoption of such technologies is expected to increase, as financial institutions recognize the need for proactive monitoring solutions. The trade surveillance-systems market is likely to see a surge in demand for systems that leverage these advanced analytics capabilities, potentially leading to a market growth rate of around 12% in the coming years.

Shift Towards Automation in Compliance Processes

The trade surveillance-systems market is experiencing a shift towards automation in compliance processes, driven by the need for efficiency and accuracy. Financial institutions in Italy are increasingly adopting automated surveillance systems to streamline their compliance efforts, reducing the reliance on manual processes that are often prone to errors. This trend is indicative of a broader movement within the industry to leverage technology for improved operational efficiency. The trade surveillance-systems market is likely to benefit from this shift, as firms seek to implement solutions that can automate routine compliance tasks, potentially leading to a market expansion of around 8% in the near future.