North America : Surgical Robotics Leader

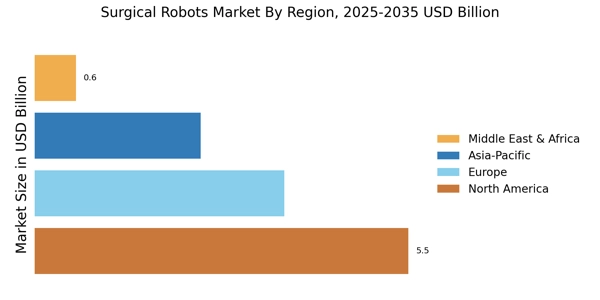

North America dominates the robotic surgery market, driven by high adoption rates, favorable reimbursement policies, and strong presence of leading medical robot companies. The region's growth is driven by advanced healthcare infrastructure, increasing adoption of minimally invasive surgeries, and significant investments in robotic technologies. Regulatory support from agencies like the FDA further catalyzes market expansion, ensuring safety and efficacy in robotic surgical systems.

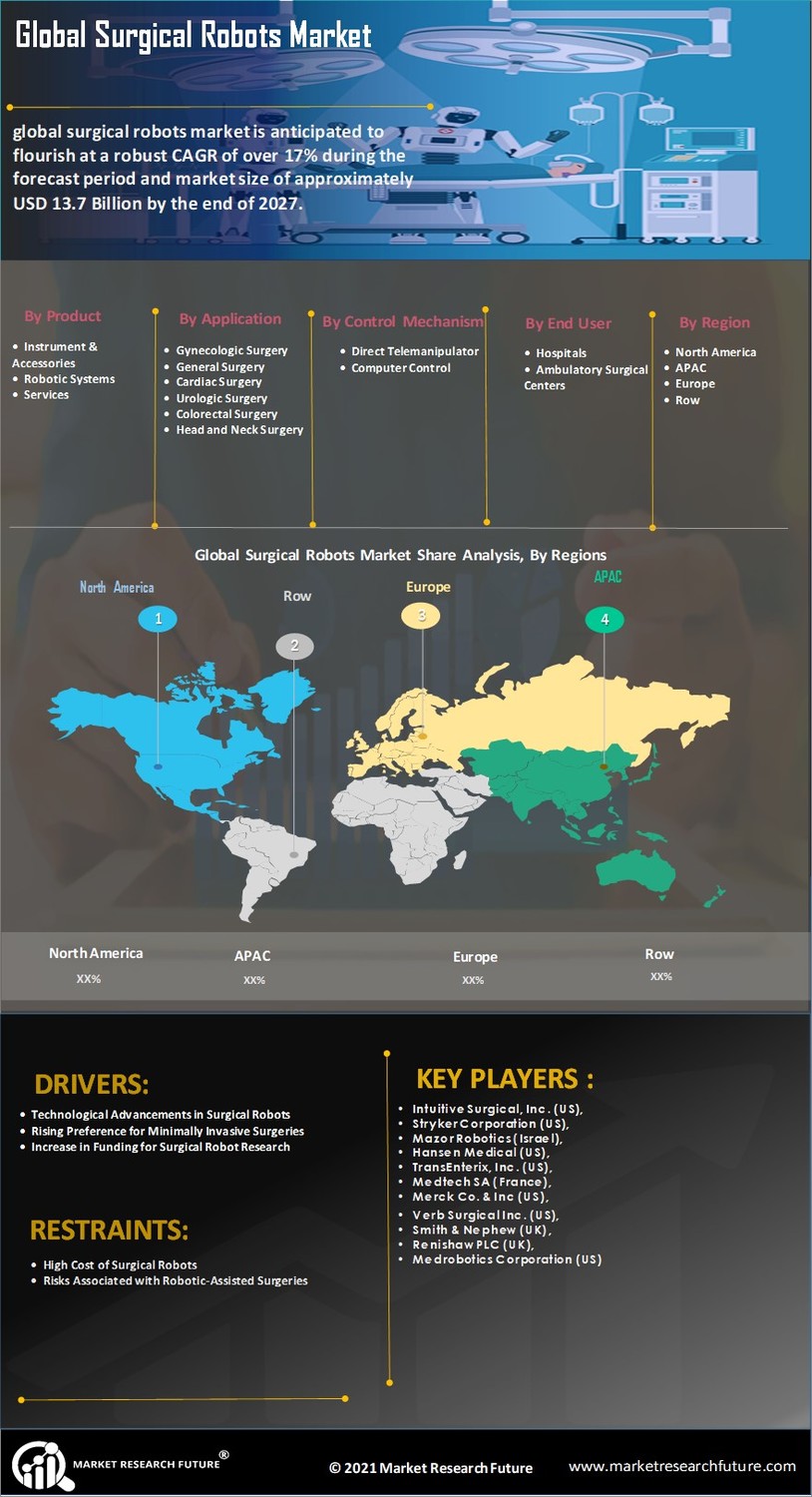

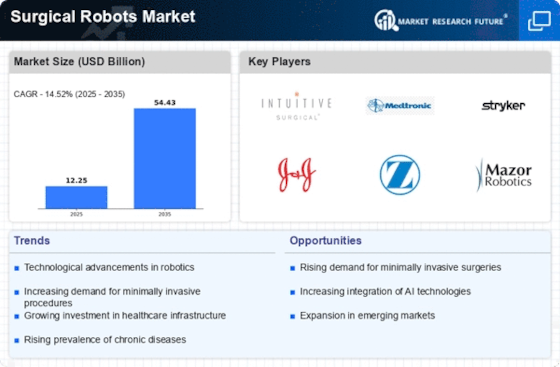

The United States is the primary contributor, with key players such as Intuitive Surgical, Medtronic, and Stryker leading the competitive landscape. The presence of established healthcare facilities and a high prevalence of chronic diseases drive demand for surgical robots. Additionally, ongoing innovations and collaborations among leading firms enhance the market's growth potential.

Europe : Emerging Surgical Robotics Hub

Europe is the second-largest market for surgical robots, accounting for around 30% of the global market share. Europe continues to emerge as a significant contributor to the surgical robotics market, supported by regulatory compliance and technological innovation. Regulatory frameworks, such as the EU Medical Device Regulation, ensure high standards for surgical robots, fostering market growth and innovation.

Leading countries include Germany, the UK, and France, where significant investments in healthcare infrastructure and technology are evident. Key players like Siemens Healthineers and Medtronic are actively involved in the market, enhancing competition. The presence of numerous research institutions and collaborations further supports the development and adoption of advanced surgical robotic systems.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is witnessing rapid growth in the surgical robots market, holding approximately 20% of the global share. Asia-Pacific demonstrates rapid expansion, driven by increasing investments and rising adoption across countries including Japan, contributing indirectly to the Japan general surgical devices market through robotic integration. Countries like China and Japan are at the forefront, with supportive regulatory environments promoting the adoption of advanced surgical technologies.

China is emerging as a key player, with significant investments in healthcare technology and a growing number of surgical procedures performed using robotic systems. The competitive landscape includes both local and international players, with companies like Intuitive Surgical and Medtronic expanding their presence. The increasing prevalence of chronic diseases and a growing aging population further drive demand for surgical robots in this region.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually emerging in the surgical robots market, currently holding about 5% of the global share. The growth is driven by increasing healthcare investments, a rising number of surgical procedures, and a growing interest in advanced medical technologies. Governments are focusing on improving healthcare infrastructure, which is expected to catalyze market growth in the coming years.

Countries like the UAE and South Africa are leading the way, with investments in healthcare facilities and technology. The competitive landscape is evolving, with both local and international players entering the market. Key players are beginning to establish partnerships and collaborations to enhance their market presence and meet the growing demand for surgical robots in the region.