North America : Market Leader in Innovation

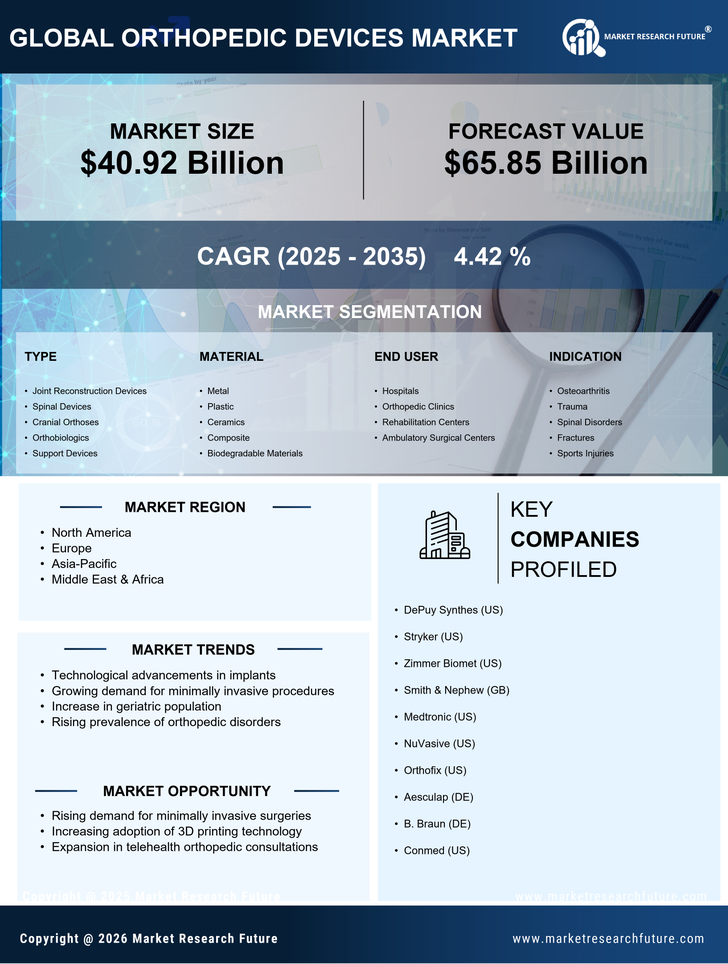

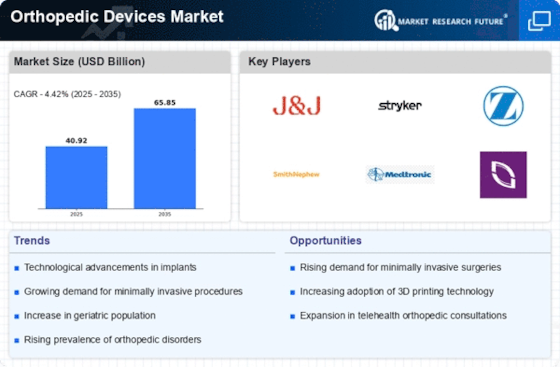

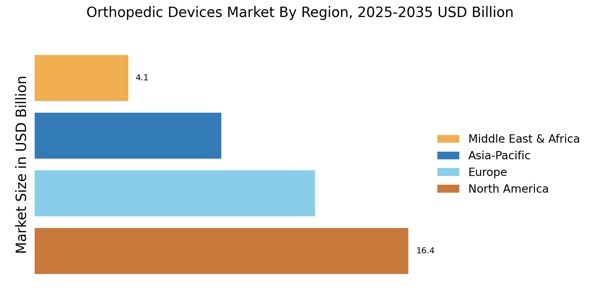

North America accounted for the largest share of the global Orthopedic Devices Market size, reaching USD 16.4 Billion in 2024. The region benefits from advanced healthcare infrastructure, high disposable incomes, and a growing elderly population, which drives demand for orthopedic surgeries. Regulatory support from agencies like the FDA further catalyzes market growth by ensuring the safety and efficacy of new devices.

The United States is the primary contributor, with key players such as DePuy Synthes, Stryker, and Zimmer Biomet leading the competitive landscape. The presence of these major orthopedic devices companies fosters innovation and enhances product offerings. Additionally, the increasing prevalence of orthopedic conditions and the rising number of joint replacement surgeries are significant factors propelling market expansion.

Europe : Emerging Market Dynamics

Europe is the second-largest market for orthopedic devices, accounting for approximately 30% of the global market share. The region is characterized by a robust healthcare system and increasing investments in medical Implants technology. Regulatory frameworks, such as the Medical Device Regulation (MDR), are enhancing product safety and efficacy, thereby boosting consumer confidence and market growth.

Leading countries include Germany, France, and the UK, where orthopedic devices companies like Smith & Nephew and B. Braun are prominent. The competitive landscape is marked by a focus on innovation and collaboration among key players. The rising incidence of musculoskeletal disorders and an aging population are driving demand for advanced orthopedic solutions, making Europe a vital market for future growth.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is an emerging powerhouse in the orthopedic devices market, holding approximately 20% of the global share. The region is witnessing rapid economic growth, urbanization, and an increasing prevalence of orthopedic conditions, which are significant drivers of market demand. Government initiatives aimed at improving healthcare access and affordability are also contributing to market expansion.

Countries like China and India are leading the charge, with a growing number of local and international players entering the market. Orthopedic devices companies such as Medtronic and NuVasive are expanding their presence in this region. The orthopedic device market is evolving, with a focus on cost-effective solutions and innovative technologies to cater to the diverse needs of the population.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa represent a resource-rich frontier for the orthopedic devices market, holding approximately 10% of the global share. The region is characterized by increasing healthcare investments and a growing awareness of orthopedic health. Regulatory bodies are working to improve standards and facilitate market entry for innovative devices, which is expected to drive growth in the coming years.

Countries like South Africa and the UAE are at the forefront, with a rising number of orthopedic surgeries and a demand for advanced medical technologies. The competitive landscape includes both local and international players, with a focus on addressing the unique healthcare challenges of the region. The increasing prevalence of lifestyle-related orthopedic conditions is further fueling orthopedic device market demand