Aging Population

The increasing proportion of elderly individuals is a primary driver of the Orthopedic Devices Market. As people age, they often experience musculoskeletal disorders, leading to a higher demand for orthopedic devices. According to recent statistics, the population aged 65 and older is projected to reach 1.5 billion by 2050, which suggests a substantial rise in conditions such as arthritis and osteoporosis. This demographic shift necessitates advanced orthopedic solutions, including joint replacements and spinal implants, thereby propelling market growth. Furthermore, the aging population is likely to require ongoing orthopedic care, which could lead to sustained demand for innovative devices and technologies within the Orthopedic Devices Market.

Technological Innovations

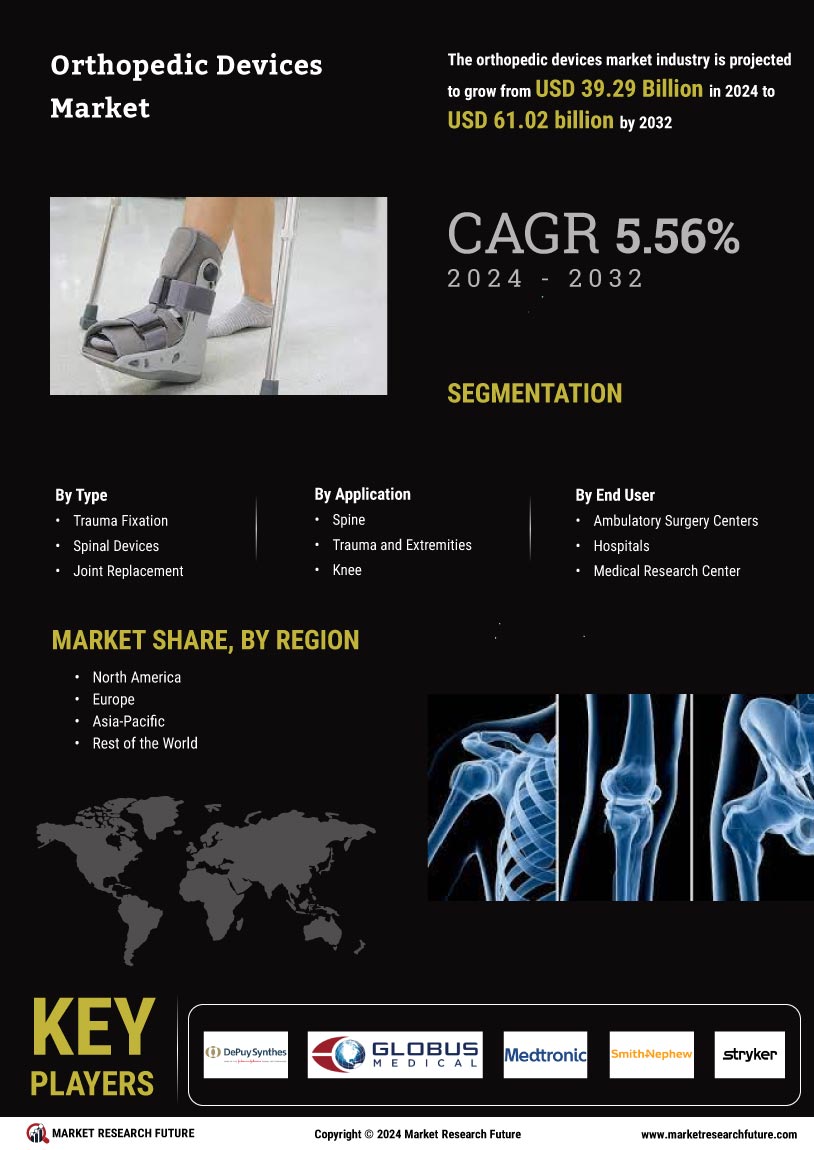

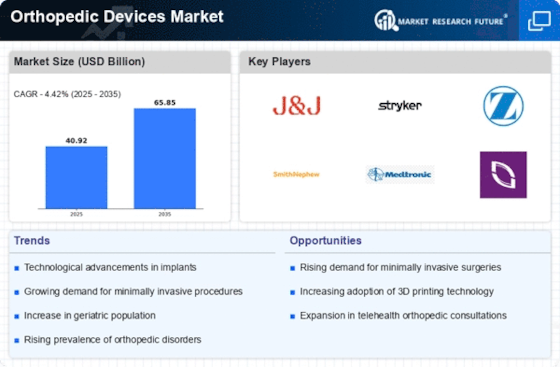

Technological advancements are revolutionizing the Orthopedic Devices Market, leading to the development of more effective and efficient treatment options. Innovations such as 3D printing, robotics, and smart implants are enhancing surgical precision and patient outcomes. For instance, 3D printing allows for the customization of implants tailored to individual patient anatomy, which may improve the success rates of orthopedic procedures. Additionally, robotic-assisted surgeries are becoming increasingly prevalent, offering surgeons enhanced control and accuracy. The market for orthopedic devices is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years, driven by these technological breakthroughs.

Increasing Healthcare Expenditure

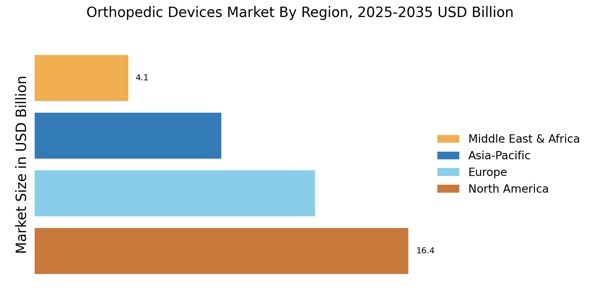

Rising healthcare expenditure is a crucial factor influencing the Orthopedic Devices Market. As countries invest more in healthcare infrastructure and services, the accessibility and availability of orthopedic treatments improve. This trend is particularly evident in emerging economies, where increased spending is facilitating the adoption of advanced orthopedic technologies. Reports indicate that healthcare spending is expected to reach trillions of dollars globally, which could lead to enhanced funding for orthopedic research and development. Consequently, the Orthopedic Devices Market is likely to experience growth as healthcare systems prioritize orthopedic care, leading to greater investment in innovative devices and treatment methodologies.

Rising Incidence of Sports Injuries

The growing participation in sports and physical activities has led to an increase in sports-related injuries, significantly impacting the Orthopedic Devices Market. Data indicates that sports injuries account for a considerable percentage of orthopedic cases, with millions of individuals seeking treatment annually. This trend is particularly evident among younger populations, where active lifestyles contribute to a higher risk of injuries such as ligament tears and fractures. Consequently, the demand for orthopedic devices, including braces, supports, and surgical implants, is expected to rise. The Orthopedic Devices Market is likely to benefit from innovations aimed at enhancing recovery and performance, catering to both amateur and professional athletes.

Growing Awareness of Orthopedic Health

There is a notable increase in awareness regarding orthopedic health, which is driving demand within the Orthopedic Devices Market. Educational campaigns and initiatives aimed at promoting musculoskeletal health are encouraging individuals to seek preventive care and treatment for orthopedic conditions. This heightened awareness is leading to earlier diagnosis and intervention, which may result in a greater need for orthopedic devices. Furthermore, as patients become more informed about their treatment options, they are more likely to opt for advanced orthopedic solutions, including minimally invasive surgeries and high-tech implants. The Orthopedic Devices Market stands to benefit from this trend, as it aligns with the growing emphasis on proactive healthcare.