Focus on Reducing Human Casualties

The Military Robots Market is significantly influenced by the focus on reducing human casualties in combat situations. As military operations become increasingly complex and dangerous, the deployment of robots for high-risk missions is seen as a viable solution. By utilizing unmanned systems for tasks such as bomb disposal, reconnaissance, and logistics, armed forces can minimize the exposure of personnel to life-threatening situations. This shift towards automation is not only aimed at preserving human life but also at improving mission success rates. The market is expected to expand as defense budgets allocate more resources towards robotic systems that enhance safety and operational effectiveness.

Advancements in Robotics Technology

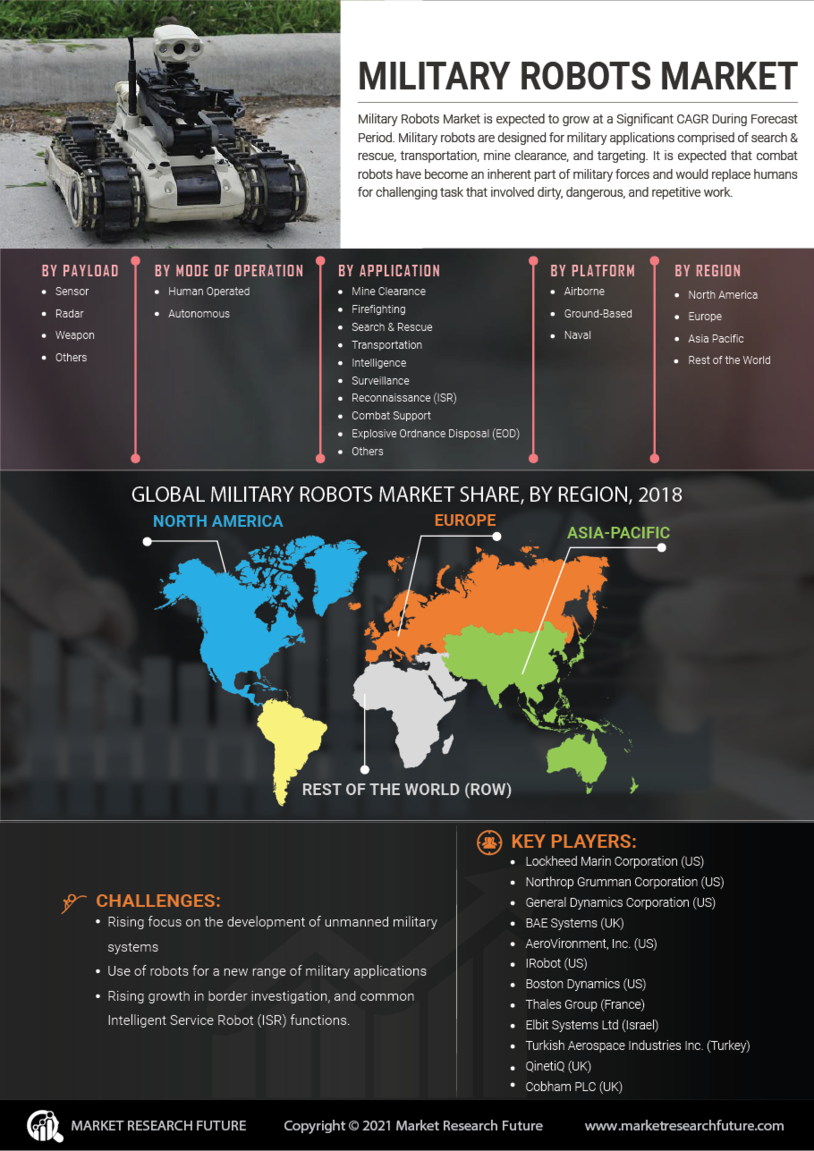

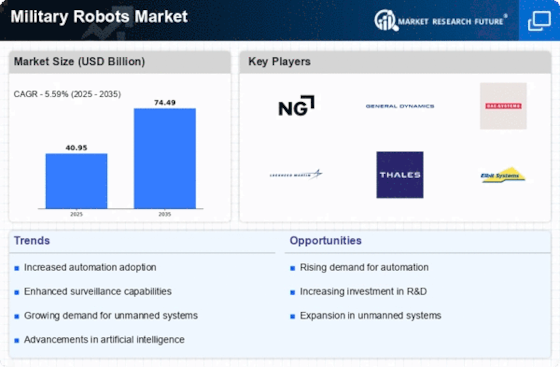

The Military Robots Market is experiencing a surge in advancements in robotics technology, which enhances the capabilities of military robots. Innovations in sensors, mobility, and autonomy are enabling robots to perform complex tasks in diverse environments. For instance, the integration of advanced navigation systems allows unmanned ground vehicles to traverse challenging terrains with precision. As a result, military organizations are increasingly adopting these technologies to improve operational efficiency and reduce risks to personnel. The market for military robots is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for more sophisticated and reliable robotic systems that can operate in various combat scenarios.

Emerging Threats and Geopolitical Tensions

The Military Robots Market is also shaped by emerging threats and geopolitical tensions that necessitate advanced military capabilities. As nations face new security challenges, the demand for sophisticated robotic systems is on the rise. The need for enhanced defense mechanisms against asymmetric warfare, cyber threats, and terrorism is prompting military organizations to invest in robotic technologies. This evolving landscape is likely to drive the development and deployment of military robots, as they offer strategic advantages in countering diverse threats. The market is poised for growth as defense forces adapt to these challenges and seek innovative solutions to enhance their operational readiness.

Increased Military Budgets and Defense Spending

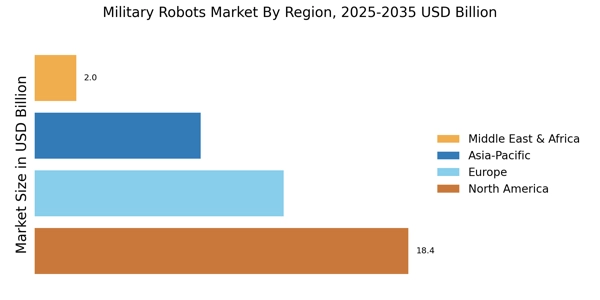

The Military Robots Market is benefiting from increased military budgets and defense spending across various nations. Governments are recognizing the strategic advantages offered by military robots, leading to substantial investments in research and development. For instance, defense budgets in several countries have seen a marked increase, with allocations for advanced technologies, including robotics, becoming a priority. This trend is likely to continue, as nations seek to modernize their armed forces and maintain a competitive edge. The growing financial commitment to military robotics is expected to drive innovation and expand the market, with projections indicating a robust growth trajectory in the coming years.

Rising Demand for Surveillance and Reconnaissance

The Military Robots Market is witnessing a rising demand for surveillance and reconnaissance capabilities. Military forces are increasingly utilizing drones and robotic systems for intelligence gathering, border security, and situational awareness. The need for real-time data and enhanced surveillance capabilities is paramount in modern warfare, leading to a substantial increase in investments in unmanned aerial vehicles (UAVs) and ground robots. Reports indicate that the market for military drones alone is expected to reach several billion dollars by 2026, reflecting the growing reliance on robotic systems for strategic operations. This trend underscores the importance of military robots in enhancing operational effectiveness and ensuring national security.