Regulatory Changes and Standards

Regulatory changes and standards are playing a crucial role in shaping the Sun Care Products Market. Governments and health organizations are implementing stricter regulations regarding the safety and efficacy of sun care products. These regulations often require manufacturers to provide comprehensive testing and labeling, ensuring that consumers are informed about the products they use. Compliance with these standards not only enhances consumer trust but also drives innovation within the industry, as brands strive to meet regulatory requirements. The ongoing evolution of regulations is likely to influence product development and marketing strategies, thereby impacting the overall dynamics of the Sun Care Products Market.

Increasing Awareness of Skin Health

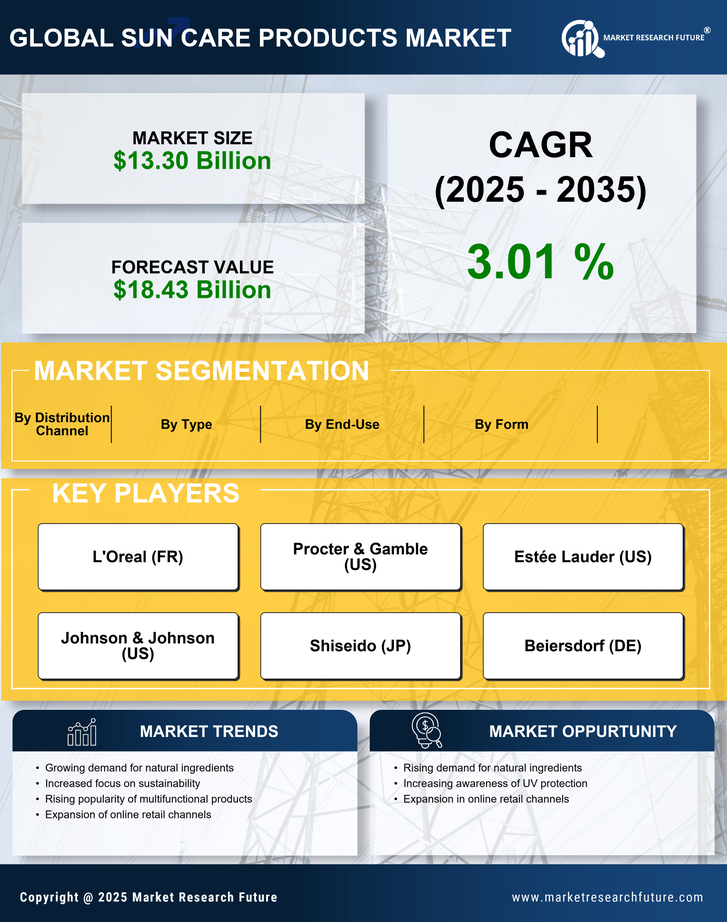

The rising awareness regarding skin health and the detrimental effects of UV radiation appears to be a pivotal driver for the Sun Care Products Market. Consumers are increasingly educated about the risks associated with sun exposure, including skin cancer and premature aging. This heightened awareness has led to a surge in demand for sun protection products, with the market projected to reach approximately 15 billion USD by 2026. As individuals prioritize skin health, brands are responding by innovating and expanding their product lines to include a variety of sun care options, such as lotions, sprays, and sticks. The emphasis on skin health is likely to continue influencing consumer purchasing decisions, thereby propelling the growth of the Sun Care Products Market.

Innovations in Product Formulations

Innovations in product formulations are transforming the Sun Care Products Market. Manufacturers are increasingly focusing on developing advanced formulations that offer enhanced protection and additional skin benefits. For instance, the incorporation of antioxidants, vitamins, and moisturizing agents into sun care products is becoming more prevalent. This trend not only caters to the demand for effective sun protection but also addresses consumers' desire for multifunctional products. The market for sun care products is expected to grow at a compound annual growth rate of around 5% over the next few years, driven by these innovations. As brands strive to differentiate themselves, the introduction of new and improved formulations is likely to play a crucial role in shaping the future of the Sun Care Products Market.

Rising Popularity of Outdoor Activities

The rising popularity of outdoor activities is significantly impacting the Sun Care Products Market. As more individuals engage in outdoor sports, travel, and leisure activities, the demand for effective sun protection products is increasing. This trend is particularly evident among younger demographics, who are more likely to prioritize sun care as part of their active lifestyles. The market is witnessing a shift towards products that offer long-lasting protection and are water-resistant, catering to the needs of outdoor enthusiasts. Furthermore, the increasing participation in activities such as hiking, beach outings, and sports is likely to drive sales in the Sun Care Products Market, as consumers seek reliable solutions to protect their skin from harmful UV rays.

Influence of Social Media and Celebrity Endorsements

The influence of social media and celebrity endorsements is reshaping consumer behavior in the Sun Care Products Market. Social media platforms serve as powerful tools for brands to engage with consumers, showcasing products through influencers and celebrities who advocate for sun protection. This trend has led to increased visibility and awareness of various sun care products, driving consumer interest and purchases. As a result, brands are investing in marketing strategies that leverage social media to reach target audiences effectively. The impact of these endorsements is likely to continue growing, as consumers increasingly rely on social media for product recommendations, thereby propelling the Sun Care Products Market forward.