Research Methodology on Steel Market

Introduction:

The steel market is a highly dynamic and lucrative market which has witnessed an upward growth trend over the last several years. This research report is aimed at understanding the various factors that contribute to the growth of the steel market and the significant trends that shape the working of the market in the future. With the help of primary research methodologies such as a comprehensive market survey, interviews, and secondary research such as the analysis of currently available industry documents, this report aims to assess the current status of the global steel market and the factors that will affect its future development.

Research Methodology:

To adequately assess the global steel market and its various trends, a well-defined research methodology is adopted. This research methodology includes primary and secondary research methodologies and is used to accurately identify and analyze the key trends of the steel market.

Primary Research Methodology:

The primary research methodology is used to obtain an in-depth understanding of the global steel market by collecting data directly from the stakeholders in the steel market. To accomplish this goal, a comprehensive market survey and interviews are conducted by experienced market research firms. The survey is used to gauge the impact of various factors such as pricing, production, distribution, quality standards, and other applicable regulations on various steel market segments. The interviews are used to assess the key stakeholders in the steel market to gain an understanding of their opinions and strategies on various steel market segments.

Secondary Research Methodology:

The secondary research methodology is used to complement the findings from the primary research methodology by analyzing industry documents and reports that are published on the global steel market. The secondary research methodology includes an in-depth analysis of published industry documents such as journals, business briefs, and other relevant sources. Through this method, the report obtains insights into the global steel market dynamics and the opportunities that may be available to new players in the market.

Data Collection Tools:

The primary data collection tools include a comprehensive market survey which is used to collect data directly from the stakeholders in the steel market. The survey uses a combination of qualitative and quantitative techniques such as questionnaires, interviews, and focus groups to gather data on various steel market segments.

The interviews focus on obtaining the opinions of key stakeholders on various steel market segments to gauge the impact of various factors on the steel market. The focus groups are used to gain insight into the strategies and opinions of the stakeholders as well as to identify areas for growth and improvement within the steel market.

Data Analysis Techniques:

To analyze the data collected from the primary and secondary research, different data analysis techniques are used. The data collected from the primary research is analyzed using descriptive statistics such as cross-tabulation and frequency tables. These techniques are used to assess the various factors that contribute to the growth and development of the global steel market. The data collected from the secondary research is analyzed using inferential statistics such as correlation and regression analysis. These techniques are used to identify significant trends and correlations in the data and to develop forecasts for the future of the global steel market.

Reporting:

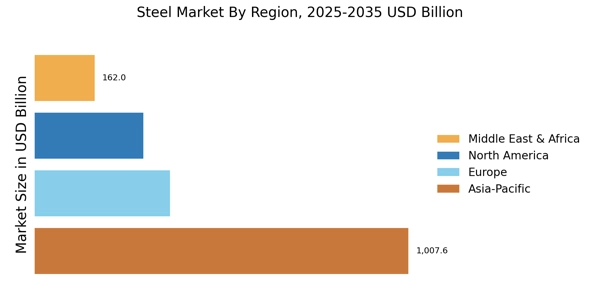

The data gathered from the research is presented in the form of a comprehensive research report. The report contains detailed information on the various steel market segments, the factors that contribute to their growth, and the trends that shapes the development of the market in the future. The report provides valuable insights into the global steel market and acts as a valuable resource for understanding the current and future development of the market.

Conclusion:

This research report has adopted a comprehensive research methodology to obtain an in-depth understanding of the various trends that shape the growth of the global steel market in the future. By using a combination of primary and secondary research methodologies, this report aims to accurately identify and analyze the key drivers and trends of the steel market. The report provides valuable insights into the current status of the steel market as well as the opportunities that may be available in the future for new players in the global steel market.