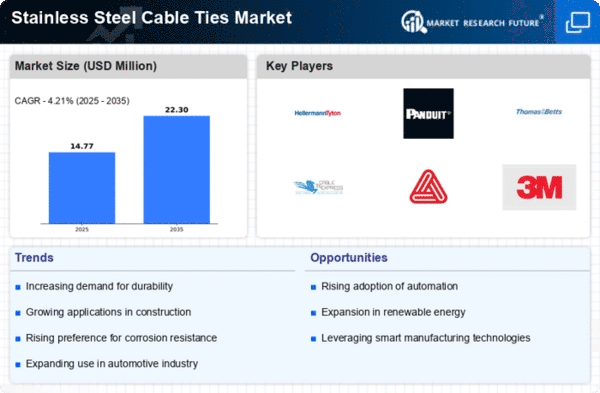

Market Growth Projections

The Global Stainless Steel Cable Ties Market Industry is projected to experience robust growth over the next decade. With an anticipated market value of 1250 USD Million in 2024, the industry is set to expand significantly, reaching approximately 2750 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 7.43% from 2025 to 2035, indicating a strong demand for stainless steel cable ties across various sectors. Factors such as increased industrialization, technological advancements, and a focus on sustainability are likely to drive this growth, positioning the market for continued success.

Increased Focus on Sustainability

The Global Stainless Steel Cable Ties Market Industry is witnessing a shift towards sustainable practices, prompting manufacturers to adopt eco-friendly materials. Stainless steel, known for its recyclability and longevity, aligns with the growing emphasis on reducing environmental impact. Companies are increasingly prioritizing sustainable sourcing and production methods, which could attract environmentally conscious consumers. This trend may contribute to the market's expansion, as the demand for sustainable products continues to rise. The industry's commitment to sustainability is likely to enhance its reputation and foster long-term growth.

Expansion of Renewable Energy Sector

The Global Stainless Steel Cable Ties Market Industry is benefiting from the expansion of the renewable energy sector. As the world shifts towards sustainable energy sources, the need for reliable fastening solutions in solar and wind energy installations increases. Stainless steel cable ties are essential for securing cables and components in these systems, ensuring durability and safety. The growth of renewable energy projects globally is likely to drive demand for stainless steel cable ties, contributing to the market's projected value of 2750 USD Million by 2035. This trend underscores the ties' versatility and importance in modern energy solutions.

Rising Demand in Construction Sector

The Global Stainless Steel Cable Ties Market Industry experiences a notable surge in demand driven by the construction sector. As urbanization accelerates, the need for durable and corrosion-resistant materials becomes paramount. Stainless steel cable ties are increasingly utilized in various applications, including securing electrical wiring and plumbing systems. This trend is reflected in the projected market value, which is expected to reach 1250 USD Million in 2024. The construction industry's growth, particularly in emerging economies, is likely to bolster the demand for stainless steel cable ties, thereby enhancing their market presence.

Growing Demand in Automotive Applications

The Global Stainless Steel Cable Ties Market Industry is experiencing increased demand from the automotive sector, where these ties are utilized for securing components and wiring. The automotive industry's shift towards lightweight materials and enhanced safety features drives the need for reliable fastening solutions. Stainless steel cable ties offer superior strength and resistance to environmental factors, making them ideal for automotive applications. As the automotive market continues to expand, the demand for stainless steel cable ties is expected to rise, further solidifying their role in this critical industry.

Technological Advancements in Manufacturing

Technological innovations in manufacturing processes are significantly impacting the Global Stainless Steel Cable Ties Market Industry. Advanced production techniques, such as automated machinery and precision engineering, enhance the quality and efficiency of stainless steel cable ties. These advancements allow for the creation of ties with improved tensile strength and durability, catering to diverse applications across various sectors. As manufacturers invest in technology, the market is poised for growth, with projections indicating a compound annual growth rate of 7.43% from 2025 to 2035. This technological evolution is likely to redefine industry standards.