Tool steel Market Summary

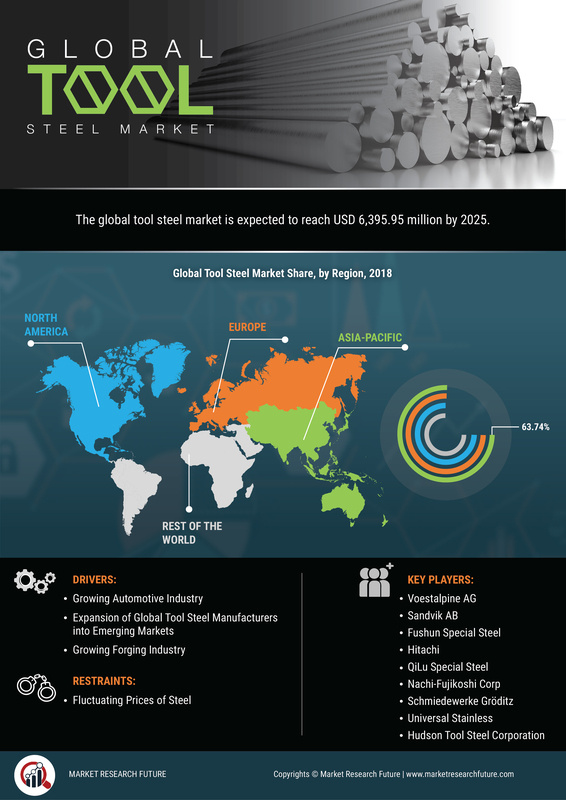

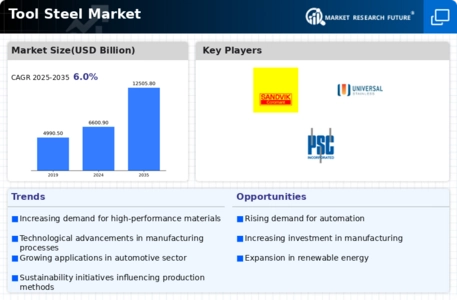

As per Market Research Future Analysis, the Tool Steel Market was valued at USD 6600.90 Billion in 2024 and is projected to grow to USD 12556.83 Billion by 2035, with a CAGR of 6.02% from 2025 to 2035. Key drivers include the expansion of manufacturers into emerging markets and growth in the forging industry. The automotive and aerospace sectors are significant consumers, particularly for high-speed tool steel (HSS), which is in high demand due to its superior properties. Sustainability initiatives are also influencing market dynamics, with a focus on recycling and cleaner production methods.

Key Market Trends & Highlights

The Tool Steel Market is witnessing several transformative trends.

- High-speed tool steel (HSS) demand is increasing, driven by its superior hardness and wear resistance.

- Sustainability efforts are gaining traction, with manufacturers focusing on recycling and eco-friendly practices.

- Powder metallurgy (PM) is emerging as a preferred manufacturing technique, offering improved mechanical properties.

- North America is expected to see significant growth due to its robust industrial sector and high demand for cutting tools.

Market Size & Forecast

| 2024 Market Size | USD 6600.90 Billion |

| 2035 Market Size | USD 12556.83 Billion |

| CAGR (2024-2035) | 6.02% |

Major Players

Key players include Voestalpine AG (Austria), Sandvik (Sweden), Baosteel Group (China), Samuel Son & Co (Canada), Hitachi Metal (Japan), and others.