Focus on Risk Management

The trade surveillance-systems market is increasingly aligned with the broader focus on risk management within financial institutions. As firms in Spain face evolving market dynamics and regulatory challenges, there is a pressing need to implement comprehensive risk management frameworks. Trade surveillance systems play a crucial role in identifying and mitigating risks associated with trading activities. In 2025, it is anticipated that investments in risk management technologies, including trade surveillance systems, will account for approximately 25% of total IT budgets in the financial sector. This emphasis on risk management is likely to drive growth in the trade surveillance-systems market, as firms seek to enhance their capabilities in identifying and addressing potential risks.

Technological Integration

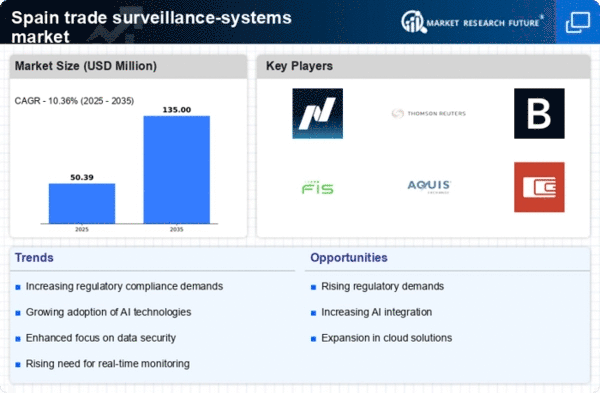

The trade surveillance-systems market is witnessing a trend towards the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enable firms to analyze vast amounts of trading data in real-time, enhancing their ability to detect anomalies and suspicious activities. In Spain, the adoption of AI-driven surveillance systems is expected to increase by 30% over the next few years, as firms recognize the potential for improved efficiency and accuracy in monitoring trading activities. This technological integration not only streamlines operations but also provides a competitive edge in the market. Consequently, the trade surveillance-systems market is likely to expand as firms invest in innovative solutions that leverage these advanced technologies.

Rising Cybersecurity Concerns

The trade surveillance-systems market is also influenced by rising cybersecurity concerns among financial institutions in Spain. As cyber threats become more sophisticated, firms are increasingly aware of the need to protect sensitive trading data and ensure the integrity of their surveillance systems. This awareness is driving investments in cybersecurity measures, which are often integrated with trade surveillance solutions. In 2025, the market for cybersecurity in the financial sector is projected to grow by 20%, with a significant portion of this growth attributed to the need for secure trade surveillance systems. Consequently, the trade surveillance-systems market is likely to benefit from this trend, as firms prioritize the implementation of secure and resilient surveillance technologies.

Increasing Regulatory Scrutiny

The trade surveillance-systems market in Spain is experiencing heightened regulatory scrutiny, driven by the need for financial institutions to comply with stringent regulations. Authorities are increasingly mandating the implementation of robust surveillance systems to monitor trading activities and detect potential market abuse. This regulatory environment is compelling firms to invest in advanced trade surveillance solutions, which are essential for ensuring compliance and avoiding hefty fines. In 2025, the Spanish financial sector is projected to allocate approximately €200 million towards compliance-related technologies, with a significant portion directed towards trade surveillance systems. As a result, the demand for these systems is likely to grow, as firms seek to enhance their monitoring capabilities and mitigate risks associated with non-compliance.

Growing Demand for Real-Time Monitoring

There is a growing demand for real-time monitoring solutions within the trade surveillance-systems market, as financial institutions in Spain strive to enhance their operational efficiency. The ability to monitor trades in real-time allows firms to respond swiftly to potential market manipulation or insider trading activities. This demand is reflected in the increasing investments in surveillance technologies, with the market expected to reach €150 million by the end of 2025. As firms prioritize timely detection and response mechanisms, the trade surveillance-systems market is likely to see a surge in the development and deployment of real-time monitoring solutions, which are essential for maintaining market integrity.