Government Initiatives and Funding

Government support plays a crucial role in the growth of the orthopedic biomaterial market. In Spain, various initiatives aimed at promoting research and development in healthcare technologies are underway. The Spanish government has allocated substantial funding for projects focused on improving orthopedic treatments and materials. This financial backing encourages innovation and attracts investments from private sectors, thereby enhancing the overall market landscape. As a result, the orthopedic biomaterial market is likely to benefit from increased research activities, leading to the introduction of novel products and solutions that cater to the evolving needs of healthcare providers.

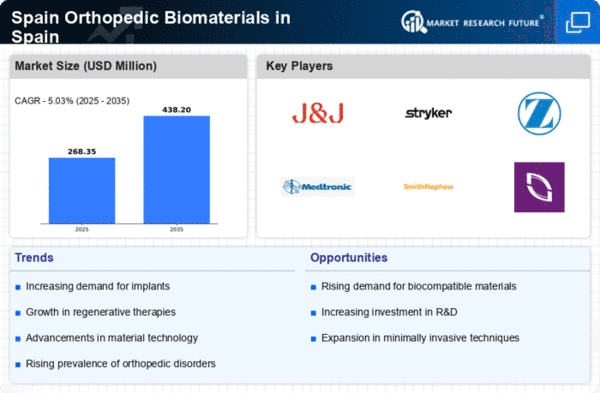

Advancements in Biomaterial Technology

Technological innovations in biomaterials are significantly influencing the orthopedic biomaterial market. The development of biocompatible materials, such as bioactive ceramics and polymers, enhances the effectiveness of orthopedic implants and devices. These advancements not only improve patient outcomes but also reduce the risk of complications associated with traditional materials. In Spain, research institutions and universities are increasingly collaborating with industry players to foster innovation in this field. The market is projected to witness a surge in demand for these advanced materials, with estimates suggesting a potential increase in market value to €1 billion by 2027.

Rising Incidence of Orthopedic Disorders

The increasing prevalence of orthopedic disorders in Spain is a primary driver for the orthopedic biomaterial market. Conditions such as osteoarthritis and fractures are becoming more common, particularly among the aging population. According to recent health statistics, approximately 20% of the Spanish population is over 65 years old, a demographic that is particularly susceptible to musculoskeletal issues. This rise in orthopedic conditions necessitates advanced biomaterials for effective treatment and rehabilitation. The orthopedic biomaterial market is expected to grow as healthcare providers seek innovative solutions to address these challenges, potentially leading to a growth rate of around 8% annually in the coming years.

Increased Awareness and Patient Education

There is a growing awareness among patients regarding orthopedic health and the available treatment options, which is positively impacting the orthopedic biomaterial market. Educational campaigns and resources provided by healthcare professionals are empowering patients to seek timely interventions for orthopedic issues. In Spain, this heightened awareness is leading to an increase in consultations and procedures related to orthopedic conditions. As patients become more informed about the benefits of advanced biomaterials, the demand for these products is likely to rise, contributing to a projected market growth of approximately 7% over the next few years.

Growing Demand for Minimally Invasive Procedures

The shift towards minimally invasive surgical techniques is reshaping the orthopedic biomaterial market. Patients and healthcare professionals are increasingly favoring procedures that reduce recovery time and minimize surgical trauma. This trend is driving the demand for specialized biomaterials that are compatible with such techniques. In Spain, the adoption of minimally invasive orthopedic surgeries is on the rise, with hospitals reporting a significant increase in these procedures. Consequently, the orthopedic biomaterial market is expected to expand as manufacturers develop products tailored for these applications, potentially leading to a market growth of 6% annually.