Rising Demand for Quality Assurance

The digital inspection market in Spain is experiencing a notable increase in demand for quality assurance across various sectors, including manufacturing and construction. Companies are increasingly adopting digital inspection technologies to ensure compliance with stringent quality standards. This trend is driven by the need to minimize defects and enhance product reliability. In 2025, the market is projected to grow by approximately 15%, reflecting a shift towards more rigorous quality control measures. The integration of advanced technologies such as AI and machine learning into inspection processes is likely to further bolster this demand, as businesses seek to optimize their operations and reduce costs associated with product failures. Consequently, the digital inspection market is poised for significant growth as organizations prioritize quality assurance in their operational strategies.

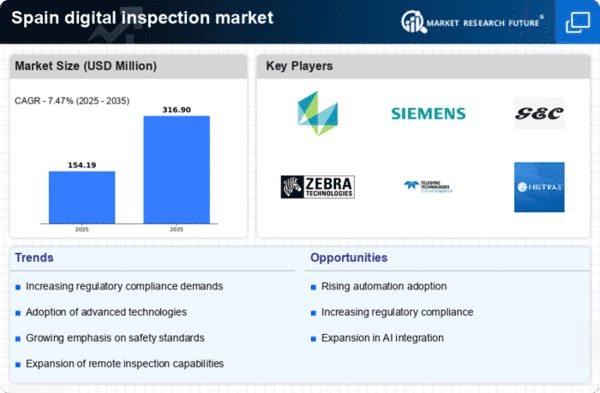

Growing Emphasis on Safety Standards

The digital inspection market in Spain is significantly influenced by the growing emphasis on safety standards across various industries. Regulatory bodies are increasingly mandating the use of digital inspection technologies to ensure compliance with safety protocols, particularly in sectors such as construction, manufacturing, and food processing. In 2025, it is estimated that compliance-related expenditures will account for approximately 20% of total operational costs in these industries. This shift towards stringent safety measures is likely to drive the adoption of digital inspection solutions, as they provide accurate and timely data for risk assessment and management. The digital inspection market is thus positioned to thrive as organizations prioritize safety and compliance in their operational frameworks.

Focus on Cost Reduction and Efficiency

In the competitive landscape of Spain, businesses are increasingly focusing on cost reduction and operational efficiency, which serves as a significant driver for the digital inspection market. Companies are recognizing that traditional inspection methods can be time-consuming and costly, prompting a shift towards digital solutions that offer faster and more accurate results. By adopting digital inspection technologies, organizations can reduce inspection times by up to 30%, leading to substantial cost savings. This trend is particularly evident in sectors such as manufacturing and construction, where efficiency is paramount. The digital inspection market is thus likely to expand as businesses prioritize technologies that enhance productivity while minimizing expenses.

Increased Investment in Infrastructure

Spain's ongoing investment in infrastructure development is a critical driver for the digital inspection market. The government has allocated substantial funds for the modernization of transportation networks, energy facilities, and urban development projects. This investment is expected to reach €30 billion by 2026, creating a robust demand for digital inspection solutions to monitor construction quality and safety. Digital inspection technologies enable real-time monitoring and data collection, which are essential for ensuring compliance with safety regulations and project specifications. As infrastructure projects become more complex, the digital inspection market is likely to benefit from the need for advanced inspection methods that can handle large-scale operations efficiently. This trend indicates a promising future for digital inspection technologies in Spain's infrastructure sector.

Technological Integration and Automation

The integration of advanced technologies and automation in inspection processes is a pivotal driver for the digital inspection market in Spain. Companies are increasingly leveraging technologies such as drones, IoT devices, and AI to enhance inspection efficiency and accuracy. This trend is expected to lead to a market growth rate of around 12% annually as businesses seek to streamline their operations and reduce manual inspection costs. The digital inspection market is witnessing a shift towards automated solutions that not only improve inspection speed but also provide comprehensive data analytics for better decision-making. As organizations continue to embrace digital transformation, the demand for innovative inspection technologies is likely to escalate, further propelling market growth.