Focus on Safety and Risk Management

The emphasis on safety and risk management in various industries is a critical driver for the digital inspection market in France. Organizations are increasingly prioritizing the identification and mitigation of risks associated with equipment failure and operational hazards. This focus is particularly evident in sectors such as energy and construction, where safety regulations are stringent. The digital inspection market is likely to benefit from this trend, as companies seek to implement comprehensive inspection strategies that leverage advanced technologies. By adopting digital inspection solutions, organizations can enhance their risk management frameworks, potentially reducing incidents and improving overall safety performance. This shift is expected to propel market growth as businesses recognize the value of proactive safety measures.

Rising Demand for Quality Assurance

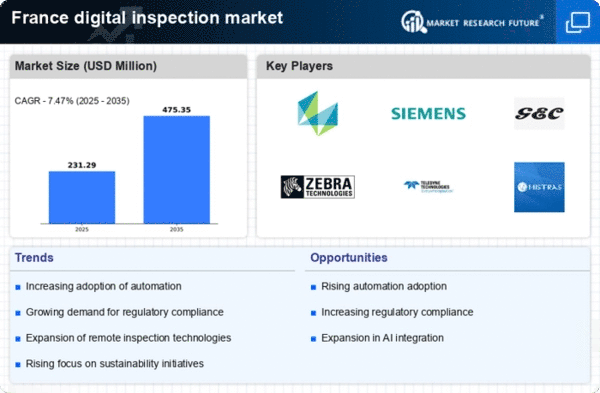

The digital inspection market in France is experiencing a notable surge in demand for quality assurance across various industries. This trend is driven by the increasing need for compliance with stringent quality standards, particularly in sectors such as manufacturing and construction. Companies are investing in digital inspection technologies to enhance product reliability and safety, which is crucial for maintaining competitive advantage. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the industry's commitment to adopting advanced inspection solutions. As organizations strive to meet customer expectations and regulatory requirements, the digital inspection market is likely to expand significantly, fostering innovation and efficiency in quality control processes.

Increased Investment in Infrastructure

France's ongoing investment in infrastructure development is significantly impacting the digital inspection market. The government has allocated substantial funds for upgrading transportation networks, energy facilities, and public utilities, which necessitates rigorous inspection processes. This investment is projected to reach €50 billion by 2027, creating a robust demand for digital inspection technologies to ensure compliance and safety standards. As infrastructure projects become more complex, the reliance on advanced inspection solutions is likely to increase, driving growth in the digital inspection market. Companies are expected to adopt innovative technologies to streamline inspection workflows and enhance project delivery timelines, thereby contributing to the market's expansion.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the digital inspection market is transforming traditional inspection methodologies in France. AI technologies enable real-time data analysis and predictive maintenance, which enhances the accuracy and efficiency of inspections. This shift is particularly relevant in sectors such as aerospace and automotive, where precision is paramount. The market is witnessing an increase in AI-driven inspection tools, which are expected to account for over 30% of the total market share by 2026. As organizations recognize the potential of AI to reduce operational costs and improve inspection outcomes, the digital inspection market is poised for substantial growth, driven by technological advancements and the need for smarter solutions.

Growing Adoption of Remote Inspection Technologies

The growing adoption of remote inspection technologies is reshaping the digital inspection market landscape in France. As industries seek to minimize downtime and enhance operational efficiency, remote inspection solutions are becoming increasingly popular. These technologies allow inspectors to conduct assessments without being physically present, utilizing drones and advanced imaging techniques. The market for remote inspection is anticipated to grow by over 25% in the next few years, driven by the need for flexibility and cost-effectiveness. This trend is particularly relevant in sectors such as oil and gas, where remote inspections can significantly reduce operational risks and costs. Consequently, the digital inspection market is likely to expand as organizations embrace these innovative solutions to optimize their inspection processes.