Growing Environmental Concerns

Growing environmental concerns are driving the chromatography columns market in South Korea, particularly in the context of environmental monitoring and analysis. The need for accurate detection of pollutants and contaminants in air, water, and soil has led to an increased demand for chromatography techniques. Regulatory bodies are imposing stricter guidelines on environmental testing, which necessitates the use of reliable chromatography columns for accurate results. The market is expected to grow as industries and governmental agencies invest in advanced analytical solutions to comply with these regulations. This trend indicates a potential increase in market size by approximately 5% over the next few years, as environmental sustainability becomes a priority.

Increasing Research Activities

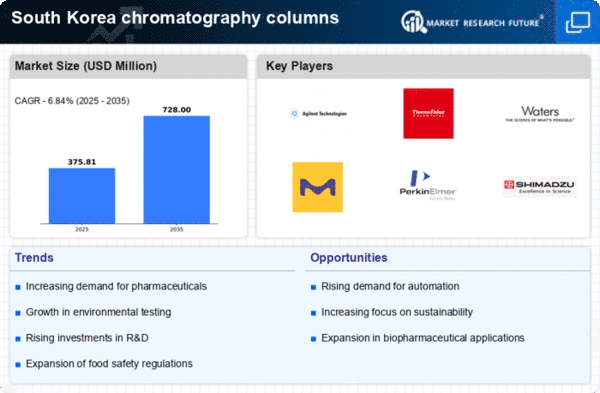

The chromatography columns market in South Korea is experiencing growth due to a surge in research activities across various sectors, including pharmaceuticals, biotechnology, and environmental science. Research institutions and universities are increasingly investing in advanced analytical techniques, which necessitate the use of high-quality chromatography columns. This trend is supported by government funding initiatives aimed at enhancing scientific research capabilities. As a result, the demand for chromatography columns is projected to rise, with an estimated growth rate of 6.5% annually over the next five years. The emphasis on innovation in research methodologies further propels the chromatography columns market, as researchers seek to improve separation techniques and analytical accuracy.

Rising Focus on Quality Control

The rising focus on quality control across various industries is significantly influencing the chromatography columns market. In sectors such as food and beverage, pharmaceuticals, and cosmetics, stringent quality assurance measures are being implemented to ensure product safety and compliance with health regulations. This heightened emphasis on quality control drives the demand for chromatography columns, as they are essential for accurate testing and analysis. The market is projected to grow by 6% annually, reflecting the increasing investment in quality assurance technologies. Companies are likely to adopt advanced chromatography solutions to enhance their testing capabilities and maintain high standards in product quality.

Expansion of Pharmaceutical Industry

The expansion of the pharmaceutical industry in South Korea significantly impacts the chromatography columns market. With the country being a hub for pharmaceutical manufacturing and development, there is a growing need for efficient analytical tools to ensure drug quality and compliance with regulatory standards. The market for chromatography columns is expected to witness a substantial increase. This increase is driven by the rising number of drug approvals and the need for rigorous testing protocols. In 2025, the pharmaceutical sector is projected to contribute approximately $30 billion to the national economy, further stimulating demand for chromatography columns. This growth is indicative of the industry's reliance on advanced chromatography techniques for drug formulation and quality control.

Emergence of Advanced Analytical Techniques

The emergence of advanced analytical techniques is reshaping the chromatography columns market in South Korea. Innovations such as ultra-high-performance liquid chromatography (UHPLC) and two-dimensional chromatography are gaining traction among researchers and industries. These techniques offer enhanced resolution and faster analysis times, which are critical for meeting the demands of modern analytical laboratories. As industries adopt these advanced methodologies, the need for specialized chromatography columns tailored to specific applications is likely to increase. This trend suggests a potential market growth of around 7% annually, as laboratories seek to upgrade their equipment to remain competitive and efficient in their analytical processes.