Growing Environmental Regulations

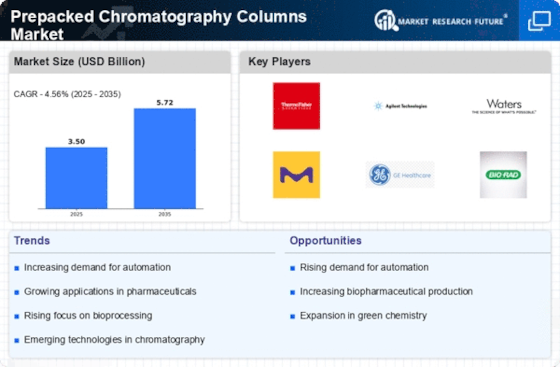

The Prepacked Chromatography Columns Market is increasingly shaped by stringent environmental regulations aimed at reducing waste and promoting sustainability. As regulatory bodies impose stricter guidelines on laboratory practices, there is a growing need for chromatography solutions that minimize environmental impact. In 2025, the market is expected to see a shift towards prepacked columns that utilize eco-friendly materials and processes. This trend is driven by the need for laboratories to comply with regulations while maintaining efficiency in their operations. Prepacked chromatography columns that are designed for easy disposal and reduced solvent consumption are likely to gain traction. Consequently, this shift not only aligns with regulatory requirements but also appeals to environmentally conscious consumers, thereby fostering growth in the market.

Increased Focus on Biopharmaceuticals

The Prepacked Chromatography Columns Market is significantly influenced by the growing emphasis on biopharmaceuticals. As biopharmaceuticals gain traction due to their targeted therapeutic effects, the demand for specialized purification techniques rises correspondingly. In 2025, the biopharmaceutical sector is expected to represent a considerable portion of the chromatography market, with a projected growth rate of approximately 10%. This trend is largely driven by advancements in biotechnology and the increasing prevalence of chronic diseases that necessitate innovative treatment options. Prepacked chromatography columns, designed for the efficient separation and purification of biomolecules, are thus becoming essential in biopharmaceutical manufacturing processes. Their ability to provide high-resolution separations and scalability makes them a preferred choice among researchers and manufacturers alike, further stimulating market growth.

Technological Innovations in Chromatography

The Prepacked Chromatography Columns Market is witnessing a wave of technological innovations that enhance the efficiency and effectiveness of chromatography processes. Recent advancements in materials and column design have led to the development of high-performance prepacked columns that offer superior separation capabilities. In 2025, the market is expected to benefit from innovations such as improved packing techniques and the introduction of new stationary phases, which can significantly reduce analysis time and increase throughput. These innovations not only improve the quality of separations but also lower operational costs for laboratories. As research institutions and commercial laboratories seek to optimize their workflows, the adoption of these advanced prepacked chromatography columns is likely to accelerate, thereby driving market expansion.

Rising Demand in Pharmaceutical Applications

The Prepacked Chromatography Columns Market experiences a notable surge in demand driven by the pharmaceutical sector. As the industry increasingly focuses on drug development and purification processes, the need for efficient and reliable chromatography solutions becomes paramount. In 2025, the pharmaceutical sector is projected to account for a substantial share of the market, with an estimated growth rate of around 8% annually. This growth is attributed to the rising complexity of drug formulations and the necessity for stringent quality control measures. Consequently, prepacked chromatography columns, which offer enhanced reproducibility and reduced preparation time, are becoming indispensable tools in laboratories. The ability to streamline workflows and ensure consistent results positions these columns as a critical component in pharmaceutical research and production, thereby propelling the overall market forward.

Expansion of Research and Development Activities

The Prepacked Chromatography Columns Market is benefiting from the expansion of research and development activities across various sectors, including academia and industry. As organizations invest more in R&D to drive innovation, the demand for reliable and efficient chromatography solutions rises. In 2025, it is anticipated that R&D expenditures will increase, particularly in fields such as pharmaceuticals, biotechnology, and environmental science. This growth is expected to create a robust demand for prepacked chromatography columns, which facilitate complex analyses and ensure reproducibility in experimental results. The ability of these columns to support diverse applications, from drug discovery to environmental monitoring, positions them as essential tools in research laboratories. As a result, the expansion of R&D activities is likely to serve as a significant driver for the prepacked chromatography columns market.