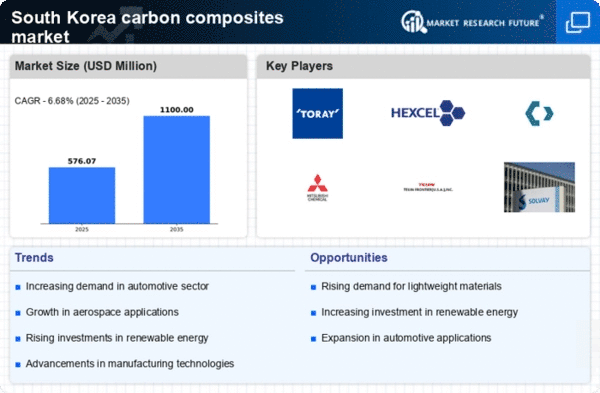

The carbon composites market in South Korea is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as aerospace, automotive, and renewable energy. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and sustainability. Companies like Toray Industries (Japan) and Mitsubishi Chemical (Japan) are focusing on enhancing their product offerings through advanced research and development initiatives, while Hexcel Corporation (US) and SGL Carbon (Germany) are leveraging strategic partnerships to bolster their market presence. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains, which is particularly crucial in a market that is moderately fragmented. The competitive structure allows for both established players and emerging companies to coexist, with larger firms often setting the pace in terms of innovation and market share. This collective influence of key players shapes the market dynamics, as they adapt to evolving customer needs and regulatory requirements.

In October Toray Industries (Japan) announced a significant investment in a new production facility aimed at increasing its capacity for carbon fiber manufacturing. This strategic move is expected to enhance the company's ability to meet the growing demand for lightweight materials in the automotive sector, thereby reinforcing its competitive position. The investment aligns with Toray's commitment to sustainability, as the new facility will incorporate energy-efficient technologies.

In September Hexcel Corporation (US) expanded its collaboration with a leading aerospace manufacturer to develop next-generation composite materials. This partnership is pivotal, as it not only strengthens Hexcel's foothold in the aerospace sector but also underscores the importance of innovation in maintaining competitive advantage. The focus on developing advanced materials is likely to yield significant benefits in terms of performance and weight reduction, which are critical factors in aerospace applications.

In August SGL Carbon (Germany) launched a new line of bio-based carbon composites, marking a strategic shift towards more sustainable product offerings. This initiative reflects the growing trend towards eco-friendly materials and positions SGL Carbon as a leader in sustainability within the market. The introduction of bio-based composites is expected to attract environmentally conscious customers and enhance the company's reputation in a competitive landscape increasingly focused on sustainability.

As of November current trends in the carbon composites market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly important, as companies seek to leverage complementary strengths to enhance their competitive positioning. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future differentiation will hinge on the ability to deliver advanced, sustainable solutions that meet the evolving demands of the market.