US Carbon Composites Market Summary

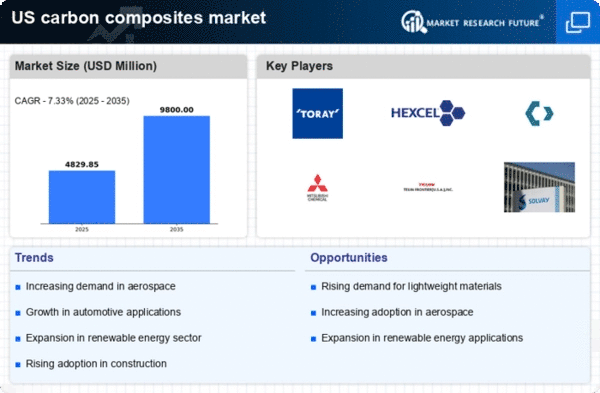

As per Market Research Future analysis, the US carbon composites market Size was estimated at 4500.0 USD Million in 2024. The US carbon composites market is projected to grow from 4829.85 USD Million in 2025 to 9800.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US carbon composites market is experiencing robust growth driven by technological advancements and increasing applications across various sectors.

- The aerospace segment remains the largest, reflecting a strong demand for lightweight materials in aircraft manufacturing.

- Automotive applications are the fastest-growing segment, as manufacturers seek to enhance fuel efficiency and performance.

- There is a notable focus on sustainability and recycling, aligning with global environmental goals and consumer preferences.

- Technological advancements in manufacturing and regulatory support for lightweight materials are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 4500.0 (USD Million) |

| 2035 Market Size | 9800.0 (USD Million) |

| CAGR (2025 - 2035) | 7.33% |

Major Players

Toray Industries (JP), Hexcel Corporation (US), SGL Carbon (DE), Mitsubishi Chemical (JP), Teijin Limited (JP), Solvay S.A. (BE), Cytec Industries (US), Zoltek Companies (US), Axiom Materials (US)