Expansion of Distribution Channels

The remdesivir market in South America is poised for growth due to the expansion of distribution channels. Improved logistics and supply chain management are enabling pharmaceutical companies to reach a broader audience, ensuring that remdesivir is accessible to healthcare providers across various regions. Recent developments indicate that the establishment of new partnerships with local distributors has increased the availability of antiviral medications in remote areas. This expansion is expected to enhance market penetration, with projections suggesting a 15% increase in distribution efficiency over the next few years. As access improves, the remdesivir market is likely to experience a corresponding rise in demand.

Growing Awareness of Viral Infections

There is a growing awareness of viral infections among the South American population, which is influencing the remdesivir market. Public health campaigns and educational initiatives are helping to inform individuals about the risks associated with viral diseases and the importance of timely treatment. This heightened awareness is likely to drive demand for antiviral medications, including remdesivir. Market analysis suggests that as more people recognize the need for effective treatments, the remdesivir market could see an increase in sales, potentially rising by 12% in the coming years. This trend underscores the importance of public health education in shaping market dynamics.

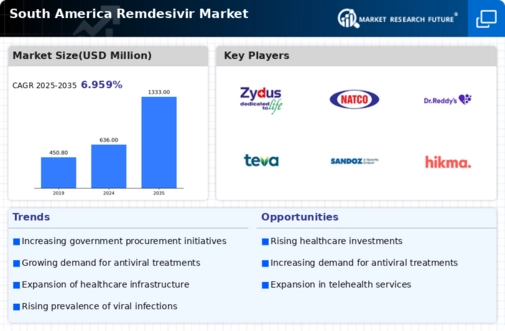

Rising Demand for Antiviral Treatments

The remdesivir market in South America is experiencing a notable increase in demand for antiviral treatments. This surge is driven by a growing awareness of viral infections and the need for effective therapeutic options. As healthcare providers and patients seek reliable solutions, the market is projected to expand significantly. Recent data indicates that the market could grow at a CAGR of approximately 15% over the next five years. This trend suggests that the remdesivir market is becoming increasingly vital in addressing public health challenges, particularly in regions with high incidences of viral diseases. The rising demand is likely to encourage pharmaceutical companies to invest in research and development, further enhancing the availability of remdesivir and similar antiviral agents.

Increased Investment in Healthcare Research

The remdesivir market in South America is likely to benefit from increased investment in healthcare research. As governments and private entities allocate more resources to medical research, the potential for innovative antiviral treatments expands. This trend is particularly relevant in the context of remdesivir, as ongoing studies may lead to new formulations or combination therapies that enhance its efficacy. Recent statistics indicate that research funding in the region has increased by 20% over the past two years, suggesting a robust commitment to advancing healthcare solutions. Such investments could stimulate growth in the remdesivir market, fostering collaboration between academic institutions and pharmaceutical companies.

Government Initiatives for Healthcare Improvement

In South America, government initiatives aimed at improving healthcare infrastructure are positively impacting the remdesivir market. Various countries are implementing policies to enhance access to essential medicines, including antiviral treatments. These initiatives often involve subsidies, tax incentives, and funding for healthcare facilities, which can lead to increased availability of remdesivir. For instance, a recent report highlighted that government spending on healthcare in the region is expected to rise by 10% annually, creating a more favorable environment for pharmaceutical companies. This supportive framework may facilitate the entry of new players into the remdesivir market, ultimately benefiting patients who require effective antiviral therapies.

Leave a Comment