Market Growth Projections

The Global Sonar Systems And Technology Market Industry is projected to experience substantial growth, with estimates indicating an increase from 12.5 USD Billion in 2024 to 20.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.51% from 2025 to 2035, reflecting the increasing adoption of sonar technologies across various sectors. The market's expansion is likely driven by advancements in technology, rising demand for maritime security, and the growing need for underwater exploration. These factors collectively contribute to a favorable outlook for the sonar systems market in the coming years.

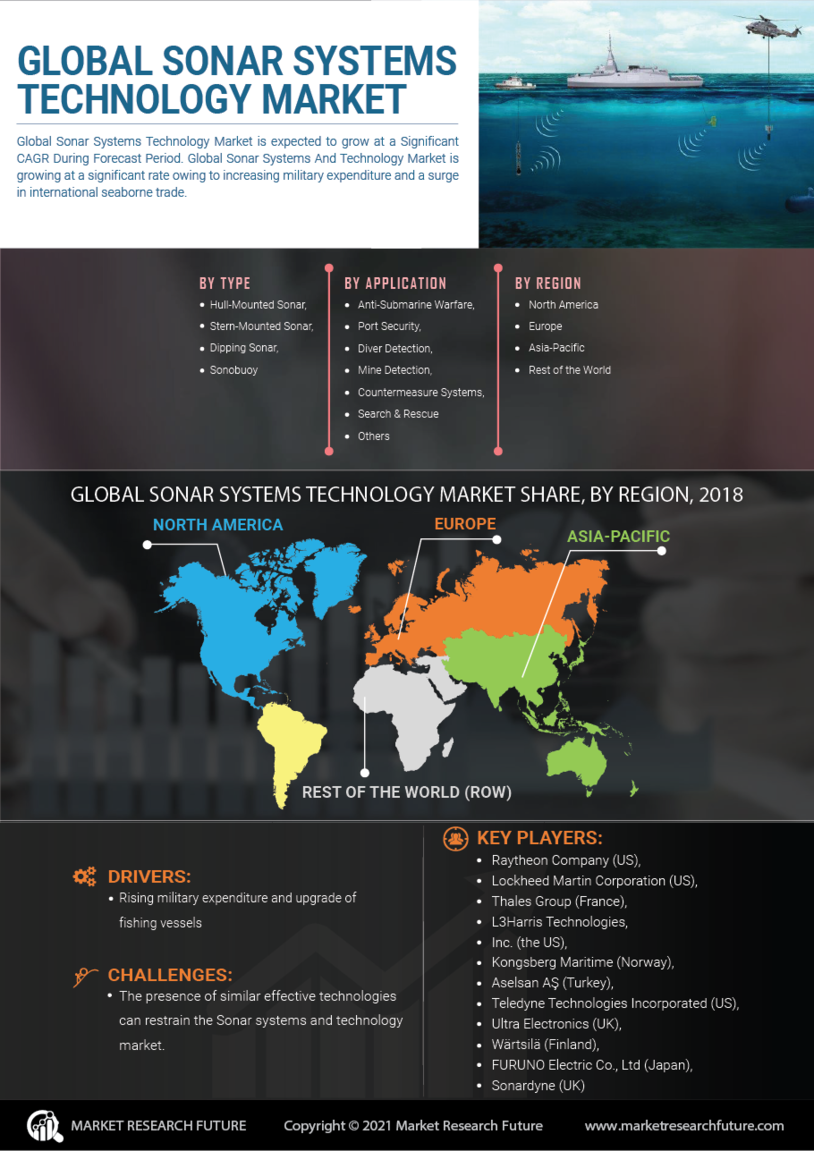

Rising Demand for Maritime Security

The Global Sonar Systems And Technology Market Industry is significantly influenced by the rising demand for maritime security. Nations are increasingly investing in sonar systems to protect their coastlines and maritime assets from threats such as piracy and illegal fishing. The integration of sonar technology in naval operations is becoming essential for national defense strategies. This trend is expected to contribute to the market's growth, with projections indicating a compound annual growth rate of 4.51% from 2025 to 2035. Enhanced maritime security measures are likely to drive the adoption of advanced sonar systems across various naval fleets.

Expansion of Commercial Shipping Industry

The Global Sonar Systems And Technology Market Industry is benefiting from the expansion of the commercial shipping sector. As global trade continues to grow, the need for efficient navigation and safe passage through busy shipping lanes becomes paramount. Sonar systems play a critical role in ensuring safe navigation by detecting underwater obstacles and providing real-time data on water conditions. This demand is anticipated to drive market growth, with the commercial shipping industry increasingly adopting advanced sonar technologies to enhance operational efficiency and safety. The integration of sonar systems in shipping operations is likely to become a standard practice.

Growing Underwater Exploration Activities

The Global Sonar Systems And Technology Market Industry is witnessing growth due to increasing underwater exploration activities. Scientific research, oil and gas exploration, and environmental monitoring are driving the demand for advanced sonar systems. These systems facilitate detailed mapping of the ocean floor and help in the assessment of marine ecosystems. The market's expansion is supported by the need for sustainable resource management and environmental conservation. As exploration activities intensify, the demand for high-resolution sonar data is expected to rise, further propelling market growth in the coming years.

Technological Advancements in Sonar Systems

The Global Sonar Systems And Technology Market Industry is experiencing rapid technological advancements that enhance the capabilities of sonar systems. Innovations such as synthetic aperture sonar and advanced signal processing techniques are improving target detection and classification. These advancements are crucial for various applications, including military, commercial shipping, and underwater exploration. As a result, the market is projected to grow from 12.5 USD Billion in 2024 to 20.3 USD Billion by 2035, indicating a robust demand for sophisticated sonar technologies. This growth is likely driven by the increasing need for precise underwater mapping and surveillance.

Increased Investment in Defense and Military Applications

The Global Sonar Systems And Technology Market Industry is experiencing increased investment in defense and military applications. Governments worldwide are prioritizing the modernization of their naval fleets, which includes the incorporation of advanced sonar systems for anti-submarine warfare and surveillance. This trend is expected to bolster market growth as nations seek to enhance their maritime capabilities. The focus on developing next-generation sonar technologies is likely to result in significant advancements in detection range and accuracy. As military budgets expand, the demand for sophisticated sonar systems is projected to rise, further driving the market.