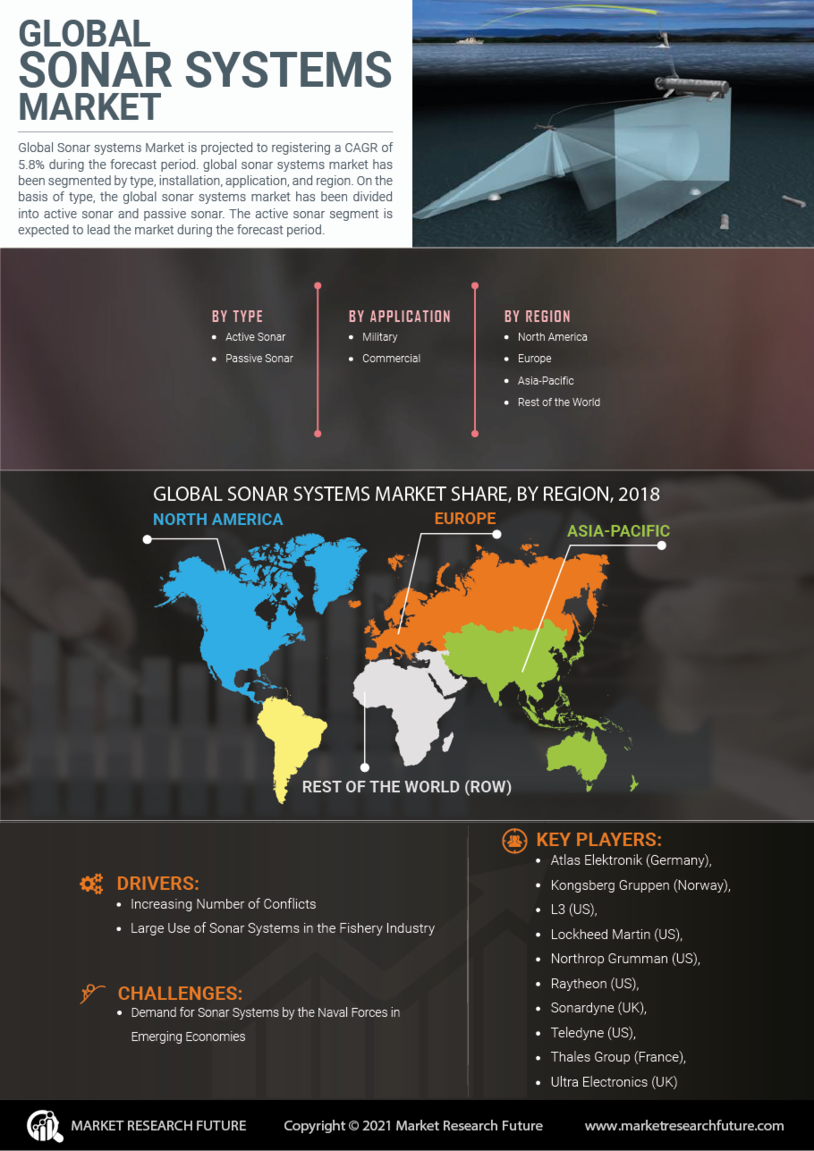

Technological Advancements

The Global Sonar Systems Market Industry experiences a notable boost due to rapid technological advancements. Innovations in sonar technology, such as the development of synthetic aperture sonar and advanced signal processing techniques, enhance detection capabilities and operational efficiency. These advancements allow for improved underwater mapping and object detection, which are crucial for various applications, including marine research and defense. As a result, the market is projected to reach 7.1 USD Billion in 2024, reflecting a growing demand for sophisticated sonar systems that can operate in complex underwater environments.

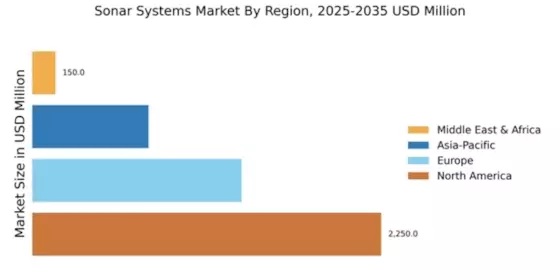

Chart Representation of Market Growth

The Global Sonar Systems Market Industry exhibits a clear upward trajectory, as illustrated in the accompanying charts. The market is projected to grow from 7.1 USD Billion in 2024 to 8.83 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 2.0% from 2025 to 2035, reflecting sustained investments in sonar technology across various sectors. The charts depict the increasing adoption of sonar systems in defense, oil and gas, and environmental monitoring, highlighting the diverse applications driving market expansion.

Environmental Monitoring and Research

Environmental monitoring and research initiatives significantly impact the Global Sonar Systems Market Industry. As awareness of marine ecosystems and their preservation grows, sonar systems are increasingly utilized for ecological studies, habitat mapping, and monitoring marine biodiversity. These applications are essential for informing conservation efforts and sustainable resource management. The integration of sonar technology in environmental research not only aids in data collection but also enhances the understanding of underwater ecosystems. This trend is likely to sustain demand for sonar systems, contributing to the overall market growth in the coming years.

Increasing Maritime Security Concerns

Heightened maritime security concerns significantly drive the Global Sonar Systems Market Industry. Nations are increasingly investing in sonar systems to monitor and secure their territorial waters against potential threats, including piracy and illegal fishing. The integration of sonar technology in naval operations enhances surveillance capabilities, enabling timely responses to security breaches. This trend is expected to contribute to the market's growth, with projections indicating a rise to 8.83 USD Billion by 2035. The focus on maritime security is likely to sustain a steady demand for advanced sonar systems over the coming years.

Growing Demand in Oil and Gas Exploration

The Global Sonar Systems Market Industry is also influenced by the growing demand for sonar systems in oil and gas exploration. As energy companies seek to optimize resource extraction, sonar technology plays a pivotal role in underwater surveys and geological mapping. The ability to accurately assess underwater terrain and identify potential drilling sites is crucial for operational efficiency. This sector's reliance on sonar systems is expected to bolster market growth, with a projected compound annual growth rate of 2.0% from 2025 to 2035, reflecting the ongoing need for advanced exploration technologies.