Research Methodology on Maritime Security Market

Introduction

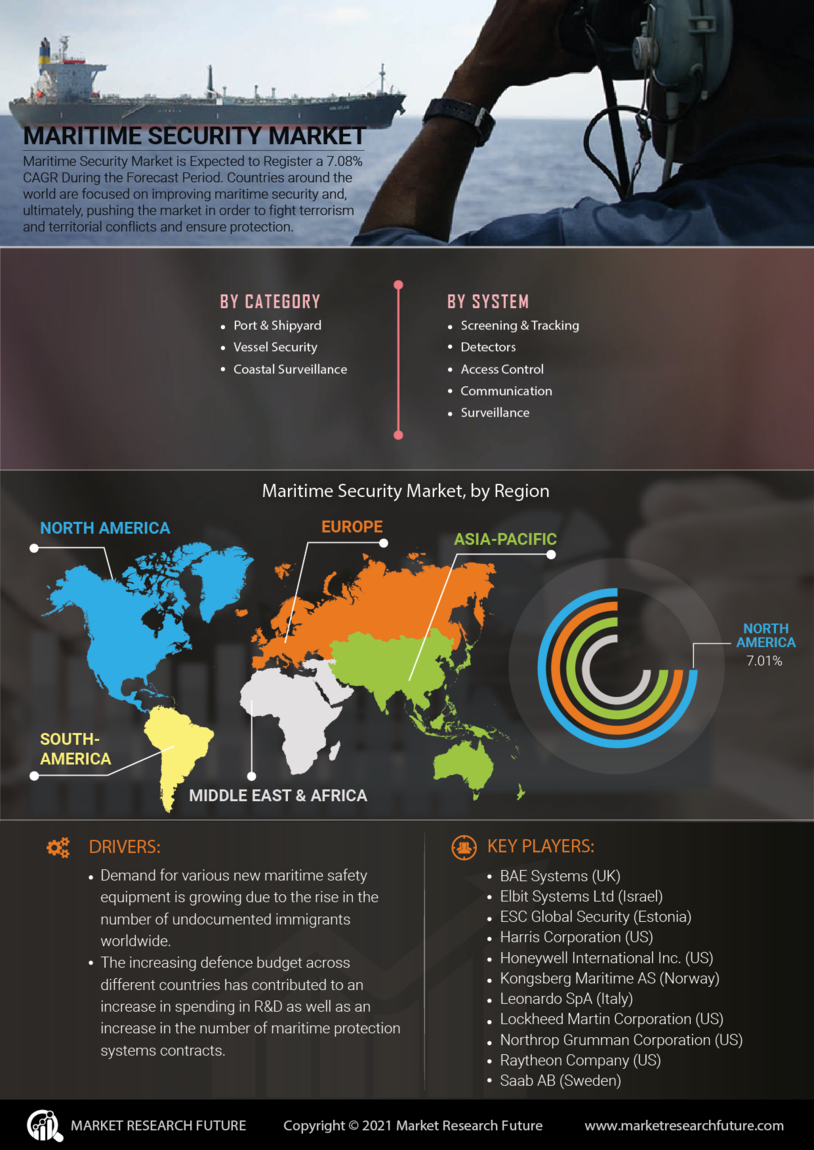

The Shipping industry relies heavily on maritime security, as it is used by companies to protect their ships, their personnel, and their merchandise from the increasing threat of piracy, smuggling, and terrorism. In recent years, the presence of organized crime networks, groups, and states has dramatically increased the security challenges that the maritime industry faces.

To ensure operational excellence and to minimize the risk of loss, the use of a range of naval and physical security measures has become increasingly essential. International and domestic trade is highly dependent on maritime security, as well as the efficient use of resources, skills and processes.

To gain insights into the growth and development of maritime security markets, both domestically and internationally, this research project focuses on the in-depth analysis of the global Maritime Security Market, with an emphasis on the latest developments regarding technological, structural and regulatory changes as well as key factors affecting market performance. The scope of this project includes:

- A comprehensive review of the existing literature and reports on maritime security-related market trends, development and performance.

Research Methodology

In order to develop a comprehensive understanding of the current conditions and trends in the global maritime security market, a broad-based methodological approach will be undertaken. This involves:

- Drawing on secondary sources such as reports, studies and news articles to analyze the current state of the industry and its related markets.

- Exploring the strategies and tactics that leading players in the market are employing or are likely to employ in order to gain strength and increase market presence.

- Conducting interviews with key players, including executives from leading companies, industry experts and analysts in order to gain an in-depth understanding of the industry structure, challenges and opportunities.

- Undertaking a comprehensive review of relevant documents and data, including available financial statements and reports.

- Identifying and analyzing current strategic and tactical challenges facing the industry, including those related to technological, regulatory or market forces.

- Performing a detailed analysis of both domestic and international market characteristics, and examining the impact of domestic and international legislation, regulations, and economic forces on the growth of the market.

- Developing a thorough understanding of the industry’s supplier landscape, including the availability and cost of various services and products, to gain insights into the factors influencing purchase decisions.

- Developing an understanding of the dynamics of the key players, including an exploration of their goals, strategies and capabilities.

- Conducting a comprehensive analysis of the industry’s competitive landscape, and developing an understanding of the current and projected market dynamics, including an assessment of the market’s size, growth and pricing power.

Data Collection

This research report involves the collection of both qualitative and quantitative data, comprising a variety of sources including reports and studies, interviews, financial statements and documents, market analysis reports, and relevant magazines and newspapers.

To ensure reliable and valid data is collected for this project, please refer to the following sources:

- Reports and studies: These sources include published reports and studies undertaken by experts in the maritime industry, such as those related to maritime security markets and their performance, industry structure and developments, and the threats, risk and opportunities within the industry.

- Interviews: Executives from leading companies, industry experts and analysts are interviewed to gain an in-depth understanding of the industry structure, challenges and opportunities.

- Financial statements and documents: The financial information of leading companies in the industry are reviewed to gain insights into the key market trends, companies’ strategies and objectives.

- Market analysis reports: Industry-related reports, such as those published by market research firms, are used to examine the size, growth and pricing power of the market.

- Magazines and newspapers: Those magazines and newspapers related to the maritime security industry will be reviewed to gain insights into industry developments, news, and legal and regulatory changes.

Data Analysis

The data for this project is collected using a multitude of methods and analysed using both qualitative and quantitative techniques. All of the data is organised, documented, and stored in an organised manner to facilitate cross-referencing and comparison of key trends.

Qualitative data analysis includes an analysis of both formative and summative components, where formative research involves the exploration and explanation of data, and summative research focuses on a comparison of gathered information for interpretation. The qualitative analysis includes generalised content analysis and descriptive methods such as coding, identifying patterns and themes, and open coding.

Quantitative data analysis takes place once the data is collected, stored and organised. Relevant statistical packages such as SPSS and SAS are used to generate reliable and valid outcomes. The quantitative analysis of this project involves an assessment of the industry structure, size, trends and opportunities.

Ethical Considerations

In order to ensure the research is conducted ethically and responsibly, the following guidelines are followed:

- All research participants will be provided with adequate information about the study and its purpose before participation.

- Participants’ identities and the data they provide are kept confidential.

- Informed consent is obtained from participants before engaging in the research.

- The collected data will be safeguarded and stored securely to protect the confidentiality of the research participants.

Conclusion

This research report provides a comprehensive analysis of the global maritime security market to gain a better understanding of the existing trends and conditions, as well as to determine the key players, strategies and opportunities in the industry. By making use of a broad-based methodological approach, a thorough review of existing literature and reports, interviews with key stakeholders, and a detailed analysis of domestic and international markets, this report develops a positive and reliable outcome that will be beneficial to industry participants, investors, policymakers and other interested parties.