The Solar Microinverter Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for renewable energy solutions. Key players such as Enphase Energy (US), SolarEdge Technologies (IL), and SMA Solar Technology (DE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Enphase Energy (US) focuses on innovation in product development, particularly in enhancing the efficiency and reliability of their microinverters, while SolarEdge Technologies (IL) emphasizes strategic partnerships to expand its global footprint. SMA Solar Technology (DE) is leveraging its strong brand reputation to penetrate emerging markets, indicating a multifaceted approach to competition that shapes the overall market environment.In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and optimize operational efficiency. The market structure appears moderately fragmented, with several players vying for market share, yet the collective influence of major companies like Enphase Energy (US) and SolarEdge Technologies (IL) suggests a trend towards consolidation. This competitive structure fosters innovation, as companies strive to differentiate themselves through advanced technology and customer-centric solutions.

In November Enphase Energy (US) announced the launch of its latest microinverter model, which reportedly offers a 20% increase in energy conversion efficiency compared to previous versions. This strategic move not only reinforces Enphase's commitment to innovation but also positions the company to capture a larger share of the growing residential solar market. The introduction of this product is likely to enhance customer satisfaction and drive sales, reflecting a proactive approach to meeting evolving consumer demands.Similarly, in October 2025, SolarEdge Technologies (IL) entered into a partnership with a leading battery manufacturer to integrate energy storage solutions with its microinverter systems. This collaboration is strategically significant as it allows SolarEdge to offer a more comprehensive energy management solution, catering to the increasing consumer preference for energy independence. The synergy between solar generation and storage is expected to enhance the value proposition for customers, thereby strengthening SolarEdge's competitive edge.

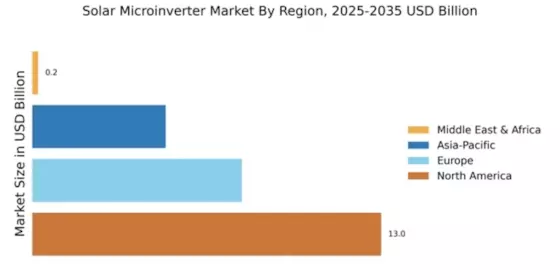

In September SMA Solar Technology (DE) expanded its operations in Asia by establishing a new manufacturing facility in Vietnam. This strategic expansion is indicative of SMA's intent to capitalize on the growing demand for solar solutions in the Asia-Pacific region. By localizing production, SMA aims to reduce costs and improve supply chain efficiency, which could enhance its competitive positioning in a rapidly evolving market.

As of December the Solar Microinverter Market is witnessing trends such as digitalization, sustainability, and the integration of AI technologies. These trends are reshaping competitive dynamics, with companies increasingly forming strategic alliances to enhance their technological capabilities and market reach. The shift from price-based competition to a focus on innovation and supply chain reliability is becoming evident, suggesting that future competitive differentiation will hinge on the ability to deliver advanced, reliable, and sustainable energy solutions.