Key Market players are putting in efforts to increase the efficiency of solar panels. It includes developing collectors into smaller sizes with customer-friendly installations. Also, there has been a focus on techniques such as nano-crystalline solar cells. This will include film processing, metamorphic multijunction solar cells, and others. In recent, development in the field has increased production from 7 GW to 40 GW. One of the players named Mordor Intelligence has estimated that solar power will be extensively used in cars, automotive, industry, agriculture, and others in the upcoming years.

JinkoSolar Holding Co, the largest Distributed Generation distribution agreement Jinko Solar Co., Ltd. has ever signed outside of China, reports that it has renewed its partnership with Aldo Solar from now through 2022. This means about four million solar modules—or two gigawatts (GW) of installed capacity—will be shipped out according to the plan.

Kenya is looking to use solar concentrators for industrial processes as fuel prices increase in June 2022. Nairobi-based Iberafrica Power (E.A.) Limited, a leading independent power producer (IPP) in Kenya, has been utilizing solar thermal since commissioning a 330 m2 installation on its own premises, while Absolicon of Sweden and its Kenyan partner Ariya Finergy put up T160 Absolicon solar collectors.

It is estimated that by 2033, the non-concentrating solar collector market in the US will exceed an 8% growth rate because of federal government incentive programs such as grants and subsidies as well as net metering. The global installed solar thermal capacity reached 6,479 MW by the end of 2020, which represents an increase of 36% compared to capacities recorded five years ago. In Germany alone, there were 44 plants producing heat from sunlight having the above-mentioned surface areas with a cumulative capacity totaling 75MW last year.

In May 2022, Solvay partnered with Inaventa Solar for more efficient solar collector designs. This product utilizes Ryton PPS1 by Solvay instead of metal for many reasons like better design flexibility, automated manufacturing, easy handling during the transportation or installation process, and reduced carbon emissions, among others, which may affect aesthetics at plant levels.

In AUG 2022, Savosolar Oyj entered an agreement with VG-Shipping Oy to acquire marine logistics company Meriaura Oy and subsequently merge it with Savosolar.In January 2020, the European Parliament adopted a resolution on the European Green Deal where decarbonization of the energy sector emerged as the most significant priority in order to achieve greenhouse gas emissions neutrality by 2050.

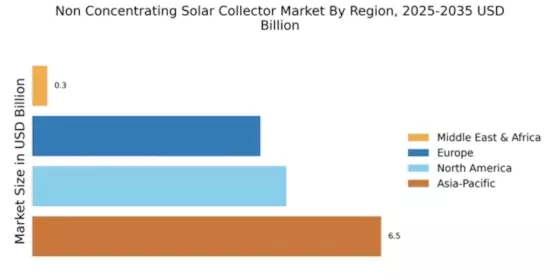

Non-concentrating Solar Collector Market Regional Analysis

North America has dominated market growth due to high usage in swimming pools and other commercial locations. It was estimated that in the year 2016, it contributed to 70 % of the total volume share. Also, there has been increasing concern for rapidly depleting natural resources in the US due to which market demand will be propelled.

Besides, developing technologies will enable the efficient utilization of tube collectors within industrial applications. In the European tourism industry, government spending has increased due to which non-concentrating solar collector market growth will be positively impacted. However, demand for flat plate collectors is stagnant in the residential sector. As conventional energy application is still in use. Asia- Pacific, Middle East, and Latin America will also contribute to the Non-concentrating Solar Collector Market share significantly during the forecast period.