Rising Energy Costs

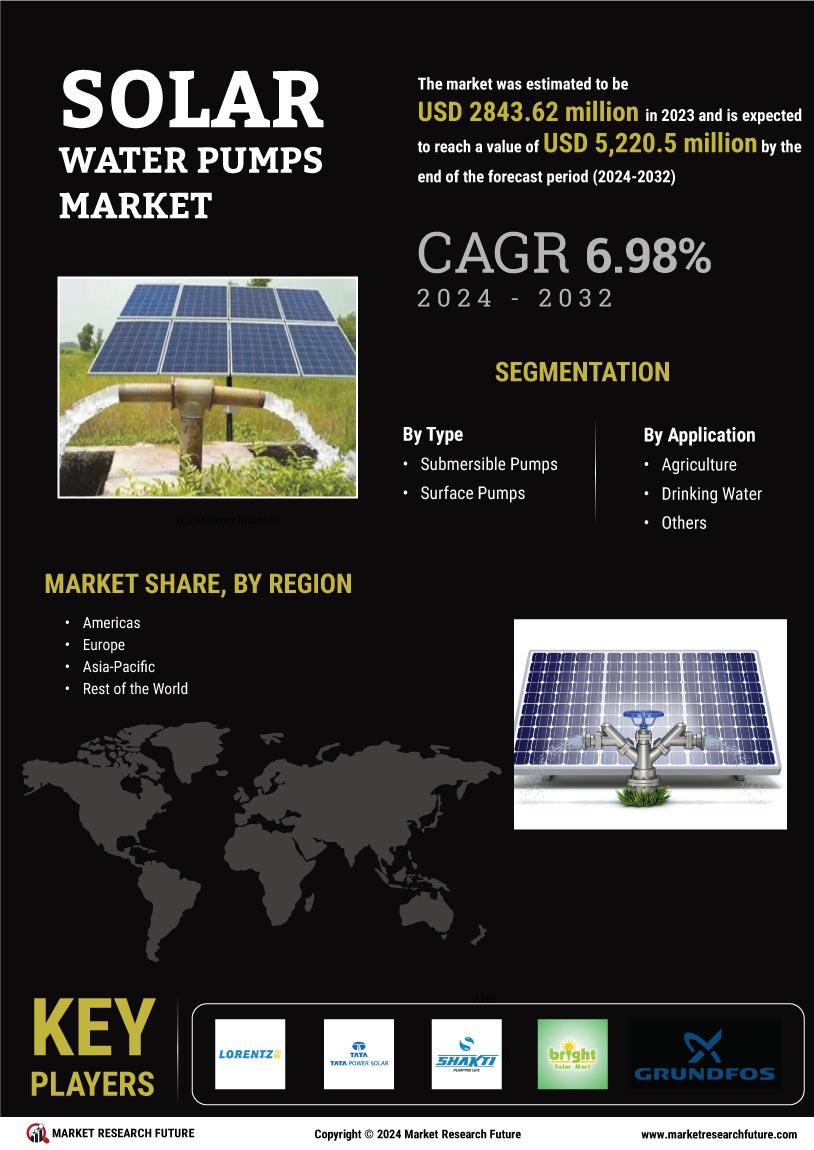

The Solar Water Pump Market is experiencing a notable surge due to the escalating costs of conventional energy sources. As energy prices continue to rise, many consumers and businesses are seeking alternative solutions to mitigate their expenses. Solar water pumps, which harness renewable energy, present a cost-effective option for irrigation and water supply. In recent years, the average cost of electricity has increased by approximately 5% annually in various regions, prompting a shift towards solar solutions. This trend is particularly evident in agricultural sectors, where farmers are increasingly adopting solar water pumps to reduce operational costs. The financial benefits associated with solar energy utilization are likely to drive further growth in the Solar Water Pump Market.

Technological Innovations

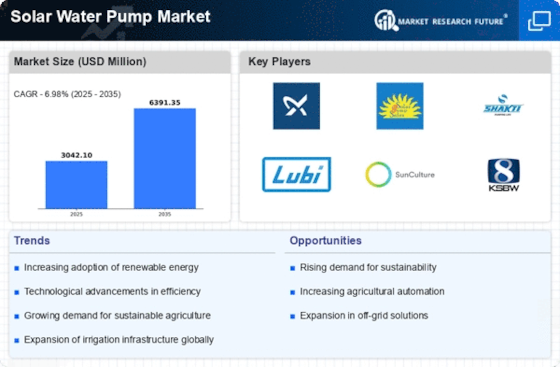

Technological innovations play a crucial role in shaping the Solar Water Pump Market. Advancements in solar panel efficiency, battery storage, and pump design have significantly improved the performance and reliability of solar water pumps. For instance, the introduction of smart irrigation systems that integrate solar technology allows for precise water management, optimizing resource use. Recent data indicates that the efficiency of solar panels has increased by over 20% in the last decade, making solar water pumps more viable for various applications. These innovations not only enhance the functionality of solar water pumps but also contribute to their affordability, making them an attractive option for consumers. As technology continues to evolve, the Solar Water Pump Market is poised for substantial growth.

Environmental Sustainability

The growing emphasis on environmental sustainability is a pivotal driver for the Solar Water Pump Market. As concerns regarding climate change and resource depletion intensify, there is a collective push towards adopting eco-friendly technologies. Solar water pumps, which utilize renewable energy, align with global sustainability goals by reducing carbon footprints and conserving water resources. According to recent studies, the agricultural sector accounts for nearly 70% of global freshwater withdrawals, highlighting the need for sustainable practices. The adoption of solar water pumps not only addresses water scarcity but also promotes responsible energy consumption. This alignment with sustainability objectives is likely to enhance the appeal of solar water pumps, thereby propelling the Solar Water Pump Market forward.

Increasing Agricultural Demand

The rising demand for agricultural products is a significant driver for the Solar Water Pump Market. With the global population projected to reach 9.7 billion by 2050, the need for efficient irrigation solutions is becoming increasingly critical. Solar water pumps offer a sustainable and cost-effective means of providing water for irrigation, thereby supporting agricultural productivity. Recent reports suggest that the agricultural sector is expected to grow at a compound annual growth rate of 3.5%, further emphasizing the need for innovative solutions. As farmers seek to enhance crop yields while minimizing costs, the adoption of solar water pumps is likely to accelerate. This trend underscores the importance of solar technology in meeting future food security challenges, thereby bolstering the Solar Water Pump Market.

Government Support and Policies

Government support and favorable policies are instrumental in driving the Solar Water Pump Market. Many governments are implementing initiatives aimed at promoting renewable energy adoption, including subsidies and tax incentives for solar technologies. These policies not only lower the initial investment costs for consumers but also encourage the widespread adoption of solar water pumps. For example, several countries have introduced programs that provide financial assistance to farmers for installing solar water pumps, thereby enhancing their accessibility. Recent data indicates that government incentives have led to a 30% increase in solar water pump installations in certain regions. This supportive regulatory environment is likely to continue fostering growth in the Solar Water Pump Market, as more stakeholders recognize the benefits of transitioning to renewable energy solutions.