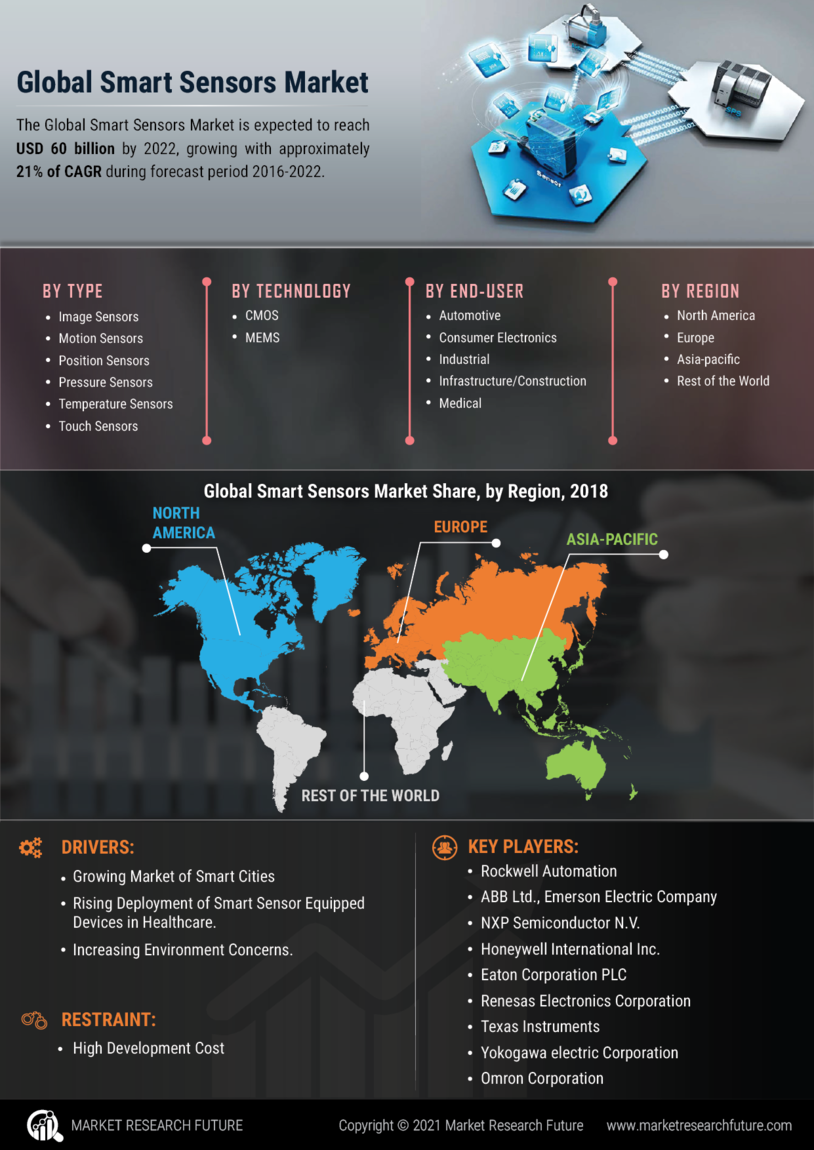

Market Growth Projections

The Global Smart Sensors Market Industry is projected to experience robust growth in the coming years, with estimates indicating a market size of 53.3 USD Billion in 2024 and a remarkable increase to 166.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 10.9% from 2025 to 2035. Such projections highlight the increasing reliance on smart sensor technologies across various sectors, including industrial automation, healthcare, and smart cities. As the demand for enhanced efficiency and connectivity rises, the Global Smart Sensors Market Industry is likely to expand significantly, driven by technological advancements and evolving consumer needs.

Rising Demand for Automation

The Global Smart Sensors Market Industry experiences a surge in demand for automation across various sectors, including manufacturing, healthcare, and transportation. Automation enhances operational efficiency and reduces human error, leading to increased productivity. For instance, smart sensors in manufacturing facilitate real-time monitoring and predictive maintenance, which can significantly lower operational costs. The market is projected to reach 53.3 USD Billion in 2024, reflecting the growing reliance on automated systems. As industries continue to adopt smart technologies, the Global Smart Sensors Market Industry is likely to expand, driven by the need for streamlined processes and improved accuracy.

Advancements in IoT Technology

The integration of Internet of Things (IoT) technology is a pivotal driver for the Global Smart Sensors Market Industry. IoT-enabled smart sensors facilitate seamless communication between devices, enabling real-time data collection and analysis. This connectivity allows for enhanced decision-making and operational efficiency across various applications, from smart homes to industrial automation. The increasing adoption of IoT solutions is expected to propel the market, with a projected growth rate of 10.9% CAGR from 2025 to 2035. As IoT technology continues to evolve, the Global Smart Sensors Market Industry is poised for substantial growth, driven by the demand for interconnected systems.

Increasing Adoption in Healthcare

The healthcare sector's increasing adoption of smart sensors is a notable driver for the Global Smart Sensors Market Industry. Smart sensors are utilized in various applications, including patient monitoring, diagnostics, and drug delivery systems. These devices enhance patient care by providing real-time data to healthcare professionals, enabling timely interventions. The market's growth in this sector is supported by the rising demand for remote patient monitoring solutions, particularly in chronic disease management. As healthcare systems evolve, the Global Smart Sensors Market Industry is likely to witness significant advancements, driven by the need for improved patient outcomes and operational efficiency.

Growing Focus on Energy Efficiency

Energy efficiency remains a critical concern globally, driving the Global Smart Sensors Market Industry. Smart sensors play a vital role in optimizing energy consumption in buildings, transportation, and industrial processes. For example, smart lighting systems equipped with sensors can adjust brightness based on occupancy, significantly reducing energy waste. As governments and organizations prioritize sustainability, the demand for energy-efficient solutions is expected to rise. This trend is likely to contribute to the market's expansion, with projections indicating a growth to 166.3 USD Billion by 2035. The Global Smart Sensors Market Industry is thus increasingly aligned with environmental goals.

Emerging Applications in Smart Cities

The development of smart cities is a transformative trend impacting the Global Smart Sensors Market Industry. Smart sensors are integral to urban infrastructure, enabling efficient traffic management, waste management, and environmental monitoring. For instance, smart traffic sensors can optimize traffic flow, reducing congestion and emissions. As urbanization accelerates, cities are increasingly adopting smart technologies to enhance livability and sustainability. This trend is expected to drive substantial growth in the market, as municipalities invest in smart solutions. The Global Smart Sensors Market Industry is thus positioned to benefit from the increasing focus on urban innovation and sustainability.