Focus on Health and Wellness

The growing emphasis on health and wellness is a pivotal driver for the Wearable Sensors Market. Consumers are increasingly adopting wearable devices to monitor their health metrics, such as heart rate, sleep patterns, and physical activity levels. This trend is supported by a rising awareness of lifestyle-related health issues, prompting individuals to take charge of their well-being. According to recent data, the health and fitness segment of the wearable sensors market is expected to account for over 40% of total market revenue by 2026. This shift towards health-centric wearables is encouraging manufacturers to develop more sophisticated sensors that provide accurate and comprehensive health insights. Consequently, the market is witnessing a proliferation of products tailored to specific health needs, further driving consumer interest and investment in wearable technology.

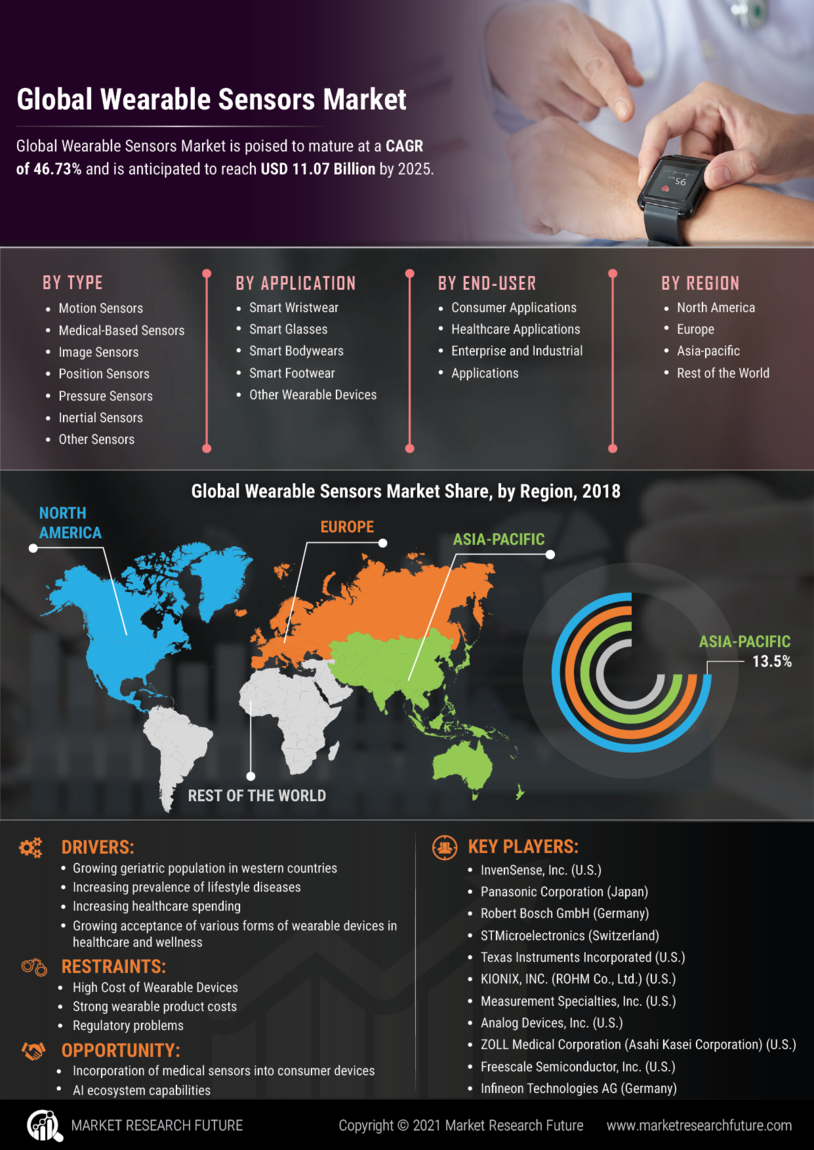

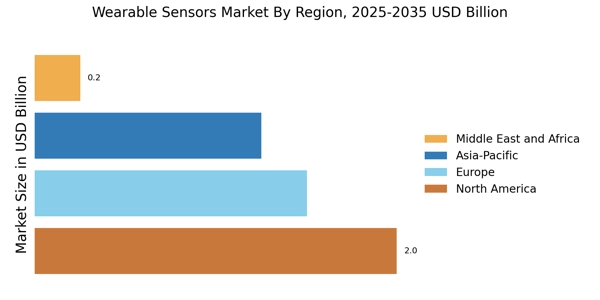

Expansion into Diverse Applications

The Wearable Sensors Market is diversifying as manufacturers explore various applications beyond traditional fitness tracking. Industries such as healthcare, sports, and entertainment are increasingly adopting wearable sensors for enhanced performance monitoring and data collection. For example, in healthcare, wearable sensors are utilized for remote patient monitoring, allowing healthcare providers to track vital signs and manage chronic conditions effectively. This expansion is reflected in the projected market growth, with estimates suggesting that the healthcare segment alone could reach a valuation of USD 10 billion by 2027. Additionally, the integration of wearable sensors in sports is revolutionizing athlete training and performance analysis, providing coaches and athletes with critical data to optimize performance. This diversification not only broadens the market's appeal but also fosters innovation as companies seek to meet the unique demands of various sectors.

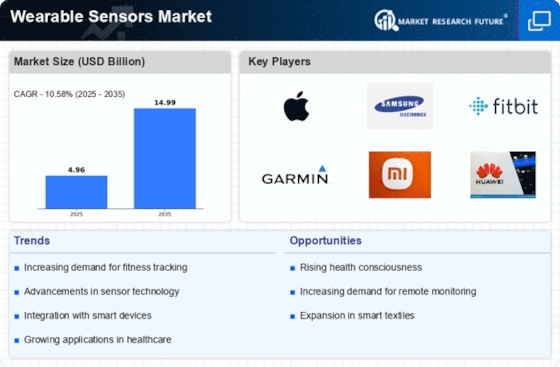

Integration of Advanced Technologies

The Wearable Sensors Market is experiencing a notable surge due to the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the functionality of wearable sensors, enabling real-time data analysis and personalized health monitoring. For instance, the incorporation of AI algorithms allows for predictive analytics, which can foresee potential health issues before they arise. This capability is particularly appealing to consumers who prioritize proactive health management. Furthermore, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years, driven by the increasing demand for smart wearables that offer sophisticated features. As a result, manufacturers are investing heavily in research and development to innovate and improve their product offerings, thereby expanding their market share.

Increased Consumer Awareness and Adoption

Increased consumer awareness regarding the benefits of wearable technology is a crucial driver for the Wearable Sensors Market. As more individuals become informed about the advantages of using wearable sensors for health monitoring and fitness tracking, the adoption rates are rising. Surveys indicate that nearly 60% of consumers are now familiar with wearable technology, leading to a growing willingness to invest in these devices. This heightened awareness is fostering a competitive landscape where manufacturers are compelled to enhance their product offerings to meet consumer expectations. Additionally, the proliferation of social media and online platforms has facilitated the sharing of user experiences, further driving interest in wearable sensors. As a result, the market is likely to see continued growth, with an increasing number of consumers integrating wearable technology into their daily lives.

Rising Demand for Remote Monitoring Solutions

The increasing demand for remote monitoring solutions is significantly influencing the Wearable Sensors Market. As individuals seek more convenient ways to manage their health, wearable sensors that facilitate remote health monitoring are gaining traction. This trend is particularly relevant for elderly populations and individuals with chronic conditions who require continuous health oversight. Recent statistics indicate that the remote patient monitoring market is expected to grow at a CAGR of 30% over the next few years, underscoring the potential for wearable sensors in this domain. By enabling real-time health data transmission to healthcare providers, these devices enhance patient care and reduce the need for frequent hospital visits. Consequently, the market is witnessing a surge in innovations aimed at improving the accuracy and reliability of remote monitoring technologies, further solidifying the role of wearable sensors in modern healthcare.