Increased Defense Budgets

The Smart Bullets Market is benefiting from increased defense budgets across various nations. Governments are allocating more resources to modernize their military capabilities, which includes investing in advanced weaponry such as smart bullets. For example, recent reports indicate that defense spending in several countries has risen by over 5% annually, reflecting a commitment to enhancing national security. This trend is particularly evident in regions facing geopolitical tensions, where the need for precision and effectiveness in military operations is paramount. Consequently, the Smart Bullets Market is poised for expansion as defense contractors seek to meet the growing demand for innovative ammunition solutions.

Technological Innovations

The Smart Bullets Market is experiencing a surge in technological innovations that enhance the functionality and efficiency of smart bullets. Advancements in materials science and miniaturization of electronic components have led to the development of more precise and reliable smart bullets. For instance, the integration of sensors and communication technologies allows for real-time data transmission, which is crucial for tactical applications. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these innovations. As military and law enforcement agencies increasingly adopt these technologies, the demand for smart bullets is likely to rise, indicating a robust growth trajectory for the Smart Bullets Market.

Growing Demand for Precision Munitions

The Smart Bullets Market is witnessing a growing demand for precision munitions, driven by the need for enhanced accuracy in military operations. As conflicts become more complex, the ability to minimize collateral damage while achieving mission objectives is increasingly critical. Smart bullets, equipped with advanced guidance systems, offer a solution to this challenge. Market analysis suggests that the segment for precision-guided munitions is expected to account for a significant share of the overall ammunition market, with projections indicating a growth rate of around 7% annually. This trend underscores the importance of smart bullets in modern warfare, further solidifying their role within the Smart Bullets Market.

Regulatory Support for Advanced Ammunition

The Smart Bullets Market is benefiting from regulatory support aimed at promoting the development and deployment of advanced ammunition technologies. Governments are recognizing the strategic advantages offered by smart bullets, leading to favorable policies and funding initiatives. For instance, certain defense agencies are providing grants and incentives for research and development in smart ammunition technologies. This regulatory environment is conducive to innovation, allowing manufacturers to explore new designs and functionalities. As a result, the Smart Bullets Market is expected to see an influx of new products and solutions, further driving market growth and enhancing the competitive landscape.

Emerging Markets and Military Modernization

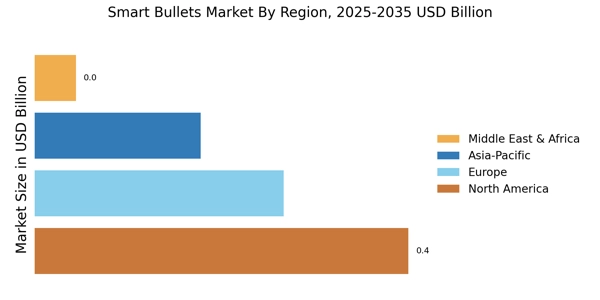

The Smart Bullets Market is also influenced by military modernization efforts in emerging markets. Countries in Asia and the Middle East are investing heavily in upgrading their armed forces, which includes the procurement of advanced ammunition technologies. This shift is driven by the recognition of the need for enhanced operational capabilities in an increasingly volatile global landscape. Reports indicate that military spending in these regions is expected to grow by approximately 6% over the next few years, creating opportunities for smart bullet manufacturers. As these markets evolve, the Smart Bullets Market is likely to expand, catering to the specific needs of modernizing armed forces.