Increasing Defense Budgets

Rising defense budgets across various nations are significantly impacting the ammunition Market. Governments are allocating more resources to enhance their military capabilities, which includes substantial investments in ammunition procurement. For instance, recent reports indicate that defense spending in several countries has increased by an average of 5% annually, reflecting a heightened focus on national security. This trend is particularly evident in regions facing geopolitical tensions, where military readiness is prioritized. Consequently, the demand for high-quality and reliable ammunition is expected to surge, providing a robust growth opportunity for manufacturers. The Ammunition Market stands to benefit from these increased expenditures, as defense contracts often entail long-term supply agreements, ensuring a steady revenue stream for producers.

Emerging Markets and Economic Development

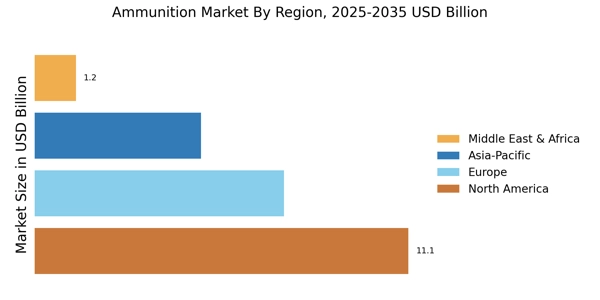

Emerging markets are becoming increasingly relevant to the Ammunition Market, driven by economic development and rising disposable incomes. As countries in Asia, Africa, and Latin America experience economic growth, there is a corresponding increase in demand for both military and civilian ammunition. This trend is particularly pronounced in nations enhancing their defense capabilities or where recreational shooting is gaining popularity. Reports suggest that the ammunition consumption in these regions could grow by over 15% in the next five years, as more consumers gain access to firearms and related products. Manufacturers are likely to focus on these emerging markets, tailoring their strategies to meet local needs and preferences. This shift could lead to a more diversified Ammunition Market, with increased competition and innovation as companies seek to establish a foothold in these developing economies.

Regulatory Changes and Compliance Requirements

The Ammunition Market is increasingly influenced by regulatory changes and compliance requirements imposed by governments. Stricter regulations regarding the sale, distribution, and use of ammunition are being implemented in various regions, aimed at enhancing public safety and reducing illegal activities. These regulations often necessitate manufacturers to invest in compliance measures, which can lead to increased operational costs. However, such regulations also create opportunities for companies that can adapt quickly and ensure their products meet the new standards. The demand for certified and compliant ammunition is likely to rise, as consumers and law enforcement agencies seek reliable products. Consequently, the Ammunition Market may experience a shift towards higher-quality offerings that adhere to stringent regulations, potentially reshaping competitive dynamics within the sector.

Growing Civilian Market for Recreational Shooting

The Ammunition Market is witnessing a surge in demand from the civilian sector, particularly in recreational shooting activities. The popularity of shooting sports, hunting, and self-defense training has led to an increase in ammunition consumption among civilians. Recent surveys indicate that participation in shooting sports has grown by over 20% in the past few years, driving the need for a diverse range of ammunition products. This trend is further supported by the rising interest in outdoor activities and personal safety concerns. As a result, manufacturers are expanding their product lines to cater to this burgeoning market, offering various calibers and types of ammunition. The growth of the civilian market is likely to play a crucial role in shaping the future of the Ammunition Market, as it diversifies the customer base and reduces reliance on military contracts.

Technological Advancements in Ammunition Manufacturing

The Ammunition Market is experiencing a notable transformation due to technological advancements in manufacturing processes. Innovations such as 3D printing and automated production lines are enhancing efficiency and precision in ammunition production. These technologies not only reduce production costs but also allow for the creation of specialized ammunition types tailored to specific needs. As a result, manufacturers are better positioned to meet the diverse demands of military, law enforcement, and civilian markets. The integration of smart technologies, such as embedded sensors in ammunition, is also gaining traction, potentially improving performance and safety. This shift towards advanced manufacturing techniques is likely to drive growth in the Ammunition Market, as companies strive to remain competitive and responsive to evolving consumer preferences.