Regulatory Compliance

Regulatory compliance is a critical driver in the Sludge Dewatering Equipment Market, as governments worldwide impose stringent regulations on waste management and environmental protection. The need to adhere to these regulations compels industries to invest in effective sludge dewatering solutions. For example, the implementation of the EU Waste Framework Directive mandates that member states manage waste in a manner that minimizes environmental impact. Consequently, industries are increasingly adopting advanced dewatering technologies to meet these compliance requirements. The market for sludge dewatering equipment is projected to grow as organizations prioritize investments in equipment that not only meets regulatory standards but also enhances operational efficiency. This focus on compliance is expected to drive innovation and growth within the Sludge Dewatering Equipment Market.

Rising Industrialization

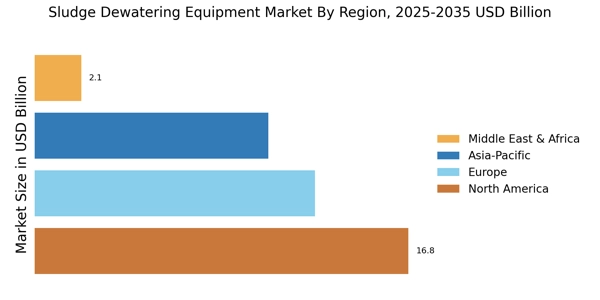

The ongoing industrialization across various sectors is a notable driver for the Sludge Dewatering Equipment Market. As industries expand, the volume of sludge generated from manufacturing processes increases, necessitating efficient dewatering solutions. Industries such as food and beverage, pharmaceuticals, and chemicals are particularly significant contributors to sludge production. The demand for effective sludge management systems is expected to rise in tandem with industrial growth. Furthermore, the increasing awareness of environmental sustainability among industries is prompting investments in advanced sludge dewatering technologies. This trend indicates that the Sludge Dewatering Equipment Market is poised for growth as industries seek to optimize their waste management practices while adhering to environmental regulations.

Technological Innovations

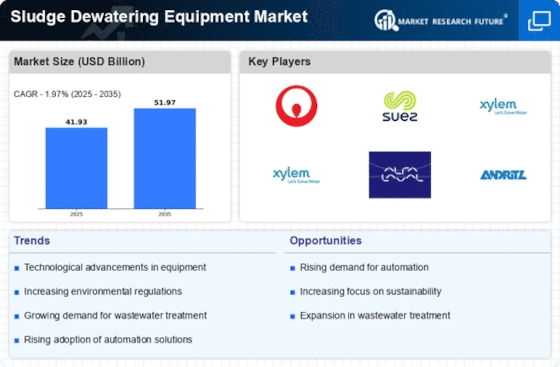

The Sludge Dewatering Equipment Market is experiencing a surge in technological innovations that enhance efficiency and reduce operational costs. Advanced technologies such as centrifuges, belt filter presses, and membrane filtration systems are being integrated into dewatering processes. These innovations not only improve the quality of the dewatered sludge but also minimize energy consumption. For instance, the introduction of automated systems allows for real-time monitoring and adjustments, leading to optimized performance. As municipalities and industries seek to comply with stringent environmental regulations, the demand for technologically advanced sludge dewatering solutions is likely to increase. This trend suggests that companies investing in research and development will have a competitive edge in the Sludge Dewatering Equipment Market.

Focus on Resource Recovery

The emphasis on resource recovery from waste materials is becoming a pivotal driver in the Sludge Dewatering Equipment Market. As sustainability becomes a priority, industries are exploring ways to recover valuable resources from sludge, such as biogas and fertilizers. This shift towards a circular economy encourages the adoption of advanced dewatering technologies that facilitate resource recovery. For instance, anaerobic digestion processes can be enhanced through effective sludge dewatering, leading to increased biogas production. The growing recognition of the economic and environmental benefits of resource recovery is likely to propel investments in sludge dewatering equipment. This trend suggests that the Sludge Dewatering Equipment Market will continue to evolve, focusing on solutions that not only manage waste but also contribute to resource sustainability.

Increased Wastewater Generation

The rising generation of wastewater due to urbanization and industrial activities is a significant driver for the Sludge Dewatering Equipment Market. As populations grow and urban areas expand, the volume of wastewater produced increases, necessitating efficient treatment solutions. According to recent estimates, wastewater generation is expected to rise by approximately 20% over the next decade. This surge in wastewater production creates a pressing need for effective sludge management systems, including dewatering equipment. Industries and municipalities are compelled to invest in advanced sludge dewatering technologies to handle the increasing volumes of sludge efficiently. This trend indicates a robust growth trajectory for the Sludge Dewatering Equipment Market as stakeholders seek to address the challenges posed by rising wastewater generation.