North America : Market Leader in Dewatering Pumps

North America is poised to maintain its leadership in the dewatering pump market, holding a significant share of 3.1 billion in 2024. The region's growth is driven by increasing infrastructure projects, stringent environmental regulations, and a rising demand for efficient water management solutions. The focus on sustainable practices and advanced technologies further propels market expansion, making it a key player in the global landscape.

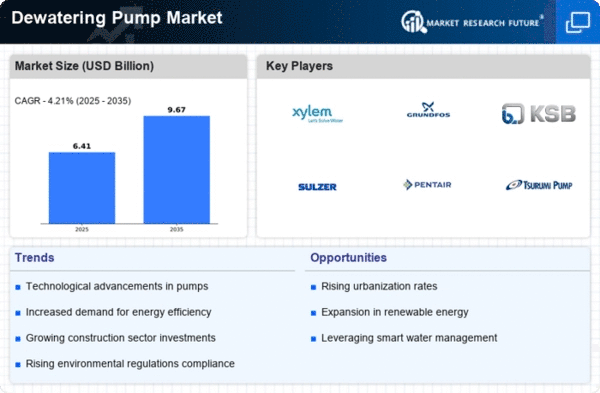

The United States and Canada are the leading countries in this region, with major companies like Xylem Inc. and Pentair plc driving innovation and competition. The presence of established players ensures a robust competitive landscape, while ongoing investments in infrastructure and water management systems are expected to sustain growth. The market is characterized by technological advancements and a shift towards energy-efficient solutions, enhancing the overall value proposition for consumers.

Europe : Emerging Market with Growth Potential

Europe's dewatering pump market is projected to grow significantly, with a market size of 1.8 billion in 2024. The region benefits from stringent environmental regulations and a strong emphasis on sustainable water management practices. Increasing urbanization and industrial activities are driving demand for efficient dewatering solutions, making it a vital market for key players. The European market is also witnessing a shift towards automation and smart technologies, enhancing operational efficiency.

Germany, France, and the UK are the leading countries in this market, with companies like Grundfos Holding A/S and KSB SE & Co. KGaA playing pivotal roles. The competitive landscape is marked by innovation and collaboration among manufacturers to meet evolving customer needs. As the region focuses on sustainability, the demand for energy-efficient and eco-friendly dewatering pumps is expected to rise, further solidifying Europe's position in the global market.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific dewatering pump market is on a growth trajectory, with a market size of 1.9 billion in 2024. This growth is fueled by rapid industrialization, urbanization, and increasing investments in infrastructure development. Countries like China and India are leading the charge, driven by their expanding construction sectors and the need for effective water management solutions. Regulatory support for infrastructure projects further enhances market prospects in the region.

China and India are the dominant players in this market, with significant contributions from local manufacturers and international companies like Tsurumi Manufacturing Co., Ltd. and Ebara Corporation. The competitive landscape is characterized by a mix of established players and emerging companies, fostering innovation and price competition. As the region continues to develop, the demand for advanced dewatering solutions is expected to rise, making it a key area for market growth.

Middle East and Africa : Untapped Market with Opportunities

The Middle East and Africa (MEA) dewatering pump market, valued at 0.35 billion in 2024, presents significant growth opportunities. The region is witnessing increased investments in infrastructure and construction projects, driven by urbanization and economic diversification efforts. Additionally, the need for effective water management solutions in arid regions is propelling demand for dewatering pumps. Regulatory frameworks are gradually evolving to support sustainable practices, further enhancing market potential.

Countries like the UAE and South Africa are at the forefront of this market, with a growing presence of both local and international players. Companies such as Atlas Copco AB and Wacker Neuson SE are actively participating in this emerging market. The competitive landscape is still developing, with opportunities for innovation and collaboration among manufacturers to meet the unique challenges of the region. As the market matures, the demand for reliable and efficient dewatering solutions is expected to increase.