Growing Industrialization

The rapid pace of industrialization is a significant driver for the Industrial Sludge Treatment Chemicals Market. As industries expand, the volume of sludge generated increases, necessitating effective treatment solutions. This trend is particularly evident in emerging economies, where industrial growth is accompanied by rising environmental concerns. The market is projected to grow at a rate of 5% annually, driven by the need for efficient sludge management practices. Industries such as manufacturing, food processing, and pharmaceuticals are increasingly adopting advanced sludge treatment chemicals to address their waste management challenges. Consequently, the Industrial Sludge Treatment Chemicals Market is poised for substantial growth in response to these industrial demands.

Technological Innovations

Technological advancements play a crucial role in shaping the Industrial Sludge Treatment Chemicals Market. Innovations in chemical formulations and treatment processes enhance the efficiency and effectiveness of sludge management. For instance, the development of bio-based chemicals and advanced oxidation processes has shown promise in improving sludge dewatering and stabilization. These innovations not only optimize operational costs but also align with sustainability goals. The market is expected to witness a significant uptick in the adoption of these technologies, with a projected growth rate of 7% annually. As industries seek to leverage these advancements, the Industrial Sludge Treatment Chemicals Market is likely to experience robust expansion.

Rising Environmental Concerns

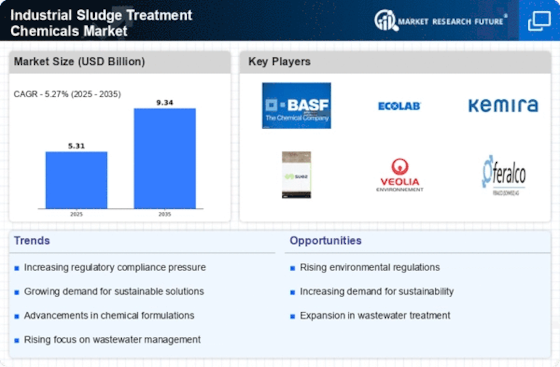

The increasing awareness regarding environmental sustainability is a pivotal driver for the Industrial Sludge Treatment Chemicals Market. As industries face mounting pressure to minimize their ecological footprint, the demand for effective sludge treatment solutions has surged. This trend is underscored by regulatory frameworks that mandate the proper disposal and treatment of industrial waste. In 2025, the market for industrial sludge treatment chemicals is projected to reach approximately USD 5 billion, reflecting a compound annual growth rate of around 6%. Companies are increasingly investing in advanced treatment technologies to comply with environmental standards, thereby propelling the growth of the Industrial Sludge Treatment Chemicals Market.

Stringent Regulatory Frameworks

Regulatory pressures are a driving force in the Industrial Sludge Treatment Chemicals Market. Governments worldwide are implementing stringent regulations to ensure the safe disposal and treatment of industrial sludge. Compliance with these regulations necessitates the use of specialized chemicals and treatment methods, thereby increasing demand within the market. In 2025, it is anticipated that regulatory compliance costs will account for a substantial portion of operational budgets for many industries. This trend compels companies to invest in effective sludge treatment solutions, further stimulating growth in the Industrial Sludge Treatment Chemicals Market. The ongoing evolution of regulations is likely to create new opportunities for market players.

Increased Investment in Wastewater Treatment

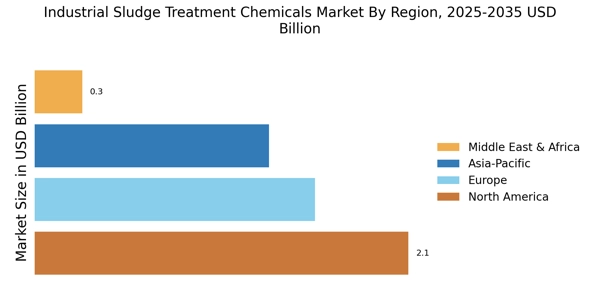

Investment in wastewater treatment infrastructure is a critical driver for the Industrial Sludge Treatment Chemicals Market. As urbanization accelerates, municipalities and industries are allocating significant resources to enhance their wastewater treatment capabilities. This trend is reflected in the projected increase in spending on wastewater treatment chemicals, which is expected to reach USD 3 billion by 2025. The focus on improving treatment efficiency and compliance with environmental regulations is driving the demand for specialized sludge treatment chemicals. As a result, the Industrial Sludge Treatment Chemicals Market is likely to benefit from this influx of investment, fostering innovation and growth in the sector.