Regulatory Compliance

Stringent regulations regarding wastewater treatment and sludge disposal are significantly influencing the Sludge Management Dewatering Market. Governments worldwide are implementing strict guidelines to ensure that wastewater treatment facilities adhere to environmental standards. Compliance with these regulations necessitates the adoption of effective sludge management practices, including dewatering processes that minimize waste volume and enhance disposal options. The increasing focus on regulatory compliance is driving investments in advanced dewatering technologies, as facilities seek to avoid penalties and maintain operational licenses. This trend is expected to bolster the Sludge Management Dewatering Market, as adherence to regulations becomes a critical factor for wastewater treatment facilities.

Increasing Urbanization

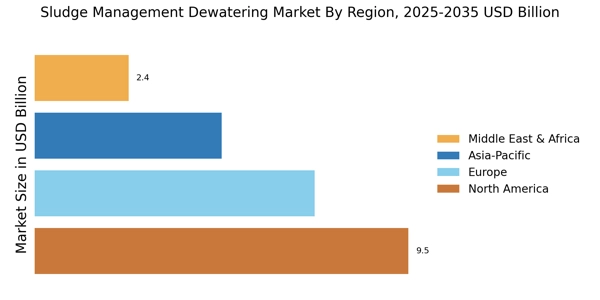

The rapid pace of urbanization is a key driver for the Sludge Management Dewatering Market. As cities expand, the volume of wastewater generated increases significantly, necessitating efficient sludge management solutions. Urban areas are projected to house over 68% of the world's population by 2050, leading to heightened demand for effective dewatering technologies. This trend compels municipalities to invest in advanced sludge management systems to handle the growing waste volumes. Consequently, the Sludge Management Dewatering Market is likely to experience substantial growth as urban centers seek to enhance their wastewater treatment capabilities and comply with environmental standards.

Technological Innovations

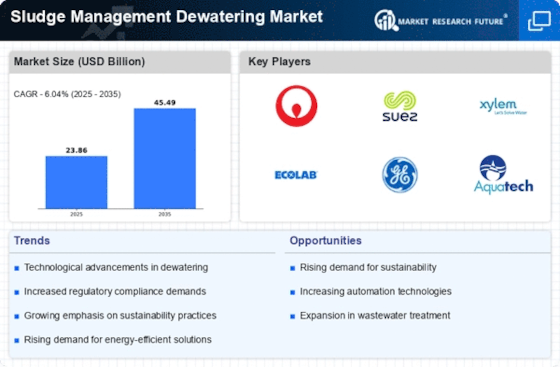

Technological advancements play a pivotal role in shaping the Sludge Management Dewatering Market. Innovations such as membrane filtration, centrifugation, and advanced thermal drying techniques are enhancing the efficiency of sludge dewatering processes. These technologies not only improve the quality of the dewatered sludge but also reduce operational costs for treatment facilities. The market is witnessing a shift towards automation and smart technologies, which streamline operations and optimize resource utilization. As a result, the Sludge Management Dewatering Market is expected to grow at a compound annual growth rate (CAGR) of approximately 5.5% over the next few years, driven by the adoption of cutting-edge technologies.

Growing Agricultural Demand

The agricultural sector's increasing demand for organic fertilizers is emerging as a significant driver for the Sludge Management Dewatering Market. Treated sludge, often referred to as biosolids, can be repurposed as a nutrient-rich soil amendment, promoting sustainable agricultural practices. As the global population continues to rise, the need for efficient food production systems intensifies, leading to greater utilization of biosolids in agriculture. This trend not only supports waste reduction efforts but also enhances soil fertility. The Sludge Management Dewatering Market is likely to benefit from this growing agricultural demand, as more farmers and agricultural enterprises recognize the value of using treated sludge as a resource.

Rising Environmental Concerns

Growing awareness of environmental issues is propelling the Sludge Management Dewatering Market forward. Stakeholders are increasingly recognizing the need for sustainable waste management practices to mitigate pollution and protect natural resources. The market is influenced by the push for eco-friendly solutions, as improper sludge disposal can lead to soil and water contamination. In response, industries are adopting advanced dewatering technologies that minimize environmental impact. The Sludge Management Dewatering Market is expected to reach USD 20 billion by 2026, indicating a robust growth trajectory driven by environmental sustainability initiatives. This trend underscores the importance of integrating environmental considerations into sludge management strategies.