Market Growth Projections

The Global Silanes and Silicones Market Industry is projected to experience substantial growth over the next decade. With a compound annual growth rate of 14.39% anticipated from 2025 to 2035, the market is expected to expand significantly. By 2035, the market could reach an impressive 29.9 USD Billion, reflecting the increasing adoption of silanes and silicones across various industries. This growth trajectory suggests a robust demand for innovative applications and products, positioning the Global Silanes and Silicones Market Industry as a key player in the global materials landscape.

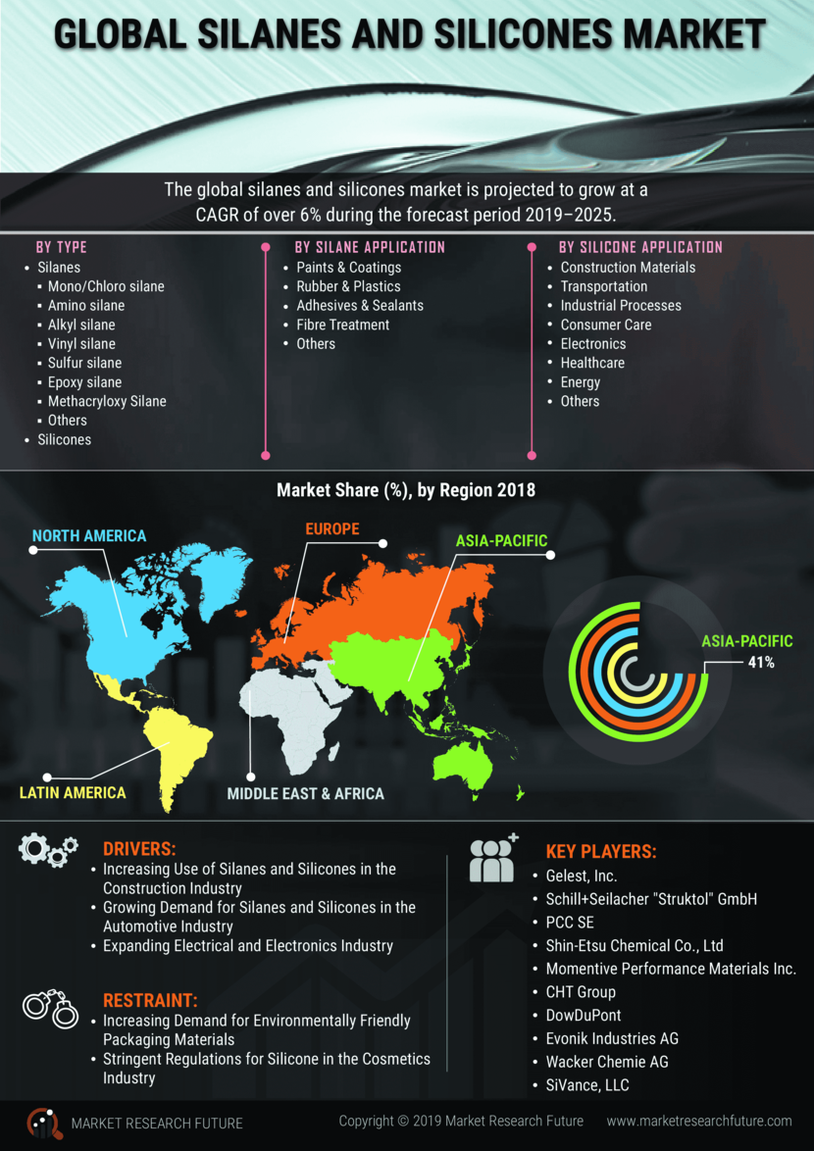

Rising Demand in Automotive Sector

The Global Silanes and Silicones Market Industry experiences a notable surge in demand driven by the automotive sector. As manufacturers increasingly utilize silicone-based materials for their durability and heat resistance, the market is projected to reach 6.81 USD Billion in 2024. This growth is largely attributed to the automotive industry's shift towards lightweight materials that enhance fuel efficiency. Furthermore, the integration of silanes in tire manufacturing and coatings is expected to bolster this trend, indicating a robust future for the Global Silanes and Silicones Market Industry.

Innovations in Personal Care Products

The Global Silanes and Silicones Market Industry is also driven by innovations in personal care products. Silicones are favored for their unique properties, such as smooth application and long-lasting effects, making them essential in cosmetics and skincare formulations. As consumer preferences shift towards high-quality, multifunctional personal care products, the demand for silicone-based ingredients is likely to increase. This trend indicates a dynamic growth potential for the Global Silanes and Silicones Market Industry, as brands continue to innovate and expand their product lines to meet evolving consumer needs.

Growth in Construction and Building Materials

The Global Silanes and Silicones Market Industry benefits from the growth in construction and building materials. Silanes are widely used as bonding agents and surface treatments in construction applications, enhancing the durability and performance of materials. As urbanization accelerates globally, the demand for innovative building solutions is on the rise. The construction sector's increasing focus on sustainability and energy efficiency further propels the use of silicone-based products. This trend suggests a promising outlook for the Global Silanes and Silicones Market Industry, particularly as it aligns with global construction initiatives.

Expansion in Electronics and Electrical Applications

The Global Silanes and Silicones Market Industry is significantly influenced by the expansion of electronics and electrical applications. Silicones are integral in the production of semiconductors, insulation materials, and adhesives, which are essential for modern electronic devices. With the increasing proliferation of smart devices and the Internet of Things, the demand for high-performance silicone materials is anticipated to rise. This sector's growth contributes to the overall market, which is expected to reach 29.9 USD Billion by 2035, reflecting a strong trajectory for the Global Silanes and Silicones Market Industry.

Environmental Regulations and Sustainability Initiatives

The Global Silanes and Silicones Market Industry is influenced by environmental regulations and sustainability initiatives. Governments worldwide are implementing stricter regulations regarding chemical usage and emissions, prompting manufacturers to adopt eco-friendly practices. Silicones, known for their low environmental impact, are increasingly favored in various applications, from automotive to construction. This shift towards sustainable materials is likely to enhance the market's growth, as companies seek to comply with regulations while meeting consumer demand for greener products. The Global Silanes and Silicones Market Industry appears well-positioned to thrive in this evolving regulatory landscape.