Research Methodology on Sensor Market

I. Introduction

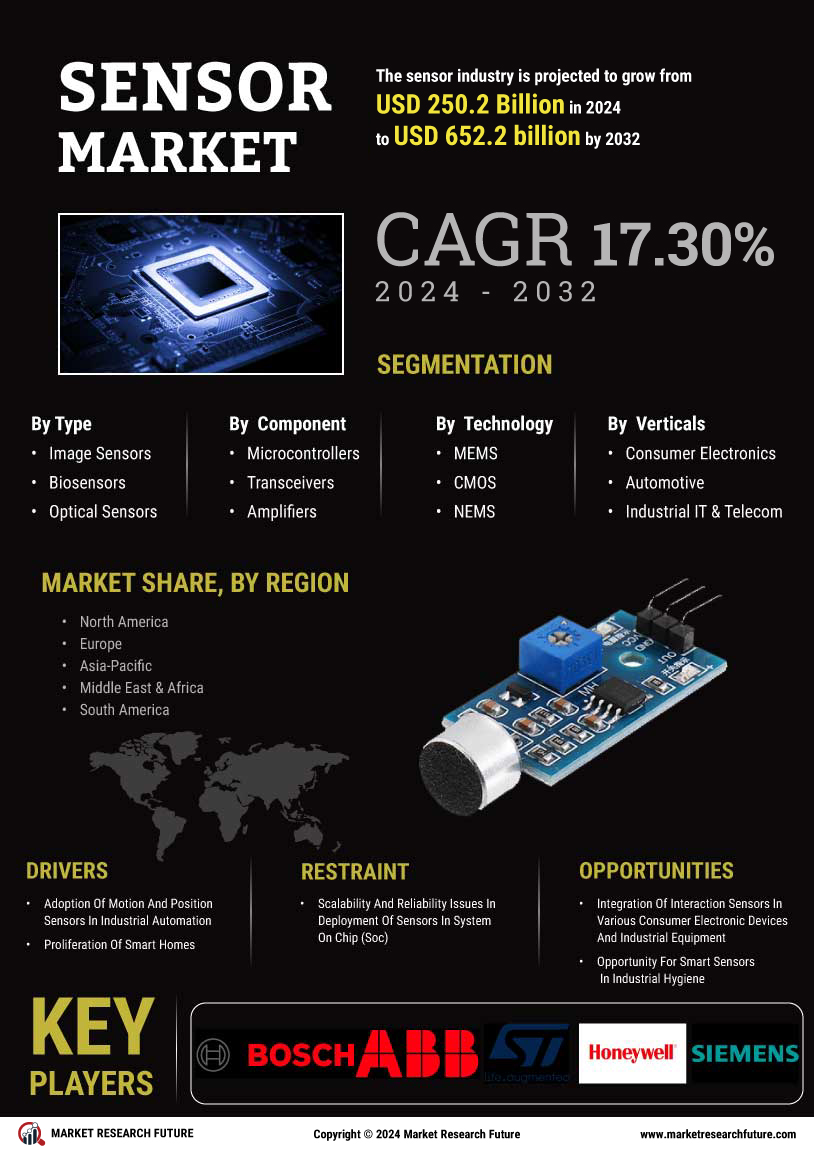

This report provides an in-depth market analysis of the Sensor Market, which includes the market size, growth trends, drivers, opportunities, and current trends in the Sensor Market. The primary objective of the report is to identify the key industry trends and future market prospects of the Sensor Market. In order to do this, a comprehensive analysis of the market is performed using secondary research and primary data.

The report is organized into six sections, namely the introduction, research objective, research methodology, research insights, data analysis, and conclusion. In the introduction, the overall objectives of the report are discussed. The research objective section outlines the objective of the report in detail.

Next, the research methodology section provides an overview of the research process, as well as the secondary and primary data used in the study. In the market size estimation section, the methodology used to estimate the market size is discussed. The data triangulation and limitations sections discuss the data triangulation process and potential limitations encountered during the study.

In the research insights section, the major market trends identified during the study are discussed. The data analysis section provides a detailed analysis of the data obtained from the analysis. Finally, the report ends with a conclusion.

II. Research Objective

The primary objective of this research report is to provide a comprehensive analysis of the Sensor Market, including an estimation of the market size, growth trends, drivers, and current trends. The secondary objective of the study is to identify industry players and their respective market shares in the global Sensor Market.

III. Research Methodology

The research methodology used in this report is based on a combination of secondary data, primary data, and market size estimation.

3.1 Research Process

The research process follows a systematic and structured methodology, which includes the identification and analysis of secondary data, primary data collection and analysis, and market size estimation. The research process consists of four primary steps, namely

- secondary data collection and analysis,

- primary data collection and analysis,

- market size estimation,

- data triangulation

3.2 Secondary Data

The secondary data used in the study is sourced from research reports, annual reports, industry magazines, shareholder filings, newspaper articles, press releases, and industry databases. The main sources of secondary data are internet searches, research databases, and industry websites.

3.3 Primary Data

Primary data is collected through interviews with industry experts and a survey of key market players. The primary data obtained from interviews and surveys are validated and verified using industry best practices.

3.4 Market Size Estimation

The market size is estimated using both the bottom-up and top-down approaches. The bottom-up approach is used to estimate the global Sensor Market size based on the average revenue generated by market players. The top-down approach is used to estimate the global Sensor Market size on the basis of usable market data.

3.5 Data Triangulation

Data triangulation is used to validate and verify the data collected from primary and secondary data sources. Data triangulation is the process of comparing data from multiple sources to arrive at an accurate picture of the market.

IV. Research Insights

This research report provides in-depth insights into the current trends and dynamic drivers of the Sensor Market. The study provides key market drivers, such as the increasing penetration of sensors across various industries and the rise in demand for sensing-based applications.

The report provides an analysis of the competitive landscape of the Sensor Market, covering profiles of major players. The study provides a comprehensive overview of the market, covering market segments, application segments, product types, and regional markets. The report provides an overview of the competitive landscape of the industry and provides an in-depth analysis of the competitive strategies used by the leading market players.

V. Data Analysis

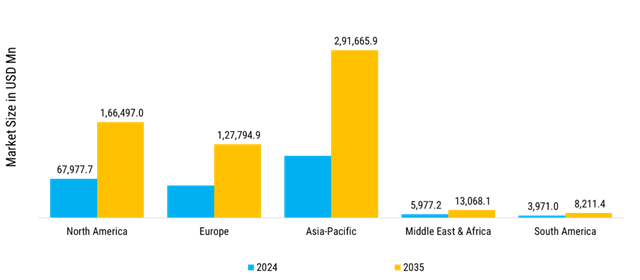

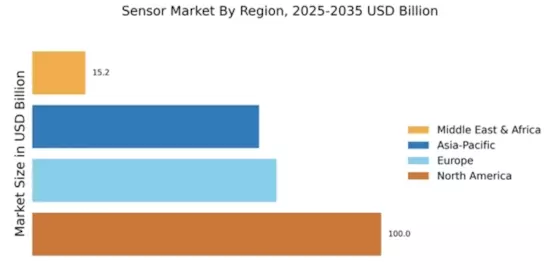

The data analysis in this report uses an array of tools, such as Porter’s Five Forces Analysis, SWOT Analysis, PEST Analysis, and Value Chain Analysis. These tools help to analyze the current and future market trends in the Sensor Market. The data analysis section provides an overview of the market size, growth trends, and competitive dynamics of the global Sensor Market.

VI. Conclusion

This research report is a comprehensive analysis of the Sensor Market, providing an overview of the market size, growth trends, drivers, and current trends in the market. The report provides an in-depth analysis of the competitive landscape, including an analysis of the competitive strategies used by the major players.

The report also provides a detailed analysis of the data collected and analyzed for the study. Based on the analysis, it is analyzed that the Sensor Market is projected to witness a significant growth rate over the forecast period 2023 to 2030.