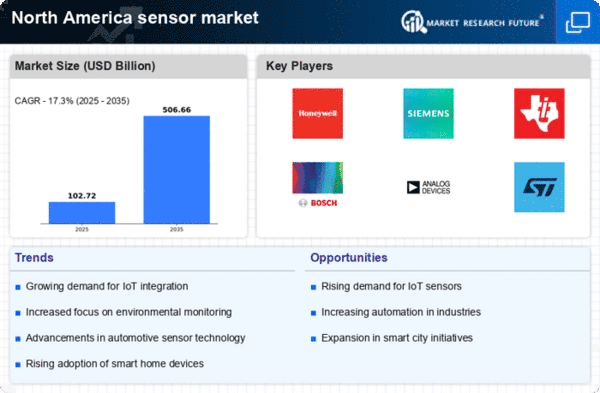

Emphasis on Energy Efficiency

The increasing emphasis on energy efficiency in North America is a significant driver for the sensor market. As businesses and consumers alike strive to reduce energy consumption and lower costs, the demand for energy-efficient solutions is on the rise. Sensors that monitor energy usage, such as smart meters and occupancy sensors, are becoming essential tools in achieving these goals. In 2025, the energy management market is anticipated to reach $50 billion, with sensors playing a vital role in optimizing energy consumption. This trend suggests that as awareness of sustainability grows, the sensor market will likely benefit from innovations aimed at enhancing energy efficiency. The integration of sensors with smart grid technologies further underscores their importance in creating a more sustainable energy landscape.

Rising Demand for Smart Devices

The proliferation of smart devices in North America is a key driver for the sensor market. As consumers increasingly adopt smart home technologies, the need for various sensors, such as motion, temperature, and humidity sensors, has surged. In 2025, the smart home market is projected to reach approximately $100 billion, with sensors playing a crucial role in enhancing user experience and energy efficiency. This trend indicates a growing reliance on sensor technology to facilitate automation and connectivity in everyday life. Consequently, manufacturers are focusing on developing advanced sensors that can seamlessly integrate with smart devices, thereby propelling growth in the sensor market. The increasing consumer preference for convenience and efficiency further underscores the importance of sensors in this evolving landscape.

Growth in Healthcare Applications

The healthcare sector in North America is experiencing a notable transformation, which is driving the sensor market. The increasing demand for remote patient monitoring and telehealth solutions has led to a surge in the use of medical sensors. In 2025, the market for wearable health devices is projected to reach $30 billion, with sensors being pivotal in tracking vital signs and health metrics. This growth indicates a shift towards personalized healthcare, where sensors play a critical role in data collection and analysis. As healthcare providers seek to improve patient outcomes and reduce costs, the integration of advanced sensors into medical devices is likely to expand. This trend not only enhances patient care but also propels the sensor market forward, as innovation in sensor technology continues to evolve.

Expansion of Industrial Automation

The ongoing expansion of industrial automation in North America significantly influences the sensor market. Industries are increasingly adopting automation technologies to enhance productivity and reduce operational costs. In 2025, the industrial automation market is expected to exceed $200 billion, with sensors being integral to monitoring and controlling processes. Sensors such as pressure, flow, and level sensors are essential for ensuring operational efficiency and safety in manufacturing environments. This trend suggests that as industries continue to embrace automation, the demand for sophisticated sensors will likely increase, driving innovation and investment in the sensor market. Furthermore, the integration of sensors with advanced analytics and AI technologies may lead to enhanced decision-making capabilities, further solidifying their role in industrial applications.

Advancements in Automotive Safety Technologies

The automotive industry in North America is witnessing rapid advancements in safety technologies, which is a crucial driver for the sensor market. With increasing regulatory pressures and consumer demand for safer vehicles, manufacturers are integrating a variety of sensors into their designs. In 2025, the automotive sensor market is projected to reach $25 billion, driven by the need for advanced driver-assistance systems (ADAS) and autonomous vehicles. Sensors such as radar, lidar, and cameras are essential for enabling features like collision avoidance and lane-keeping assistance. This trend indicates that as the automotive sector continues to innovate, the sensor market will likely experience substantial growth, fueled by the ongoing development of safety technologies that enhance vehicle performance and passenger safety.