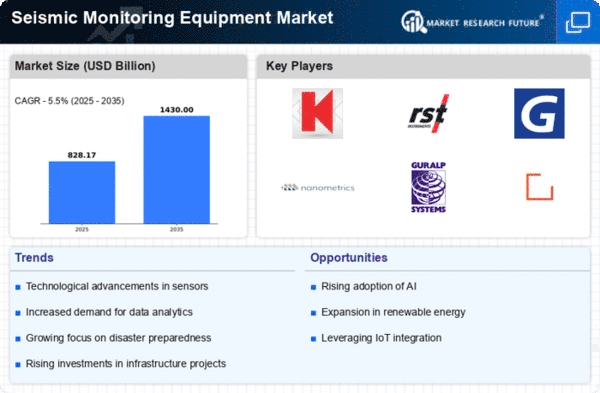

Market Growth Projections

The Seismic Monitoring Equipment Industry is projected to experience substantial growth over the next decade, with estimates indicating a market size of 3250 USD Million in 2024 and an anticipated increase to 5670 USD Million by 2035. This growth trajectory suggests a CAGR of 5.19% from 2025 to 2035, reflecting the increasing investments in seismic monitoring technologies and infrastructure. The market is likely to be driven by various factors, including technological advancements, government initiatives, and the rising frequency of natural disasters. Such projections indicate a promising future for the seismic monitoring equipment sector.

Technological Advancements

Rapid advancements in technology are significantly influencing the Global Seismic Monitoring Equipment Industry. Innovations in sensor technology, data analytics, and machine learning are enhancing the accuracy and efficiency of seismic monitoring systems. For example, the integration of IoT devices allows for real-time data transmission and analysis, enabling quicker responses to seismic events. As these technologies evolve, they are likely to attract investments from both public and private sectors, further propelling market growth. The anticipated CAGR of 5.19% from 2025 to 2035 suggests a robust expansion driven by these technological improvements.

Increasing Natural Disasters

The frequency of natural disasters, such as earthquakes and tsunamis, is rising globally, which drives the demand for the Seismic Monitoring Equipment Industry. Countries prone to seismic activity, like Japan and Indonesia, are investing heavily in advanced monitoring systems to enhance disaster preparedness and response. For instance, Japan has implemented a nationwide seismic monitoring network that provides real-time data, aiding in timely evacuations and minimizing casualties. This trend is expected to continue, with the market projected to reach 3250 USD Million in 2024, reflecting the urgent need for reliable seismic monitoring solutions.

Government Initiatives and Funding

Government initiatives aimed at improving disaster resilience are crucial drivers of the Seismic Monitoring Equipment Industry. Various nations are allocating substantial budgets to enhance their seismic monitoring capabilities. For instance, the United States Geological Survey has been instrumental in funding research and development of advanced seismic monitoring technologies. Such initiatives not only bolster national safety but also stimulate economic growth through job creation in the technology sector. As governments recognize the importance of seismic monitoring, the market is expected to grow significantly, reaching an estimated 5670 USD Million by 2035.

Urbanization and Infrastructure Development

The rapid urbanization and infrastructure development in seismic-prone regions are driving the Seismic Monitoring Equipment Industry. As cities expand, the potential for earthquake-related damages increases, necessitating robust monitoring systems to protect lives and property. Countries like Turkey and Chile are investing in seismic monitoring technologies to safeguard their urban infrastructure. The integration of seismic monitoring into urban planning is becoming a standard practice, ensuring that new constructions are equipped with the necessary safety measures. This trend is expected to further fuel market growth as urban areas continue to develop.

Growing Awareness of Earthquake Preparedness

There is a growing awareness regarding earthquake preparedness among communities and governments, which is positively impacting the Global Seismic Monitoring Equipment Market Industry. Educational campaigns and training programs are being implemented to inform the public about the importance of seismic monitoring and preparedness measures. This heightened awareness is leading to increased investments in monitoring equipment and infrastructure. For instance, regions with high seismic risk are prioritizing the installation of advanced monitoring systems to ensure safety and minimize damage. This trend is likely to contribute to the market's growth trajectory in the coming years.