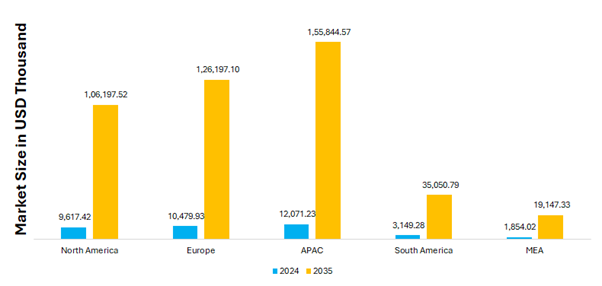

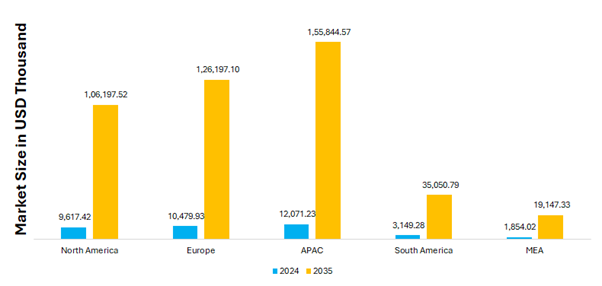

North America: Emerging Biochar Innovator

North America holds approximately 25.87% of the global biochar market for Electric Arc Furnace (EAF) steelmaking. The region is in the early stages of biochar adoption, focusing on converting wood residues and biomass into carbon-rich materials for injection and recarburizing. Pilot projects are exploring densified biochar as a viable substitute for traditional carbon sources. Although regulatory support and growing interest in low-carbon materials are driving momentum, large-scale adoption faces logistical and economic challenges. The United States leads the market, supported by evolving policies and growing demand for sustainable steel production.

Europe: Leader in Policy-Driven Adoption

Europe accounts for about 28.19% of the global market and is a proactive region in integrating biochar into steelmaking. Strong research initiatives and favorable policy frameworks are accelerating the replacement of fossil reductants with renewable carbon alternatives. Efforts to standardize biochar specifications and scale production capacity support broader industry uptake. Countries like Germany, France, and the UK are at the forefront, with companies and governments collaborating to decarbonize the steel sector and enhance furnace efficiency.

Asia Pacific: Expanding through Biomass Abundance

The Asia Pacific region holds the largest share at 32.47%, driven by abundant agricultural and forestry residues. Interest is growing through exploratory trials and research on transforming local biomass into effective carbon injectants and slag foaming agents. Despite challenges with inconsistent feedstock quality and processing standards, countries such as China, India, and Japan are actively pursuing biochar solutions to support their expanding EAF steel industries and sustainability targets.

South America: Traditional Biomass Usage Meets Innovation

South America accounts for 8.47% of the market, benefiting from a long history of biomass charcoal use in metallurgy. The region’s rich biomass resources position it well to develop engineered biochar alternatives for steel production. However, formal adoption of biochar tailored for EAF applications is still emerging, with ongoing efforts to integrate these solutions into mainstream steelmaking processes across countries like Brazil and Argentina.

Middle East & Africa: Nascent but Growing Opportunity

The Middle East and Africa represent 4.99% of the global market, where biochar use in EAF steelmaking is currently minimal. However, expanding electric arc furnace capacity powered by increasing renewable energy access presents future growth opportunities. Countries such as the UAE and South Africa are beginning to explore biochar’s potential as a low-carbon carbon source, with evolving energy dynamics and decarbonization goals expected to drive adoption in the coming years.