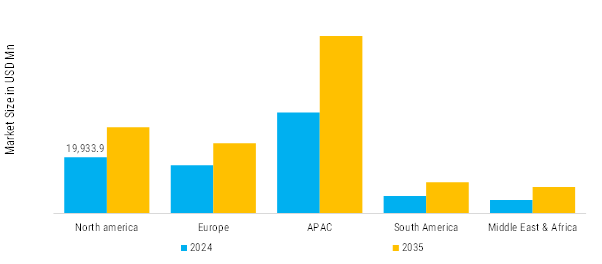

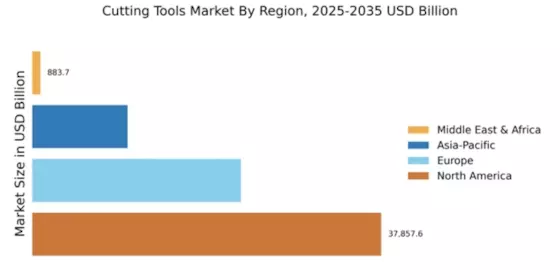

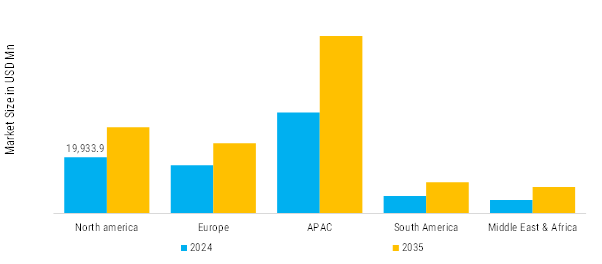

North America: Emerging manufacturing machine

The North American cutting tool market is one of the most technologically advanced and mature markets globally, driven predominantly by the United States and Canada. It plays a critical role in the global manufacturing and machining landscape due to its strong industrial base, emphasis on precision engineering, and early adoption of advanced machining and automation technologies. In this region, cutting tools such as drills, end mills, inserts, reamers, and taps are used extensively across sectors including automotive, aerospace & defense, oil & gas, medical devices, and general industrial manufacturing. One of the most prominent applications of cutting tools in North America is in the automotive sector, where legacy manufacturers such as Ford, General Motors, and new entrants like Tesla continue to invest in automated production lines that rely heavily on durable, high-performance tools for engine parts, transmission systems, and structural components

Europe: Emerging Cloud Market

The European cutting tool market stands as one of the most advanced and innovation-driven segments globally, owing to the region’s deep-rooted industrial base and engineering expertise. Cutting tools such as milling cutters, drills, inserts, broaches, and grinding wheels are essential in various high precision manufacturing sectors, including automotive, aerospace and defense, energy, medical devices, industrial machinery, and die/mold applications. European industries demand tools that offer exceptional durability, precision, and efficiency, especially as they shift toward more automated, sustainable, and digitally integrated production environments. In the automotive sector, cutting tools are crucial for machining engine blocks, drivetrains, and increasingly, EV components like battery enclosures and lightweight chassis made of aluminum or composites. Countries like Germany and Italy are hubs for automotive production, with brands like BMW, VW, and Ferrari relying on advanced machining.

Asia-Pacific: Rapidly Growing Cloud Sector

The Asia-Pacific (APAC) region stands as the most prominent and rapidly growing market in the global cutting tool industry. This dominance is primarily fueled by extensive manufacturing activities across countries such as China, India, Japan, South Korea, and Taiwan. In APAC, the demand for cutting tools is notably high in the automotive industry, where manufacturers in India, China, and Japan utilize them to fabricate engine components, transmission systems, and structural parts. Moreover, general engineering and fabrication shops across the region heavily rely on solid carbide tools, indexable inserts, and HSS tools for small-batch and customized production. Meanwhile, the aerospace industry in Japan and India is increasingly adopting advanced tools like polycrystalline diamond (PCD) and cubic boron nitride (CBN) to machine high-strength materials such as titanium and composites.

Middle East and Africa: Emerging Cloud Frontier

The Middle East & Africa (MEA) cutting tool market is an emerging but increasingly important segment of the global tooling industry, characterized by a gradual shift toward industrialization, infrastructure growth, and manufacturing localization. This regional market encompasses countries across the Gulf Cooperation Council (GCC) such as Saudi Arabia, the UAE, and Qatar, as well as African economies including South Africa, Egypt, Nigeria, and Kenya. While the MEA region has traditionally been dependent on imports for high-precision manufacturing technologies, current trends indicate a growing investment in cutting tools such as drills, end mills, reamers, and inserts for use in diverse sectors like oil & gas, construction, defense, aerospace, mining, and automotive. One of the major growth drivers in the MEA cutting tool market is economic diversification, particularly in the Gulf states. For instance, Saudi Arabia’s Vision 2030 and the UAE’s Industrial Strategy 300bn are focused on reducing reliance on oil exports and building robust domestic manufacturing bases.

South America: Developing of agriculture industry

South America’s agriculture equipment manufacturing industry, especially in Argentina and Brazil, further expands the market by necessitating tools for producing robust and high-durability parts for tractors, harvesters, and plowing machines. Meanwhile, general-purpose cutting tools continue to serve a large segment of small and medium-sized enterprises (SMEs) engaged in mold making, welding, and machining workshops across the region. For instance, Brazil’s policy-driven "Nova Indústria Brasil" (New Brazil Industry) initiative aims at reindustrialization and modernization across strategic sectors including agroindustry, defense, and infrastructure aiming to boost domestic production, reduce dependence on imports, and foster local tool demand by 2033.