Growth of the Construction Sector

The woodworking machine market is significantly influenced by the expansion of the construction sector. As urbanization accelerates and infrastructure projects proliferate, the demand for wooden structures and components rises correspondingly. Recent statistics indicate that the construction industry is expected to grow at a rate of approximately 4% annually, which directly impacts the need for efficient woodworking machinery. This growth compels manufacturers to enhance their production capabilities, leading to increased investments in advanced woodworking machines. Consequently, the woodworking machine market stands to gain from this upward trend, as companies seek to fulfill the rising demand for high-quality wooden products in construction.

Increased Focus on Sustainable Practices

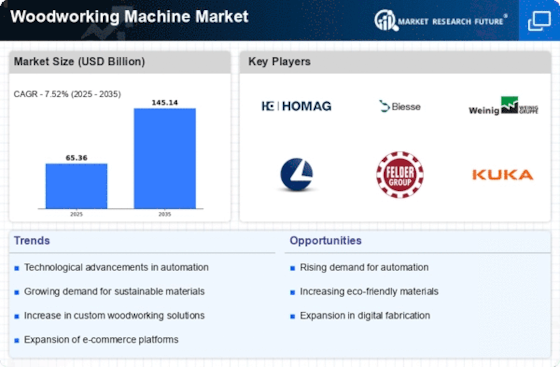

Sustainability initiatives are becoming increasingly prominent within the woodworking machine market. As environmental concerns gain traction, manufacturers are compelled to adopt eco-friendly practices and invest in sustainable machinery. This shift is reflected in the growing demand for machines that utilize renewable resources and minimize waste. Recent data suggests that the market for sustainable woodworking machinery is expanding, with a projected growth rate of around 6% over the next few years. This trend not only aligns with consumer preferences for environmentally responsible products but also encourages manufacturers to innovate and develop machines that adhere to sustainability standards, thereby enhancing their competitiveness in the woodworking machine market.

Expansion of E-commerce and Online Retail

The woodworking machine market is experiencing a transformation due to the rapid expansion of e-commerce and online retail platforms. As consumers increasingly turn to online shopping for furniture and home decor, manufacturers are adapting their production strategies to meet this demand. The rise of e-commerce is projected to grow at a rate of approximately 8% annually, prompting woodworking companies to invest in machinery that can produce customized products efficiently. This shift not only enhances accessibility for consumers but also encourages manufacturers to streamline their operations, thereby driving growth within the woodworking machine market. As a result, the industry is likely to witness a surge in demand for versatile and efficient woodworking machines that cater to the evolving landscape of online retail.

Rising Demand for Furniture and Interior Design

The woodworking machine market experiences a notable surge in demand driven by the increasing popularity of customized furniture and interior design solutions. As consumers seek unique and personalized home furnishings, manufacturers are compelled to invest in advanced woodworking machinery to meet these preferences. According to recent data, the furniture sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth necessitates the adoption of efficient woodworking machines that can produce intricate designs and high-quality finishes. Consequently, the woodworking machine market is likely to benefit from this trend, as manufacturers strive to enhance their production capabilities to cater to evolving consumer tastes.

Technological Advancements in Woodworking Machinery

Technological innovations play a pivotal role in shaping the woodworking machine market. The integration of automation, artificial intelligence, and advanced software solutions into woodworking machinery enhances productivity and precision. For instance, CNC (Computer Numerical Control) machines have revolutionized the industry by allowing for intricate cuts and designs that were previously unattainable. The market for CNC machines alone is expected to witness substantial growth, with projections indicating a rise of around 7% annually. As manufacturers increasingly adopt these technologies, the woodworking machine market is poised for transformation, enabling businesses to optimize their operations and reduce waste while improving product quality.