Technological Advancements in Robotics

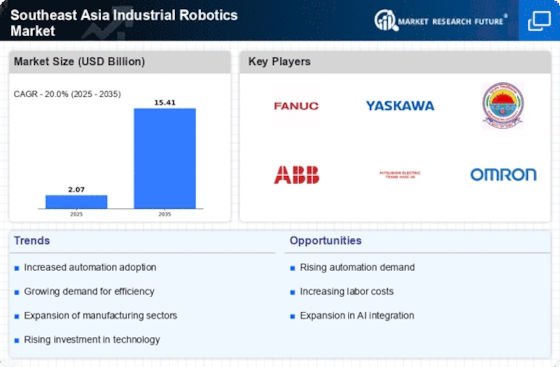

Technological advancements are significantly shaping the Southeast Asia Industrial Robotics Market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of industrial robots. These advancements enable robots to perform complex tasks with greater autonomy and adaptability. For instance, the introduction of advanced vision systems allows robots to identify and manipulate objects with precision. The market for industrial robotics in Southeast Asia is expected to reach USD 5 billion by 2026, reflecting the increasing investment in cutting-edge technologies. As companies seek to leverage these advancements to improve productivity and reduce labor costs, the demand for sophisticated robotic solutions is likely to escalate, further propelling the growth of the Southeast Asia Industrial Robotics Market.

Rising Labor Costs and Skills Shortages

Rising labor costs and skills shortages are compelling manufacturers in Southeast Asia to turn towards automation, thereby driving the Southeast Asia Industrial Robotics Market. Countries in the region are witnessing a steady increase in wages, which poses challenges for maintaining competitive pricing. Additionally, the shortage of skilled labor in technical fields exacerbates the situation, prompting companies to seek robotic solutions that can operate efficiently with minimal human intervention. The industrial robotics market is projected to grow as businesses invest in automation to mitigate these challenges. By integrating robots into their operations, manufacturers can not only reduce labor costs but also enhance productivity and maintain quality standards. This trend underscores the critical role of robotics in addressing labor-related issues within the Southeast Asia Industrial Robotics Market.

Increased Focus on Safety and Compliance

The Southeast Asia Industrial Robotics Market is witnessing an increased focus on safety and compliance, which is driving the adoption of industrial robots. As industries face stringent regulations regarding workplace safety, the integration of robotics offers a viable solution to mitigate risks associated with manual labor. Robots can perform hazardous tasks, thereby reducing the likelihood of workplace accidents and ensuring compliance with safety standards. Furthermore, the implementation of collaborative robots, or cobots, allows for safer human-robot interactions, enhancing overall workplace safety. The market for safety-compliant robotic solutions is expected to grow as companies prioritize employee well-being and regulatory adherence. This emphasis on safety and compliance is a significant driver for the Southeast Asia Industrial Robotics Market.

Growing Demand for Precision Manufacturing

The Southeast Asia Industrial Robotics Market is experiencing a notable surge in demand for precision manufacturing. Industries such as electronics, automotive, and aerospace are increasingly adopting robotic solutions to enhance production accuracy and efficiency. The region's manufacturing sector is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, driven by the need for high-quality products and reduced operational costs. As manufacturers strive to meet stringent quality standards, the integration of industrial robots becomes essential. This trend not only improves product consistency but also minimizes waste, thereby contributing to sustainable manufacturing practices. Consequently, the growing demand for precision manufacturing is a pivotal driver for the Southeast Asia Industrial Robotics Market.

Expansion of E-commerce and Logistics Sectors

The expansion of e-commerce and logistics sectors is significantly influencing the Southeast Asia Industrial Robotics Market. As online shopping continues to gain traction, the demand for efficient warehousing and distribution solutions is on the rise. Robotics plays a crucial role in automating these processes, from inventory management to order fulfillment. The logistics sector in Southeast Asia is projected to grow at a CAGR of 10% over the next five years, driven by the increasing reliance on technology to streamline operations. Companies are investing in robotic systems to enhance efficiency, reduce delivery times, and improve customer satisfaction. This trend highlights the growing importance of robotics in meeting the demands of a rapidly evolving e-commerce landscape, thereby propelling the Southeast Asia Industrial Robotics Market.